Ethereum Price Spikes 9% to Break the Ceiling with Bullish Bitcoin Raging

Ethereum price nears $230 as the overall crypto market swells further in a breakthrough Q2 2019. | Source: Shutterstock

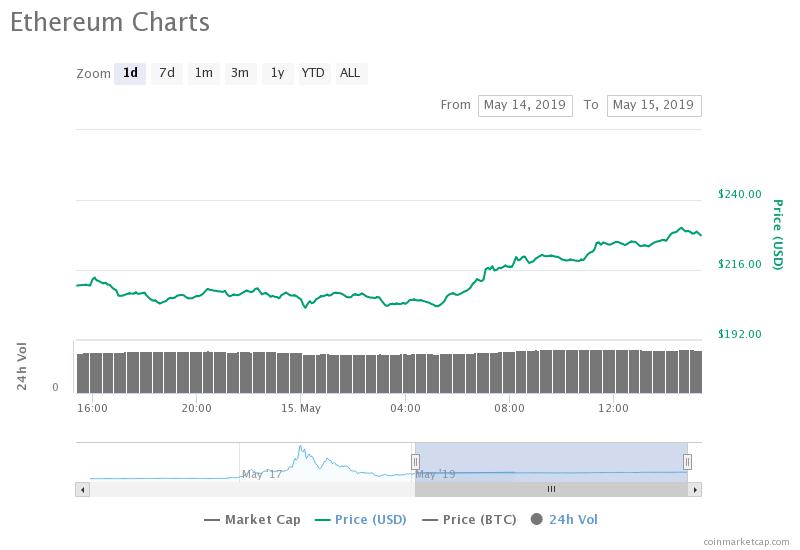

By CCN.com: The price of Ethereum (ETH) has surged by nine percent against the U.S. dollar in the past 24 hours following the 38 percent rally of bitcoin in the past 30 days.

The recovery of Ethereum was somewhat expected by traders as the asset demonstrated a lackluster performance in the first quarter of 2019.

While the bitcoin price recorded a staggering 110 percent gain against the U.S. dollar year-to-date, prior to its recent nine percent spike, Ethereum was up about 51 percent from $136 to $206.

With Ethereum and Other Major Assets Rising, Will Bitcoin Continue to Rise?

It took bitcoin more than three months to break out of the $4,000 resistance level in the early months of 2019. Yet, in less than a month, the bitcoin price spiked from $5,000 to over $8,000, breaking out of key resistance levels at $6,000 and $7,000.

As one trader said, although some expect bitcoin to retrace in the near-term, both technical indicators and the momentum of the dominant cryptocurrency remain bullish, raising the overall sentiment around the market.

“After breaking the much anticipated 6000 level BTC still looks amazing. Trend, momentum and sentiment are all clearly bullish. That said it’s at resistance and a pullback would make sense. I’d much rather be a buyer at support than a seller at resistance,” the trader said .

Considering that the sentiment around bitcoin and the rest of the cryptocurrency market remains generally optimistic, analysts foresee major cryptocurrencies sustaining their momentum in the medium term.

Some variables exist, like the resumption of deposits and withdrawals on Binance, the world’s largest cryptocurrency exchange.

Binance is set to reopen its trading platform in the upcoming hours. Some analysts have suggested it may lead to the inflow of capital into alternative cryptocurrencies and be beneficial for the market.

Confidence is Rising

In December 2018, Ethereum co-creator and ConsenSys CEO Joseph Lubin declared the bottom of the cryptocurrency market, when the bitcoin price was hovering at around $3,150.

Lubin cited intensifying fear, uncertainty, and doubt (FUD) around the future of the cryptocurrency market and the progress the cryptocurrency industry had made in the past 16 months.

He said at the time:

I am calling the cryptobottom of 2018. This bottom is marked by an epic amount of fear, uncertainty, and doubt from our friends in the 4th and crypto-5th estates. What I’ve witnessed among the chattering class the past few weeks in response to ConsenSys 2.0 is a rather typical tune: the alarmed, the eulogistic, and the gleeful.

We have been on the receiving end of an epic amount of conjecture and preemptive paranoia — filled with damning rhetoric about situations journalists and bloggers don’t have real data for, actual insight into, or understanding of.

Since then, Ethereum has surged by 70 percent and well-performing cryptocurrencies like Litecoin demonstrated a stunning 207 percent year-to-date.

The recent upside price movement of bitcoin is considered to have been driven by existing investors in the cryptocurrency market and as such, some have suggested the possibility of a new next wave of capital inflow when the mainstream begins to take notice.

In the past 24 hours, the search engine interest towards bitcoin, as portrayed by data provided by Google Trends, has spiked to mid-2018 levels, indicating that the broader market is beginning to take notice as prices of crypto assets surge.

Click here for a real-time Ethereum price chart.