Ethereum Price Nosedives 15% in Crypto Market’s $28 Billion Wipeout

Many traders have turned bearish on Ethereum way too soon, according to a leading technical strategist. | Source: Shutterstock

Overnight, within merely hours, the valuation of the crypto market dropped by $28 billion as major assets in the likes of Ethereum and Litecoin fell in the range of 11 to 15 percent.

Analysts have largely attributed the correction to a technical move given the 200 percent year-to-date gain of bitcoin since January.

Market largely oversold, can it recover?

Global markets analyst Alex Krüger said on July 12 that while the medium to long term trend of bitcoin remains bullish, a drop in the price of bitcoin below $11,300, which has served as a key support level, could lead to a drop below $10,000.

“Mid/long term bullish; Short term bullish above 11500/11600, bearish below 11300; R: 11800, 12000, 12300, 12500; Key level above for bears to defend is 12300; if price moves below 11300, 10000-9650 is first larger target area. 50 DMA stands at 9760,” he said earlier this week.

At the time, Krüger cited the remark of U.S. President Donald Trump on bitcoin which dismissed cryptocurrencies as an asset class and condemned the development of Libra as potential short term bear signals.

“Many have interpreted Powell’s testimonies & Trump’s bitcoin remarks as short term bearish. The long-term impact could be seen as either bullish (awareness) or bearish (increased regulatory tail risk). Coupled with a lower high, the balance has shifted slightly to the downside,” Krüger noted.

Although the downside movement of bitcoin and the rest of the crypto market has seemingly been technical and many industry executives have considered the first remark on bitcoin by a sitting U.S. President as a positive indicator, President Trump’s dismissal of bitcoin could have fueled the dip.

On the technical side, Cred, a highly regarded trader, said that the $10,900 to $11,000 range has been an important support level for bitcoin and losing that, coupled with a drop below $10,500, suggests that sellers are in control.

“$10,900-$11,100 has been support. A strong daily close through that level would be good evidence that sellers are in control. Losing $10,500 would support that idea. Weekly chart looks heavy with price being accepted below $11,700 area. Bullish bias only above major S/R,” explained Cred.

Similarly, other technical analysts like Josh Rager have said that bears have made a comeback in the past week, citing $10,500 as a crucial level for bitcoin.

https://twitter.com/Josh_Rager/status/1150381578469728258

In a bear trend, alternative crypto assets rarely initiate independent upside movements and tend to depend on bitcoin.

Gloom for alternative crypto assets

Major crypto assets have already recorded large losses against both bitcoin and the U.S. dollar but at the current juncture of the market wherein technical analysts are increasingly seeing a scenario of a bigger pullback in play, investors seem to be losing interest in alternative crypto assets.

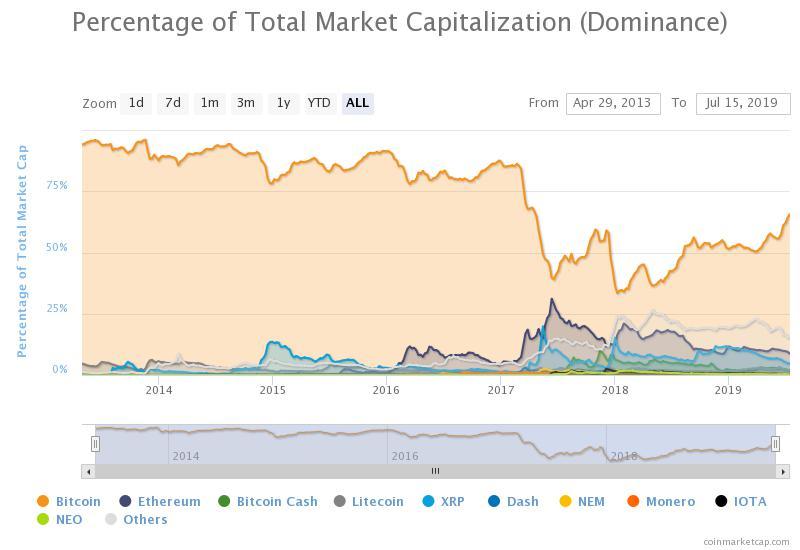

Consequently, the dominance of bitcoin has increased to 65.8 percent, nearing 66 percent for the first time since April 2017.

Some technical analysts have also suggested that the market has shown oversold conditions as of late, which could lead to recovery but if key supports continue to break, the downside movement could intensify.

Click here for a real-time ethereum price chart.