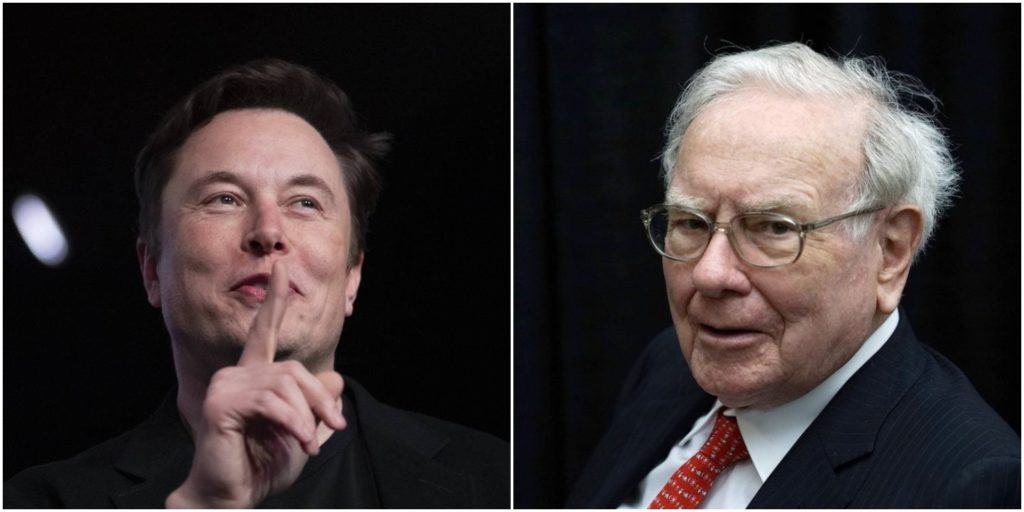

Elon Musk & Tesla Insurance Ignore Warren Buffett’s Warning

Elon Musk and Tesla ignored Warren Buffett's warning that getting into the insurance business would be a losing gamble for the EV giant. | Source: AP Photo / Jae C. Hong (i), REUTERS/Rick Wilking/Files (ii). Image Edited by CCN.com.

By CCN.com: Tesla CEO Elon Musk wasn’t fazed by Warren Buffett’s discouraging words on the EV maker potentially getting into the auto insurance business.

Tesla announced this week that it would do just that, beginning in its back yard: California.

In the off chance your Tesla explodes, there’s now insurance for that

Tesla has suffered repeated public relations fiascos thanks to high-profile crashes involving its controversial Autopilot system. The latest was in August when a Model 3 blew up not once, but twice, in Moscow.

https://www.youtube.com/watch?v=ayJmY_eLhK0

There’s now insurance for that, direct from the auto company itself! Moreover, Tesla claims it will be able to offer insurance plans at massive discounts compared to other insurers.

That seems to be inconceivable to insurance industry players who’ve pointed out the rates to insure Tesla EVs tend to be higher than for other automakers.

The main culprit for the higher insurance rates relates to the cost of Tesla replacement parts. In May, AutoNews reported the Tesla Model S is the 15th-most costly vehicle to insure, with an average annual premium of $3,300.

Warren Buffett’s warning to Elon Musk goes unheeded

It’s not every day that you hear Warren Buffett weigh in on companies that aren’t in his Berkshire Hathaway portfolio.

However, he chimed in on Tesla earlier this year, warning the auto company – and Elon Musk – that launching an insurance business would likely prove to be a losing gambit.

“The success of the auto companies getting into the insurance business is probably as likely as the success of the insurance companies getting into the auto business,” he quipped.

It bears pointing out that one-third of Berkshire Hathaway’s business is in insurance. Berkshire’s portfolio includes Geico, the second-largest US auto-insurer.

It’s of little surprise that Musk moved forward with Tesla Insurance. He’s rarely stirred by pundits and criticism, as demonstrated by his retort to Buffett’s warning:

Buffett has yet to publicly comment on Tesla’s decision to spurn his advice.