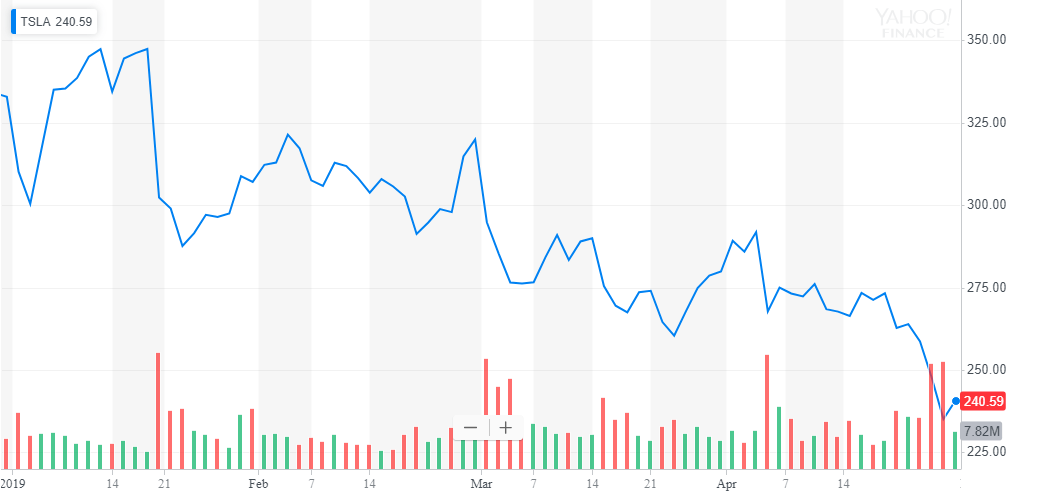

Elon Musk Risks Blowback After Tesla Stock Plunges 31% in 2019

Tesla stock has crashed by 31% in 2019. Should Elon Musk suffer shareholder backlash? | Source: REUTERS/Joe Skipper/File Photo

By CCN.com: Due to a series of controversies including the shocking video of a Tesla Model S exploding in Beijing, a drastic shift to online sales, and a catfight between CEO Elon Musk and the U.S. Securities and Exchange Commission (SEC), Tesla had an underwhelming first quarter in 2019.

Tesla Stock Down 31% in 2019 While US Market Embarks on Massive Recovery

From January 11, within four months, Tesla’s stock price plunged from $347 to $239, by more than 31 percent.

According to Hitin Anand, a senior analyst at research firm CreditSights, the high valuation of Tesla at $41 billion indicates that investors see a strong long-term prospect for the company despite the concerns of several major investment firms and high-profile short sellers.

“Tesla’s market capitalization means there is ‘a large buyer base that is still valuing future growth for this company,’ Anand said , stating that Tesla will be able to raise additional capital as it wrote in its quarterly report.

Should Tesla’s Fundraising Sound Shareholder Alarms?

In its quarterly report submitted to the SEC, Tesla stated that the current cash flows of the company from operating activities would allow the firm to proceed with adequate liquidity for at least an additional year.

However, to fuel the growth rate of the company, Tesla said that it might want to raise additional capital to ensure that those operations can be sustained over the long-term.

Tesla emphasized that it may not need or want to spend the additional capital it raises, noting that it is a strategic move to maintain the fast rate of growth of the company.

In the foreseeable future, Tesla said that a large portion of the firm’s expenditures would be allocated to the expansion of its products, the installment of more Superchargers, and vehicle repair networks.

“We may need or want to raise additional funds in the future, and these funds may not be available to us when we need or want them, or at all. If we cannot raise additional funds when we need or want them, our operations and prospects could be negatively affected,” the quarterly report of Tesla read.

Year-over-year, Tesla has seen a noticeable increase in revenues. In the first quarter of 2018, Tesla recorded total revenue of $3.4 billion. In comparison, in the first quarter of 2019, Tesla recorded total revenue of more than $4.5 billion, primarily due to a spike in automotive sales.

Hence, while it could undoubtedly be a period for investors to become increasingly concerned on the growth trend of Tesla due to the weak first quarter of 2019 that failed to meet the expectations of Wall Street, it is too early to dismiss the projection of the company throughout 2019.

After six months of being long on Tesla, Citron Research editor and short seller Andrew Left reportedly closed his long contract on the company and is no longer short or long on the stock.

“I do not believe the company is insolvent, although I do believe they need to raise money,” Left said .

Elon Musk & Co. Face Crucial Challenge

As Jeffrey Sonnenfeld, a senior associate dean at the Yale School of Management, said on CNBC, Tesla failed in expectations.

“[It isn’t that Musk has] just dramatically failed in expectations but it’s that he set these expectations himself, [Tesla’s stock is not] anywhere near $420,” Sonnenfeld said .

A potential variable in the medium-term success of Tesla is the U.S.-China trade talks. Tesla has invested heavily in its Gigafactory in China and the challenges of shipping Teslas to China have added to the struggle of the company.

That said, if Tesla moves forward with its plan to raise additional capital, which some strategists and short sellers see as a crucial move for the company, the firm would need to continue strengthening its financials to satisfy investors in the upcoming quarters.

Otherwise, Elon Musk – already under fire for his endless Twitter scandals – could face even more shareholder backlash.