Elon Musk Loads Up Tesla Stock But Carmaker’s Worst Enemy is Tesla Itself: Morgan Stanley

Tesla has a headache coming and it's used Teslas, according to a Morgan Stanley analyst. | Source: Shutterstock

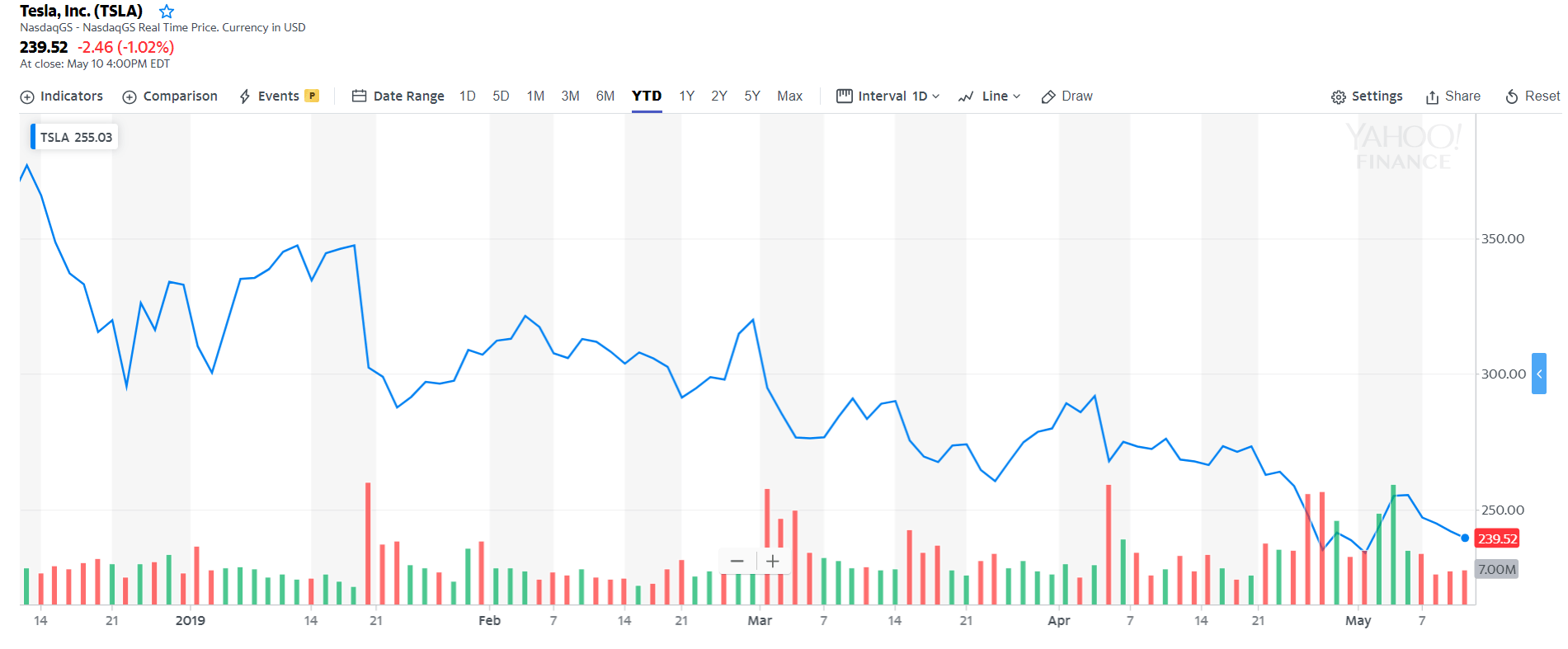

By CCN.com: Tesla stock has been down in the dumps so far this year. Billionaire Elon Musk’s company has eroded investors’ wealth to the tune of almost 28% in 2019, as operational challenges have taken precedence over the CEO’s mind-numbing claims about how Tesla stock could rise to $2,900 in the future.

But don’t be surprised to see Tesla stock making investors more miserable as Morgan Stanley analyst Adam Jonas’ recent note indicates that demand for its cars could be on the wane.

A new headache for Elon Musk

Jonas, a well-followed Tesla analyst, recently said in a research note to clients that the Elon Musk-led company’s efforts to increase production and deliveries will backfire. As reported by CNBC , Jonas’ note says:

Many auto companies make great efforts to maintain and remarket their used vehicles to increase accessibility of the used product to customers who otherwise cannot afford to buy new … we note there may be a simultaneous price to pay in terms of eroding scarcity value.

Jonas goes on to add that there will be over 860,000 Tesla cars on the road by the end of 2019.

Earlier this year, Elon Musk said that Tesla could deliver between 360,000 to 400,000 vehicles in 2019, though he later claimed that deliveries could be at the higher end of that range.

Considering Musk’s weak track record of delivering on his promises, it would be surprising to see Tesla deliver even 360,000 vehicles this year.

Assuming that the company does manage to move 360,000 units, it would mean that Tesla will deliver one car for every 2.5 cars that are already on the road. This means that there’s a huge pre-owned Tesla market out there already, with the oldest car probably being seven years old as the Model S was launched in 2012.

Are too many Tesla cars hurting the stock?

There’s an indication that this burgeoning pre-owned car market is hurting Tesla’s sales and stock already. The company’s customer deposits fell to $768 million last quarter as compared to $793 million the quarter before despite the introduction of the Model Y in the month of March.

Moreover, sales of the Model 3 reportedly plunged 74% in January this year as compared to the previous month. That’s bad news for Tesla stock as the Model 3 sold 145,000 units in 2018, and the company has been betting on this vehicle to drive growth in 2019 thanks to its affordable price point.

But the numbers say otherwise. Tesla’s deliveries fell to 63,000 cars in the first quarter of 2019, down from nearly 91,000 vehicles in the preceding quarter. Of course, Elon Musk claims that logistics problems kept Tesla from meeting its delivery targets, but in reality, there could be two factors working against the company.

First, the large number of old Tesla cars present on the roads gives buyers a cheaper way to get into the electric vehicle ecosystem. Second, the phase-out of the federal EV tax credit and the price hikes put in place by Tesla is making its pre-owned cars more attractive.

These factors are probably taking a toll on the company’s financial performance as its latest results show us, putting pressure on Tesla’s stock price in turn.

As such, Tesla stock could get caught up in the dynamics of the car market as consumers look to stretch their dollar by going for older cars instead of spending more money on new ones, especially considering that the company can upgrade the software of its older cars to enhance their capabilities.

So don’t think that the Tesla stock carnage is over as an increasing population of older cars is capable of denting its new car sales.