Tesla’s ‘Dog Mode’ Malfunctions, Placing Elon Musk in Hot Seat Again

Billionaire Elon Musk is fixing the "Dog Mode" feature in his Tesla cars after a customer complained that it almost killed his pooch. | Source: REUTERS/Mike Blake

Billionaire Elon Musk is fixing the “Dog Mode” feature in his Tesla electric cars after a customer complained that it almost killed his pet.

Musk was alerted to the problem on Twitter by bitcoin investor Rahul Sood, the CEO of e-sports blockchain betting platform Unikrn. As CCN.com reported, Unikrn is an esports company backed by tech billionaire Mark Cuban.

Tesla unveiled Dog Mode in February

After lamenting that it was extremely hot in Seattle, Sood told Musk that he had used “Dog Mode” in his Tesla. It’s a feature that regulates the car’s temperature to keep unattended pets cool until their owner returns.

Tesla owner to Elon Musk: ‘You’re the best’

Instead of cooling his dog off, Sood said the temperature inside his Tesla soared to a stifling 85 degrees. “Dog mode only works if in auto, if you manually set the fan and leave, the AC turns off,” Sood explained.

Musk responded by tweeting: “Fixing.”

Sood thanked Musk for taking care of the problem. He then tweeted a photo of his dog, Enzo, who looked happy and well.

In addition to regulating temperature, “Dog Mode” notifies passersby of a dog’s safety by displaying a message on a touchscreen inside the Tesla that reads, “My owner will be back soon. Don’t worry! The AC/heater is on and it’s [70 degrees].”

Tesla unveiled the feature in February 2019, noting that hundreds of dogs die each year from heatstroke after being left unattended by their owners running “quick errands.”

Elon Musk was able to quickly address the “Dog Mode” flaw. However, Tesla is still being roiled by urgent problems.

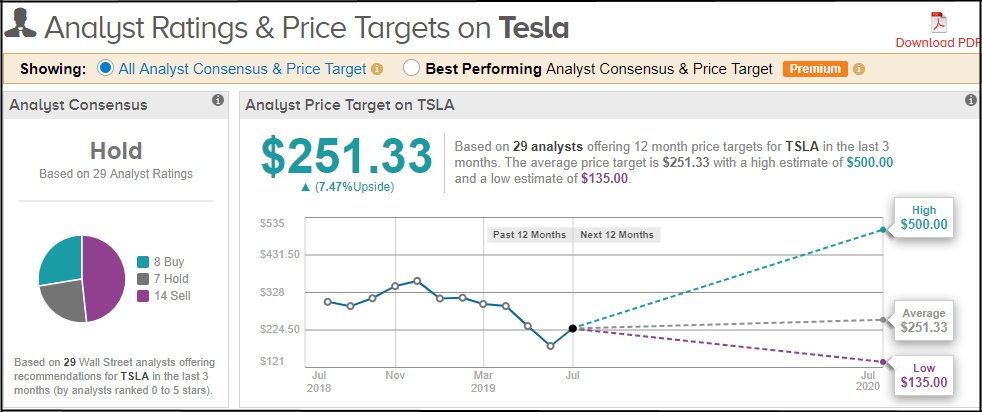

For one, Tesla recently posted a second-quarter loss of $1.12 a share. The Q2 loss was wider than the loss of 40 cents a share that analysts had expected.

Meanwhile, second-quarter revenue came in at $6.35 billion, slightly below the $6.41 billion that Wall Street had expected.

Tesla stock under pressure

Tesla has been under pressure this entire year. In May, TSLA tumbled into a “code red” after its stock price plunged below $200 a share.

At the time, Musk admitted in a frantic internal email that Tesla was in dire financial straits and that it only had $2.2 billion in cash on hand. That was just enough money to last another 10 months. To stem the bleeding, Musk instituted an immediate cost-cutting plan.

Last week, Elon Musk surprised Wall Street when he announced that Tesla would be self-funding going forward.

Many analysts remain bullish

While many on Wall Street are washing their hands of Tesla given its difficult year, some analysts remain bullish.

Craig Irwin of Roth Capital Partners noted that Tesla is years ahead of its competition, especially with its use of silicon carbide semiconductors.

“Tesla has set the pace on new technology adoption and really pushed the pedal on an industry that is very stodgy,” Irwin said. “Tesla is very much a technology company that looks like a car company.”

Wright also pointed out that Apple wanted to acquire Tesla in 2013, so it’s probably still interested. And this keeps him from losing faith in Tesla despite its recent struggles.

In 2013, Tesla’s stock was trading at roughly $104, so Apple’s $240-a-share bid was a significant markup from its price at the time. That shows that Apple believed Tesla was worth the big bucks.

So if Apple has faith in Tesla, it’s likely that other technology companies also want to court it. In other words, Tesla was a hot property back then, and it remains so today.

Related: Notorious Tesla short-seller demands Elon Musk resign