Dow’s Punishing 6-Week Skid Eclipses Alarming Milestone: 1,600 Points

The Dow collapse surpassed 1,600 points on Friday after the DJIA failed to bring an end to its punishing six-week freefall. | Source: REUTERS / Shannon Stapleton (i), REUTERS/Brendan McDermid (ii). Image Edited by CCN.com.

By CCN.com: The Dow and broader U.S. stock market booked heavy losses on Friday after the Trump administration took its tariff war south of the border to Mexico, amplifying concerns about a synchronized slowdown in global economic growth.

Dow Implodes; S&P 500, Nasdaq Follow

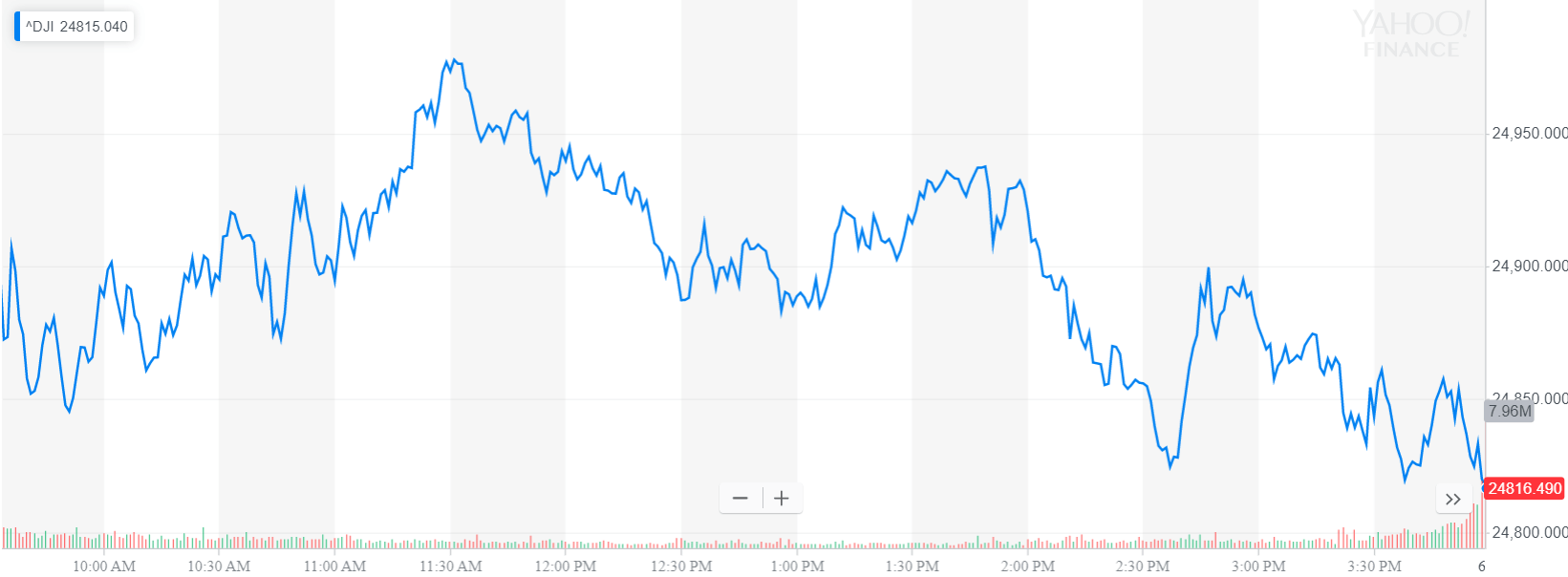

All of Wall Street’s major indexes headed sharply lower Friday, extending a brutal pre-market session for Dow futures. The Dow Jones Industrial Average declined 354.84 points, or 1.4%, to close at 24,815.04.

The broad S&P 500 Index of large-cap stocks fell 1.3% to 2,752.06, with nine of 11 primary sectors contributing to the selloff. Eight of those traded at a loss of 1% or more, with communication services leading the downward spiral.

The Nasdaq Composite Index, which is heavily exposed to communication and technology companies, plunged 1.5% to 7,453.15.

A measure of implied volatility known as the CBOE VIX approached its historic mean on Friday, offering yet another warning sign that the bull market was losing momentum. VIX peaked at 19.72 on a scale of 1-100 where readings above 20 approach the historical average.

Stock Market Suffers Historic Losing Streak

After a red-hot start to 2019, the month of May goes down as one of the worst for U.S. stocks since the financial crisis. The Dow Jones Industrial Average has extended its losing streak to six weeks, marking its worst stretch of consecutive losses in about eight years. Over that period, the blue-chip index has lost a staggering 1,600 points.

Investors have adopted a risk-off mentality over the past month as the United States and China drifted further apart on a trade deal, compromising the already shaky outlook on the global economy. During that stretch, capital has poured into government debt, pushing the yield on the 10-year U.S. Treasury to nearly two-year lows.

In a recent interview with CNBC , Bespoke Investment co-founder Paul Hickey said “Treasurys are extremely overbought right now” compared with the historical trend and are currently testing key levels of around 2.20%. Bond yields fall when prices rise.

The 10-year Treasury yield plunged below that key level Thursday. On Friday, it reached a low of 2.13%.

Click here for a real-time Dow Jones Industrial Average price chart.