Dow’s 800-Point Crash Spares No One as IMF Unleashes Grim Warning

The stock market is in the midst of another bruising correction on Tuesday. | Image: TIMOTHY A. CLARY

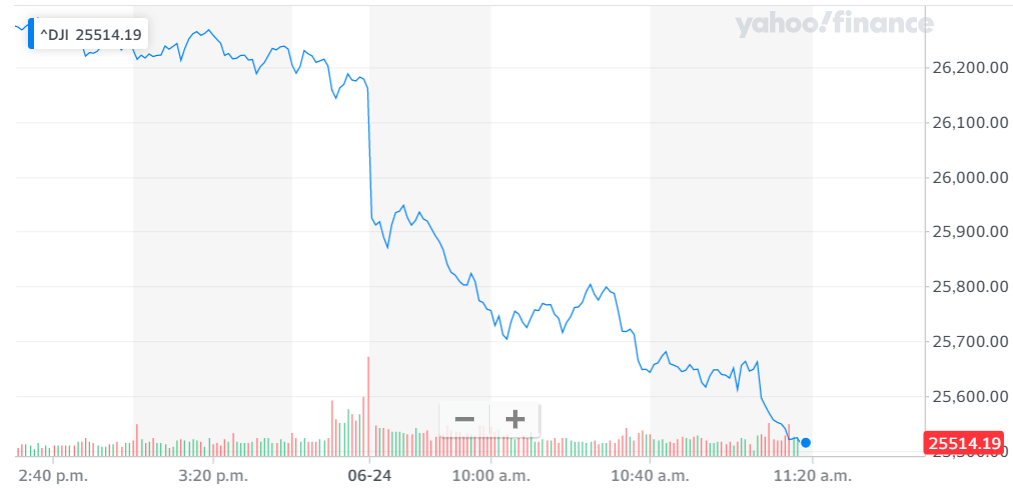

- The Dow Jones Industrial Average plunged by as much as 843 points Wednesday.

- The losses follow a highly volatile pre-market session as investors reacted to President Trump’s shockingly low re-election odds as per the New York Times.

- All 30 of the Dow’s blue-chip companies record losses, with Boeing leading the declines.

The Dow and broader U.S. stock market underwent another wave of selling on Wednesday, as investors reacted to a grim forecast about the global economy. President Trump’s re-election odds are also in focus after a New York Times poll put Joe Biden lightyears ahead of the incumbent.

Dow 30 Plunge; S&P 500, Nasdaq Follow

All of Wall Street’s major indexes printed heavy losses Wednesday, reflecting a volatile pre-market for Dow futures .

The Dow Jones Industrial Average plunged by as much as 843 points. Year-to-date, the blue-chip index is down over 11%.

All 30 Dow index members recorded losses, with Boeing (NYSE:BA) leading the declines. Raytheon Technologies (NYSE:RTX), ExxonMobil (NYSE:XOM), and Dow (NYSE:DOW) also declined sharply.

The broad S&P 500 Index of large-cap stocks plunged 2.9%, with all 11 primary sectors recording declines . Energy shouldered the most substantial losses; as a sector, it fell 5.8%. Financials, industrials, and healthcare companies also posted significant declines.

Meanwhile, the technology-focused Nasdaq Composite Index declined by 2.6%.

Volatility Rises

The CBOE Volatility Index, commonly known as the VIX, spiked 14.1% to 35.80. Anything above 20 represents higher than usual volatility.

Typically, the CBOE VIX moves in the opposite direction of stocks. When the VIX rises, stocks fall, and vice-versa.

Volatility approached record highs in March as stocks plunged into a bear market. Although the gauge is still higher than average, it’s much lower than where it was a few months ago.

IMF Downgrades Global Economic Outlook

Losses were magnified by a damning report on the global economy from the International Monetary Fund (IMF). The lending institution has downgraded its outlook on global economic growth, referring to the pandemic as a “crisis like no other.”

The IMF’s revised forecast shows global GDP contracting 4.9% in 2020. In April, the Fund projected a 3% contraction.

The U.S. economy is forecast to fall 8% this year, while Eurozone GDP is expected to contract 10.2%. China’s economic growth is pegged at a modest 1% this year as India, Latin America, and developing Europe all contract.

A sudden resurgence in virus hot spots across the United States has cast doubts about the likelihood of a quick recovery. Brazil, Russia, and India have also become epicenters of the novel disease.

Low-income households are more prone to economic hardship due to the pandemic.

According to the IMF:

The adverse impact on low-income households is particularly acute, imperiling the significant progress made in reducing extreme poverty in the world since the 1990s.