Breaking: Dow Holds Gains as FOMC Minutes Confirm Dovish Turn for Fed

Consumer inflation fell | Source: SAUL LOEB / AFP

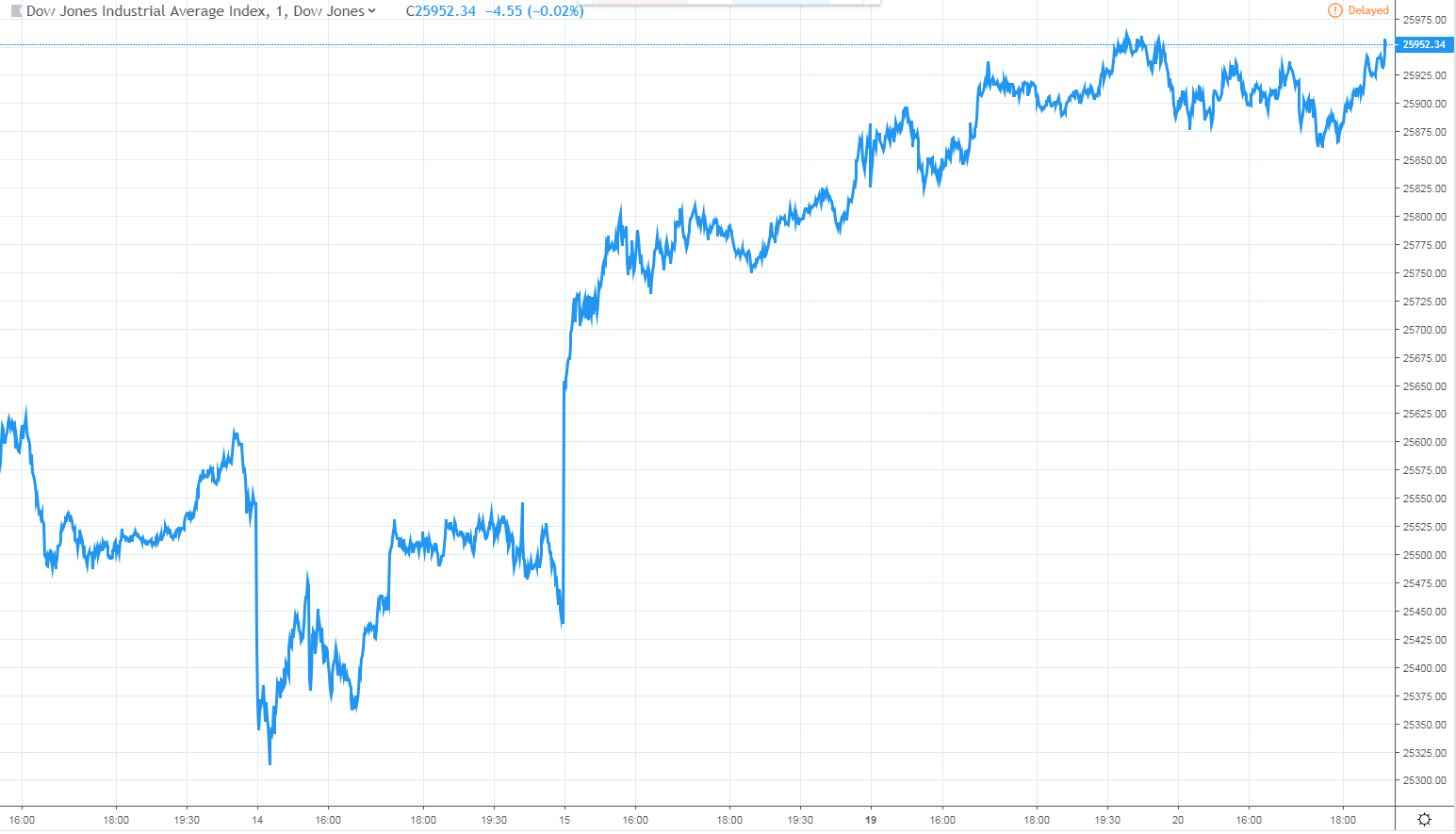

The Dow held onto gains Wednesday afternoon following the release of the Federal Reserve policy meeting minutes, which confirmed the central bank’s intent to pause interest-rate hikes.

DOW HOLDS GAINS, NASDAQ TURNS RED

The Dow Jones Industrial Average rose 61 points, or 0.2%, to 25,952.32. The blue-chip index traded slightly higher through the early morning, mirroring a tepid pre-market session for Dow futures.

The broad S&P 500 Index climbed 0.1% to 2,782.29, with most of the gains concentrated in primary industries. Materials stocks rose 1.4% on average, while energy shares added 0.5%. Stocks tied to real estate, consumer staples, and health care reported losses.

Meanwhile, the Nasdaq Composite Index reversed its gains, falling 0.1% to 7,480.35.

The eight-week rally in share prices has zapped volatility from the markets, according to the CBOE VIX. The most widely used measure of investor anxiety declined a further 3.3% on Wednesday to hit 14.39. That’s the lowest since Oct. 4. For comparison, the VIX historically trades above 20.00 and it peaked north of 36.00 before Christmas Eve.

U.S. stocks experienced their best start to a year in three decades, but this chart spells trouble for the S&P 500.

FOMC MINUTES CONFIRM RATE-HIKE PAUSE

At 2:00 p.m. ET, the Federal Reserve released the official transcript of its January policy meeting, where officials voted to keep interest rates on hold. Members of the Federal Open Market Committee (FOMC) struck a dovish tone at their meeting last month by reinserting language referring to ‘patience’ in their approach to tightening. This came after the December downgrade on the number of rate hikes expected for 2019.

“Participants pointed to a variety of considerations that supported a patient approach to monetary policy at this juncture as an appropriate step in managing various risks and uncertainties in the outlook,” the minutes said .

The transcript mirrors excerpts of the official policy statement, which was released on Jan. 30:

“In light of global economic and financial developments and muted inflation pressures, the Committee will be patient as it determines what future adjustments to the target range for the federal funds rate may be appropriate to support these outcomes,” the statement read.

Futures traders took this to mean that no additional rate hikes are coming this year. Fed Fund futures prices imply a greater likelihood of a rate cut before another upward adjustment.

Five Federal Reserve officials are scheduled to deliver speeches in the latter half of the week. On Friday, the central bank will release its latest Monetary Policy Report.

The FOMC will not meet again until next month. The March rate statement will be accompanied by a revised summary of economic projections covering GDP, unemployment, and inflation.

Featured image courtesy of Shutterstock. Chart via TradingView.