Dow Treads Water as Stock Market Lurches Toward Critical Test

The Dow endured a slight dip on Monday as the U.S. stock market lurched toward critical tests on multiple key economic fronts. | Source: Photo by Johannes EISELE / AFP

By CCN.com: The Dow and broader U.S. stock market drifted slightly lower on Monday, as investors disengaged from the markets in anticipation of fresh trading catalysts tied to economic data, corporate earnings, and a potential breakthrough in China trade negotiations.

Dow Edges Lower; S&P 500, Nasdaq Follow

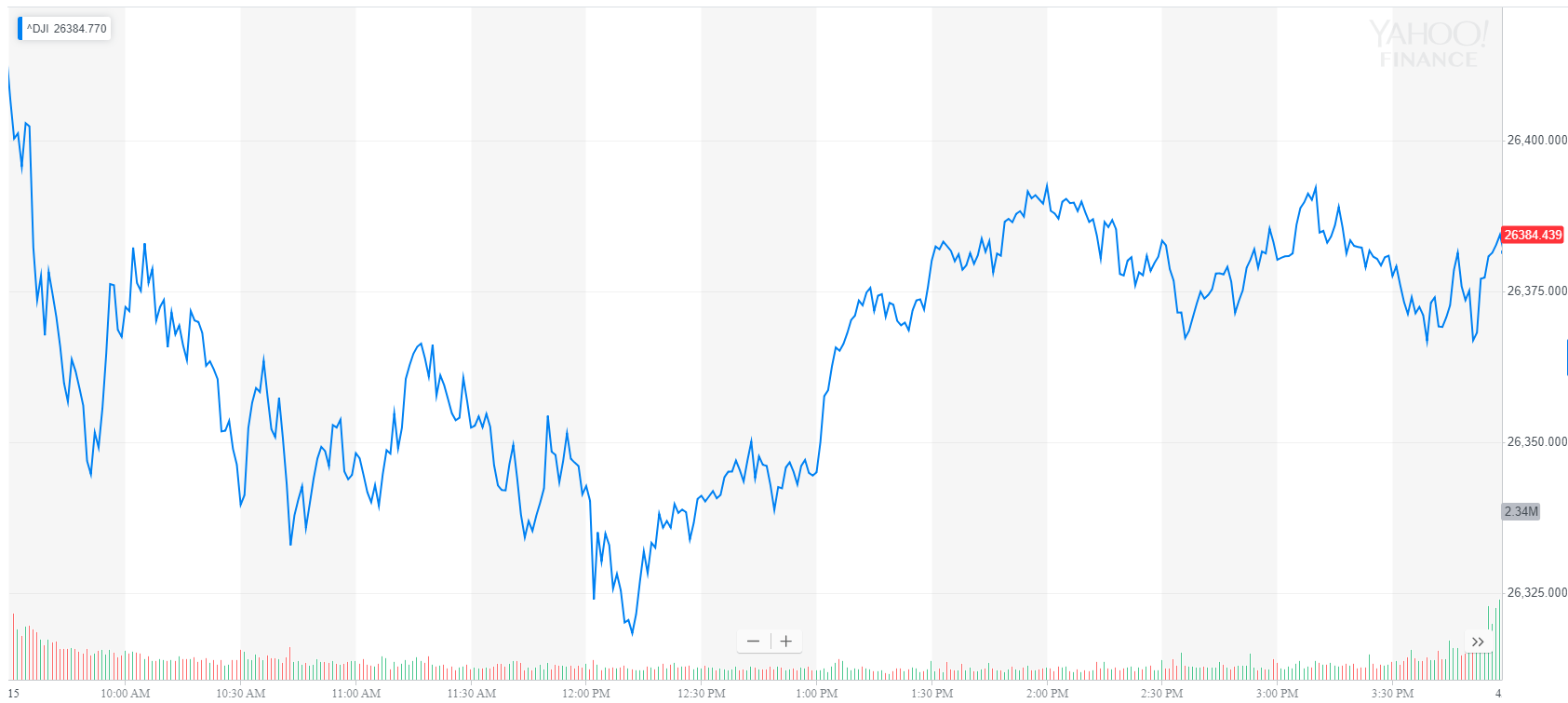

Stocks traded tepidly at the start of the week, reflecting a mostly subdued pre-market for Dow futures. The Dow Jones Industrial Average tumbled 27.53 points, or 0.1%, to 26,384.77. The blue-chip index was down as much as 99 points earlier in the day.

The broad S&P 500 Index of large-cap stocks declined 0.1% to 2,905.58, with most of the losses concentrated in financials, materials, and industrials.

The Nasdaq Composite Index also fell 0.1% to 7,976.01.

Earnings, Trade War Dominate Pivotal Week for Stock Market

Earnings season was in full swing on Monday after Goldman Sachs Group Inc. (GS) and Citigroup Inc. (C) reported first-quarter results. Goldman said quarterly profits tumbled amid weakness in its trading and underwriting businesses. Citigroup’s quarterly revenues declined more than expected as its trading business also suffered.

Bank of America Corp (BAC), BlackRock Inc. (BLK). Netflix Inc. (NFLX), and Dow blue-chip UnitedHealth Group Inc. (UNH) are due to report on Tuesday.

Investors this week will get a better sense of how the economy is performing with reports on industrial production, retail sales, and housing starts all scheduled for release.

Market participants will also be keeping close tabs on U.S.-China trade negotiations after Treasury Secretary Steven Mnuchin said he was hopeful that talks were approaching their final lap. On Sunday, Reuters reported that U.S. negotiators had lowered demands that Beijing curb industrial subsidies as a pre-condition for a final trade agreement. According to Reuters, the Trump administration is looking to secure a deal in the next month or so and is willing to give China more leeway on subsidies.

Although there is no deadline for a final agreement, President Trump would like to finalize a new framework well in advance of his 2020 election campaign. There are signs that the Trump administration is looking to take its trade fight to the European Union after the president criticized Brussels’ Airbus subsidies. As Hacked reported last week, Trump’s EU tariff threat sent the Dow tumbling.