Dow Trapped in Limbo as Investors Fear US Stocks are Too Expensive

Following Monday's Dow rout, investors are scared that the U.S. stock market is too expensive. | Source: Shutterstock

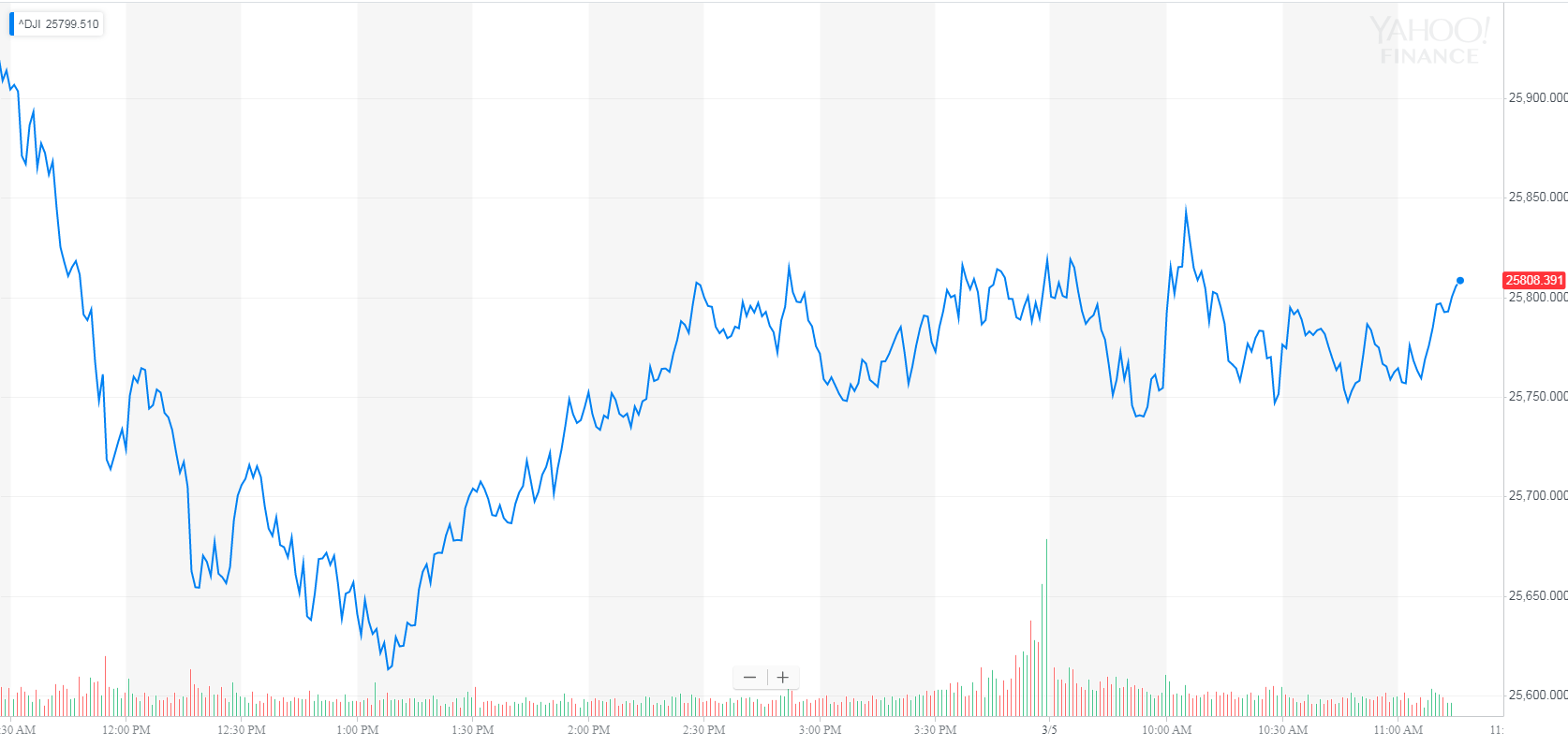

The Dow and broader U.S. stock market weakened on Tuesday, as overvaluation risks kept the major indexes subdued following a sharp correction at the start of the week.

Dow, S&P 500 Fail to Rally as Valuation Risks Linger

A lack of positive momentum kept the major indexes subdued on Tuesday, with the Dow Jones Industrial Average edging down 10 points, or 0.0.4%, to 25,809.67. The blue-chip index opened slightly higher but quickly fizzled, reflecting a lackluster pre-market session for Dow futures.

The broad S&P 500 Index of large-cap stocks was trading flat at 2,792.46 after paring earlier losses. Downside pressure was primarily concentrated in financials and energy stocks, which account for roughly $10.5 trillion of the S&P 500’s market cap. On the opposite side of the ledger, communication services and discretionary shares rallied 0.4%.

The benchmark index is stuck below 2,800, a level that has eluded the bulls since October. Buyers failed to rally beyond that point four times over that stretch, a strong sign that investors are concerned about valuation risks. The S&P 500 closed above 2,800 on Friday but quickly reversed course at the start of the week.

Read more about why stocks could be headed lower: Does this Chart Spell Doom for the S&P 500 Index?

The technology-focused Nasdaq Composite Index reversed losses to trade at 7,584.26, having gained 0.1%.

The CBOE Volatility Index, also known as the VIX, rose 4.3% on Tuesday to 15.26. VIX spiked more than 20% on Monday before backtracking later in the session.

US-China Trade Deal to the Rescue?

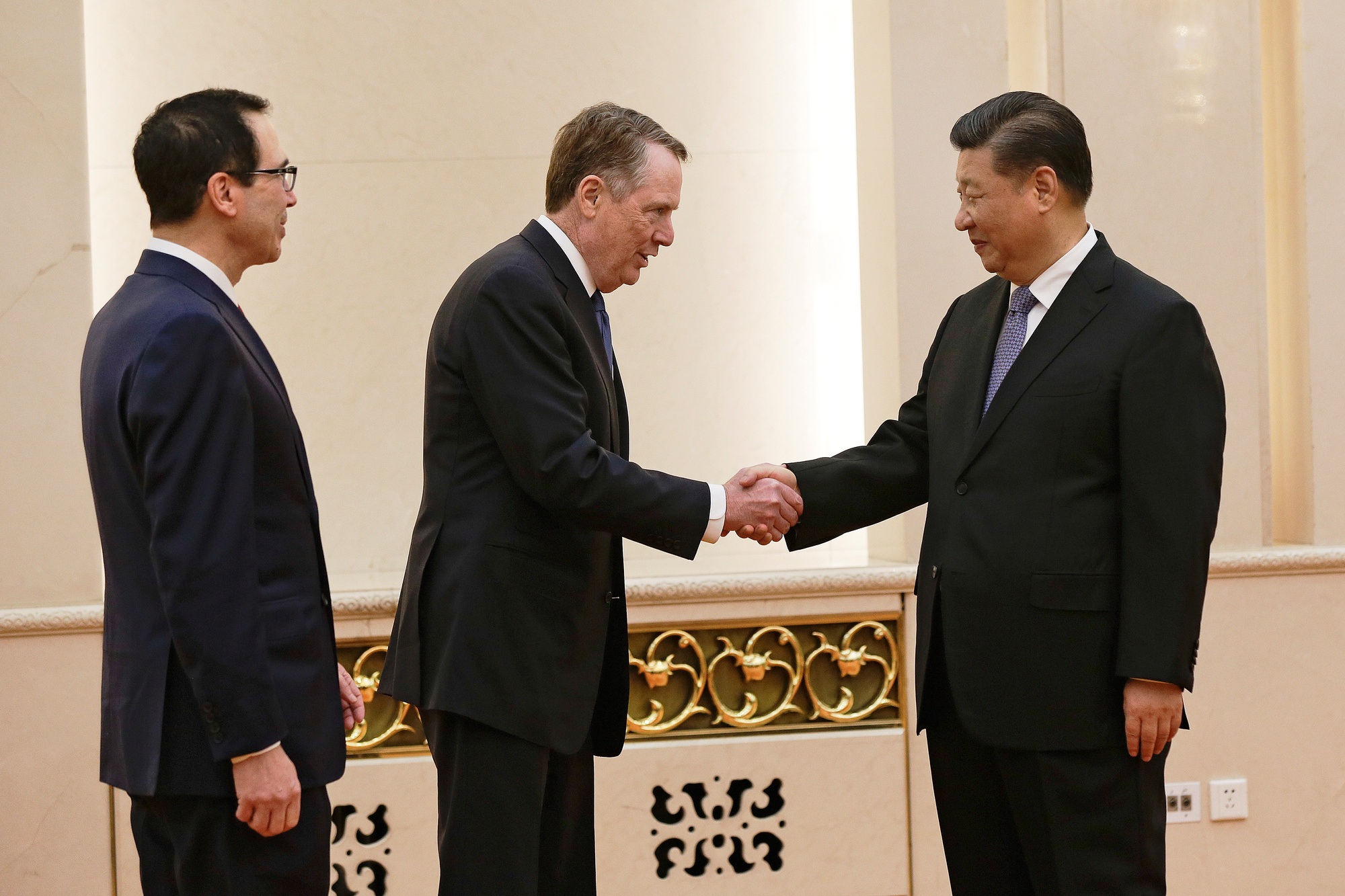

Equity markets may be overvalued, but that never stopped investors from buying up stocks during the so-called Trump reflation trade. The next major catalyst for the bulls will likely come in the form of a trade deal between the United States and China.

On Sunday, The Wall Street Journal reported that a new trade deal was imminent following weeks of high-level negotiations between the two superpowers. The Chinese have reportedly agreed to lower tariffs and other restrictions on American businesses provided that Washington removes most, if not all, duties on Chinese imports.

The so-called trade war has cost American exporters tens of billions of dollars in lost business, according to a new study by the Institute of International Finance. The Trump administration likely believes this is a small price to pay for re-balancing the terms of trade with a country known for pursuing an unfair trade agenda.

The trade war has cost China way more, as evidenced by the sharp drop in foreign direct investment and slowdown in economic growth. For these and other reasons, Beijing is keen on signing a new trade deal that keeps exports flowing to the world’s largest economy.

While a trade deal looks imminent, no further updates have come from the White House or Beijing. Talks are likely to resume at some point this month, which should provide markets with more tangible clues on the direction of negotiations.