Dow Teeters after Nancy Pelosi Says Democrats Won’t Impeach Trump

The Dow rallied after the Trump administration struck a deal with Nancy Pelosi to avert another economy-rattling government shutdown. | Source: Doug Mills / POOL / AFP

Dow futures slipped back into the red on Tuesday as the US stock market grapples with the fallout of the UK’s impending Brexit vote, as well as House Speaker Nancy Pelosi’s revelation that she does not support plans to impeach President Donald Trump.

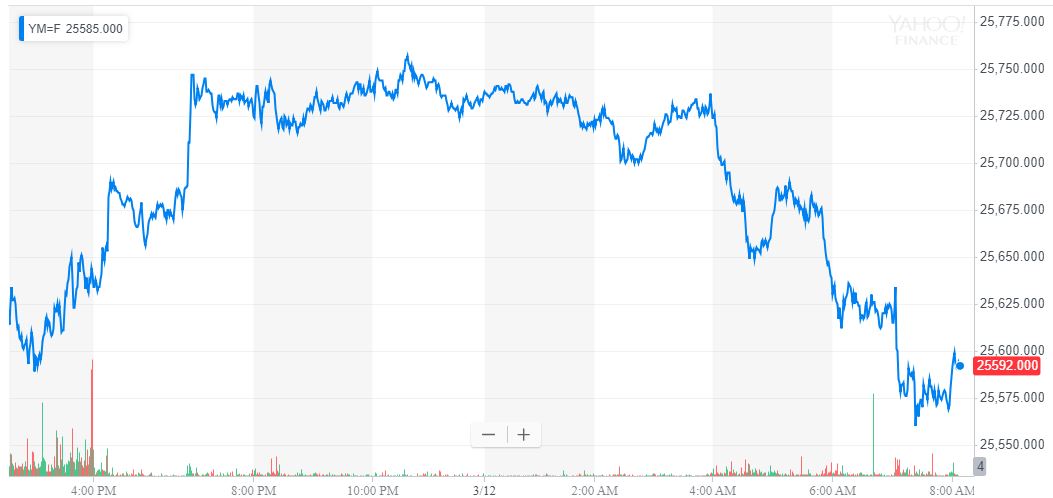

Dow Futures Slip after Massive Monday Recovery

On Monday, the Dow recovered from an opening-bell bloodbath to mount a 442.88 point recovery and close more than 200 points higher, notching its first session gain since March 1. The S&P 500 rose 40.23 points or 1.47 percent to close at 2,783.30, crossing the crucial 2,750 threshold but failing to break through resistance at 2,800. The Nasdaq, meanwhile surged by 149.92 points to record a mammoth 2.02 percent increase.

The Dow and its peers don’t look poised to extend Monday’s recovery, however.

As of 8:28 am ET, Dow Jones Industrial Average futures had lost 73 points or 0.28 percent, implying a loss of 56.88 points at the open. S&P 500 futures were unchanged, while Nasdaq futures crept to a 0.11 percent advance.

Brexit, Boeing Weigh on Dow Jones

US stock futures had traded higher earlier in the session but slipped after UK Attorney General Geoffrey Cox failed to give Prime Minister Theresa May the all-clear on her amended Brexit deal, even after she secured legally-binding assurances regarding the “Irish backstop” from the EU late Monday night. May’s Brexit deal faces a parliamentary vote on Tuesday evening, and its success is uncertain now that Cox has said that “legal risk remains.”

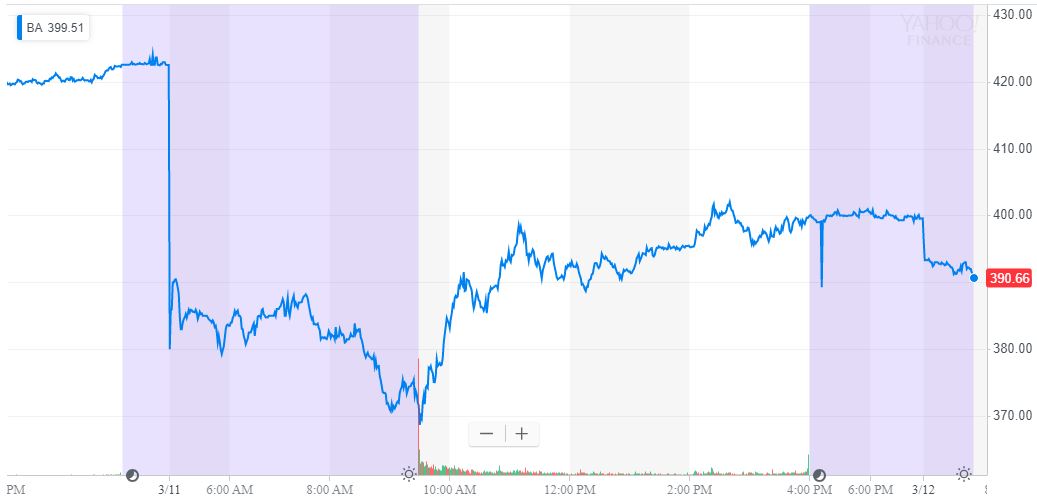

The Dow also faces ongoing downward pressure from Boeing, which continues to reel from the tragic crash of Ethiopian Airways Flight ET302.

Australia has joined a growing number of countries in grounding all flights of 737 MAX 8 aircraft, and Boeing stock is down 2.38 percent in pre-market trading after dropping by 5.33 percent on Monday.

Pelosi Says ‘No’ on Trump Impeachment, Saving Dow from 5,000 Point Plunge

Though not visible in today’s pre-market session, the Dow and its peers could benefit from the long-term tailwinds of Speaker of the House Nancy Pelosi stating unequivocally that she opposes impeaching President Donald Trump , even though that is something that the Democratic base desperately wants.

Claiming that Trump was “just not worth it,” she diverged from many in her party by stating that just because Trump is not “fit to be president of the United States,” it doesn’t mean the Democrats should wage a politically-risking impeachment fight:

“Impeachment is so divisive to the country that unless there’s something so compelling and overwhelming and bipartisan, I don’t think we should go down that path, because it divides the country.”

Writing in a Wall Street Journal op-ed , Velocity Capital founder Andy Kessler argued that drawn-out impeachment proceedings would wreak havoc on the stock market as fund managers scrambled to position their capital to ride out an uncertain future.

He said:

“A drawn-out impeachment process could cut as much as 5,000 points off the Dow, roughly half of the Trump bump.”

According to Kessler’s thesis, taking impeachment off the table should rescue the stock market from a major bout of volatility. However, the market’s future is anything but stable as the US careens toward the 2020 election season.

Crypto Market Adds $800 Million But Bitcoin Remains Stuck Below $4,000

Outside of Wall Street, the cryptocurrency market also traded sideways, with the bitcoin price rising 0.48 percent to $3,893 over the previous 24 hours, according to Yahoo/CryptoCompare. Litecoin and EOS each added two percent, while binance coin and cardano outperformed with gains in excess of 5 percent. The only top-10 cryptocurrency to post significant declines was stellar, which fell 3.17 percent after surging more than 20 percent over the past week. The overall crypto market cap added about $800 million for the day, settling at a present value of $134 billion.