Dow Surges 200 Points as Manufacturing Rebound Pumps US Stock Market

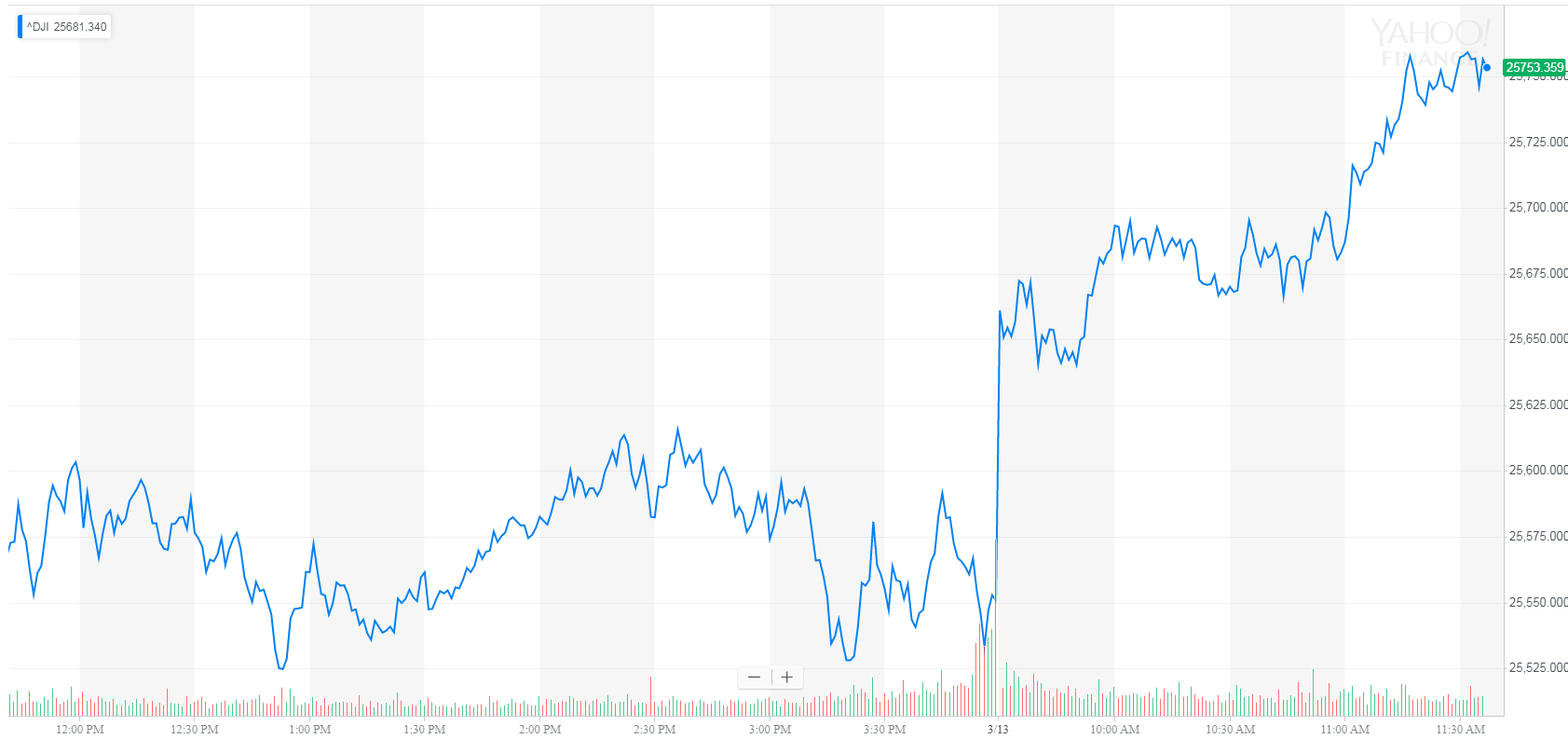

The Dow jumped by around 200 points on Wednesday following a volatile session for US stock market futures. | Source: AP Photo / Richard Drew

The Dow and broader U.S. stock market surged on Wednesday after a key gauge of manufacturing demand rose faster than expected in January, raising optimism that the economy was still on track.

Dow Jumps Past 25,750; S&P 500, Nasdaq Follow

Wall Street’s major indexes rose sharply through the late morning, overcoming a choppy pre-market for Dow futures. The Dow Jones Industrial Average climbed 198 points, or 0.8%, to 25,752.72.

All but three of the Dow’s 30 index members recorded gains, with UnitedHealth Group Inc. (UNH), United Technologies Corp (UTX), and Visa Inc. (V) climbing at least 1.1% each. After a two-day bloodbath, shares of Boeing Co (BA) showed signs of stabilizing after President Trump spoke with the company’s CEO by telephone Tuesday.

The S&P 500 Index of large-cap stocks rose 0.9% to 2,815.79, where it was on track to settle at four-month highs. All 11 primary sectors contributed to the rally, with information technology and health care each adding 1%. Financials and primary markets also rose sharply.

An impressive rally in technology stocks propelled the Nasdaq Composite Index to significant gains. The tech-driven average surged 1% to 7,666.76, the highest since November.

The CBOE Volatility Index, commonly known as the VIX, was on track for its lowest settlement of the year around midday. VIX fell 3.3% to 13.32 on a scale of 1-100 where 20-25 represents the historic average.

Manufacturing Rebound Pushes US Stock Market Higher

The U.S. manufacturing sector is showing signs of life again after an abrupt slowdown in the second half of 2018. Durable goods orders rose 0.4% in January, confounding expectations of a 0.5% drop, the Department of Commerce reported Wednesday. That was the third consecutive monthly gain.

Nondefense capital goods excluding aircraft, a key barometer of business spending plans, rebounded 0.8% during the month. That was well above forecasts and followed a sharp drop of 0.9% in December.

Separately, Commerce economists said construction spending surged 1.3% in January, more than three times higher than expected.

The Labor Department also reported that factory-gate prices increased less than expected last month, another sign of muted inflation in the world’s largest economy. The producer price index (PPI) edged up 0.1% in February and 1.9% year-over-year. Core inflation rose 0.1% on month and 2.5% annually, official data showed .

Muted inflation gives the Federal Reserve plenty of justification to keep interest rates on hold for the foreseeable future. On Tuesday, the Commerce Department said consumer price inflation approached two-and-a-half year lows in February.

The Federal Open Market Committee (FOMC) will hold its next policy meeting on March 19-20. The official interest rate statement will be accompanied by a revised summary of economic projections covering GDP, unemployment, and inflation.