Dow Shoots North But Hedge Fund Pro Warns of 40% Stock Market Crash

The Dow seesawed higher en route to its best week in 6 months. However, investing guru Stanley Druckenmiller warned of a looming stock market crash. | Source: Shutterstock (i), Brendan Mcdermid/Reuters (ii). Image Edited by CCN.com.

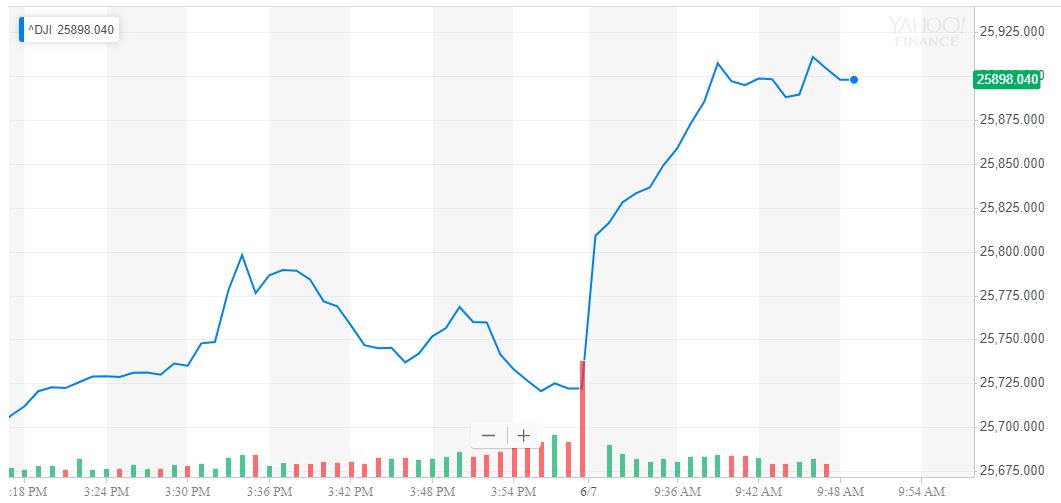

By CCN.com: The Dow overcame a worrisome jobs report to shoot higher on Friday, as the US stock market plowed ahead toward its best week since November 2018. However, one hedge fund legend warns that if Donald Trump fails to mount a successful reelection campaign, his successor could trigger a brutal 40% stock market crash.

Dow Seesaws Higher as Economy Backs Fed Into a Corner

Wall Street’s major indices sped toward blockbuster gains on Friday, building on a volatile pre-market session. As of 1:23 pm ET, the Dow Jones Industrial Average had leaped an astounding 277.81 points or 1.08%; the DJIA last traded at 25,998.47.

The S&P 500 rose 33.51 points or 1.18% to 2,877.

The Nasdaq, meanwhile, added 130.19 points or 1.71% to reach 7,745.74 to round out a bullish day on Wall Street.

Terrible May Jobs Report Triggers Recession Alarm Bells

Stock prices boomed on Friday, even after the Labor Department released its much-anticipated May jobs report , which, though not an outright disaster, did little to quell lingering recession fears.

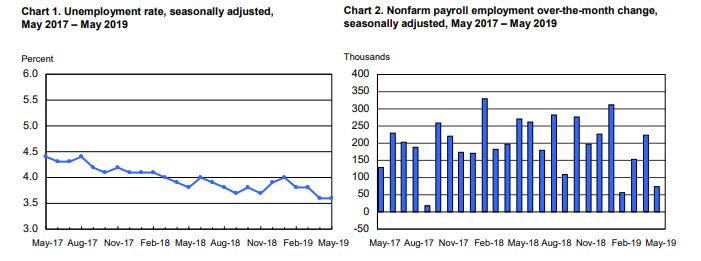

Here’s the good news: The unemployment rate held steady at 3.6% – a five-decade low.

But here’s the bad news: Non-farm payrolls rose by just 75,000 jobs in May, missing the consensus estimate of 177,000 by a staggering 58% margin. Even worse, the Labor Department revised the March and April NFP figures down by a combined 75,000 jobs.

If there’s a silver lining, it’s that the visible cracks in the economic boom could spur the Federal Reserve to pursue an interest rate cut sooner rather than later. However, as CCN.com reported, economists warn that Fed rate cuts are not a miracle salve.

And the fact that the Fed is considering them at all does not reflect well on the overall health of the US economy, which has yet to face the full brunt of Trump’s trade war threats.

Billionaire Druckenmiller: a 2020 Trump Loss Could Catalyze 40% Stock Market Crash

Regardless of the Dow’s short-term prospects, stock market analysts continue to point and scream at the rapidly-approaching 2020 US presidential election, which they warn could initiate a black swan event for the Dow, S&P 500, and Nasdaq.

This morning, billionaire hedge fund legend Stanley Druckenmiller revealed just how high the stakes really are, telling CNBC that if a “crazy” Democrat like Bernie Sanders bests Trump in 2020, it would likely provoke a 40% stock market crash.

“If Bernie Sanders became president, I think stock prices should be 30% to 40% lower than they are now,” he said.

At present levels, a 40% sell-off would slam the Dow below 15,500, the S&P 500 down to 1,700, and the Nasdaq toward 4,550.

Equally as concerning is that Druckenmiller firmly believes that Trump will lose reelection, leaving the fate of the stock market in the hands of a crowded Democratic field that has lurched farther left than any in recent memory.

Stock Market Eyes Best Week Since November 2018

Friday’s rally virtually assures that the Dow will snap its six-week losing streak in spectacular fashion, as the stock market looks poised to record its best week in more than six months.

On Thursday, the Dow soared 181.09 points or 0.71% to close at 25,720.66. The S&P 500 rose 17.34 points or 0.61%, and the Nasdaq increased 40.08 points or 0.53% to 7,615.55.

Click here for a real-time Dow Jones Industrial Average price chart.