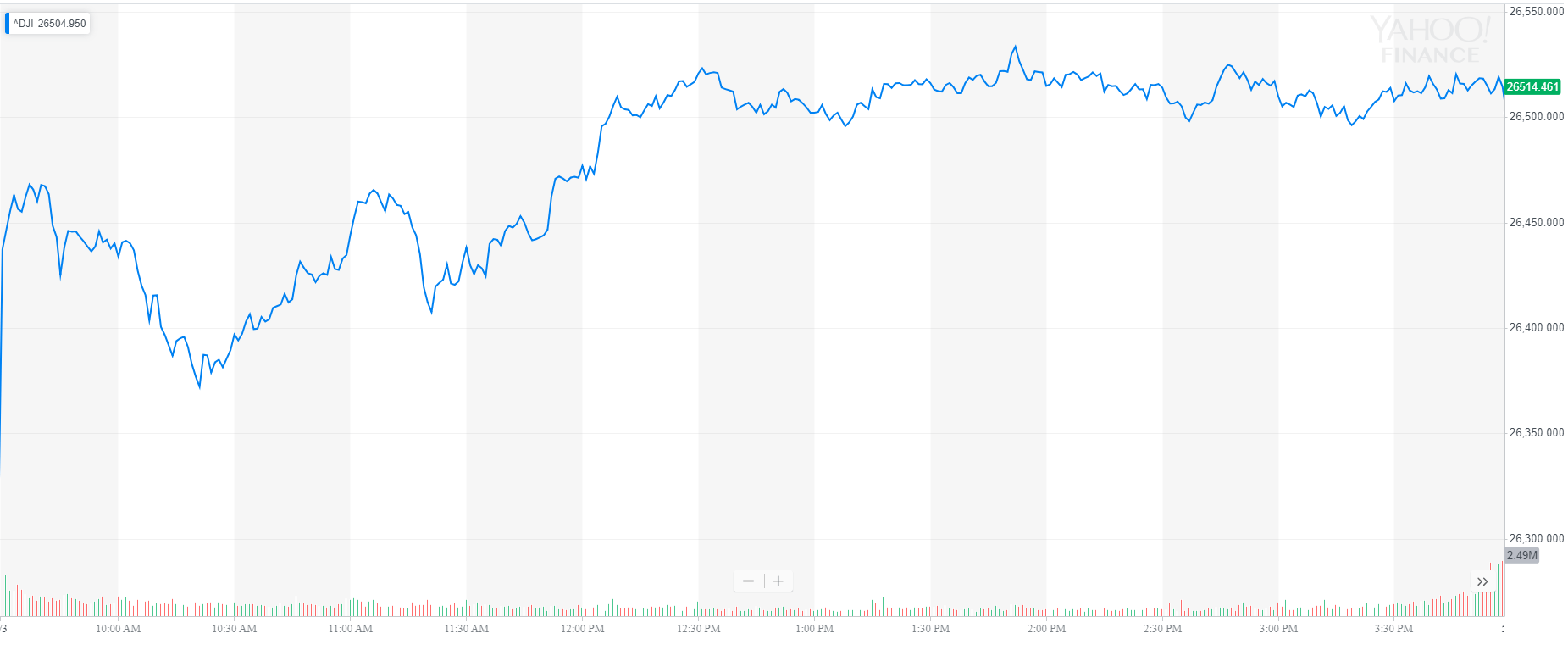

Dow Soars 200 Points on Blowout Jobs Report, But Tepid Wages Rattle Bond Markets

The stock market is on the verge of a major recovery. Here's why Wall Street has suddenly turned bullish despite numerous macro threats. | Source: Shutterstock

By CCN.com: The Dow and broader U.S. stock market blasted higher on Friday after stronger than expected jobs data quelled lingering doubts about the health of the domestic economy. But the picture wasn’t perfect, as tepid wage growth rattled bond markets, sending U.S. Treasury yields lower.

Dow Adds Triple Digits; S&P 500 Closes on Record Territory

All of Wall Street’s major indexes prepared to close sharply higher, reflecting a strong pre-market for Dow futures. The Dow Jones Industrial Average rose by as much as 2127 points through the middle of the day. It would later pair gains to settle up 199.65 points, or 0.8%, at 26,5o4.74.

The broad S&P 500 Index of large-cap stocks climbed 1% to 2,945.64, where it was nearing record highs. All 11 primary sectors contributed to the rally.

The technology-focused Nasdaq Composite Index jumped 1.6% to 8,164.00, a new record high.

Trump’s Job Market Continues to Surge

U.S. employers added 263,000 workers to payrolls in April, far exceeding the median forecast calling for 180,000, the Department of Labor reported Friday from Washington. The March hiring rate was revised slightly lower to reflect gains of 189,000 from the 196,000 that was originally reported.

Labor data also showed that unemployment returned to 49-year lows in April, falling to 3.8% from 4% previously. This came at the expense of labor force participation, as the percentage of Americans employed or actively searching for work dropped to 62.8% from 63%.

Average hourly earnings grew 0.2% month-on-month, which was slightly below expectations. Tepid wage growth is often viewed as a sign of weak inflation. This was immediately picked up by the bond market, and U.S. Treasury prices rose.

The yield on the benchmark 10-year Treasury bond reached a session low of 2.51% from 2.552% on Thursday, according to CNBC data.

President Trump’s case for reelection has strengthened in recent months amid progress in the economy and in free trade. Gross domestic product (GDP) expanded 3.2% annually in the first quarter, marking the best start to a year since 2015. Meanwhile, the United States and China continue to eye a resolution to their trade dispute by early next month.

Click here for a real-time Dow Jones Industrial Average price chart.