Dow Sputters as Rosenblatt Warns of ‘Deterioration’ in Key Stock

The Dow lurched toward a second straight loss on Monday as Wall Street research firm Rosenblatt slapped a sell rating on its sixth-largest stock. | Source: AP Photo/Richard Drew

The Dow lurched toward a second consecutive loss on Monday as Wall Street wrestled with uncertainty over Federal Reserve interest rate policy. Meanwhile, analysts at Rosenblatt downgraded a key DJIA stock.

Dow Lurches Toward Second Straight Loss

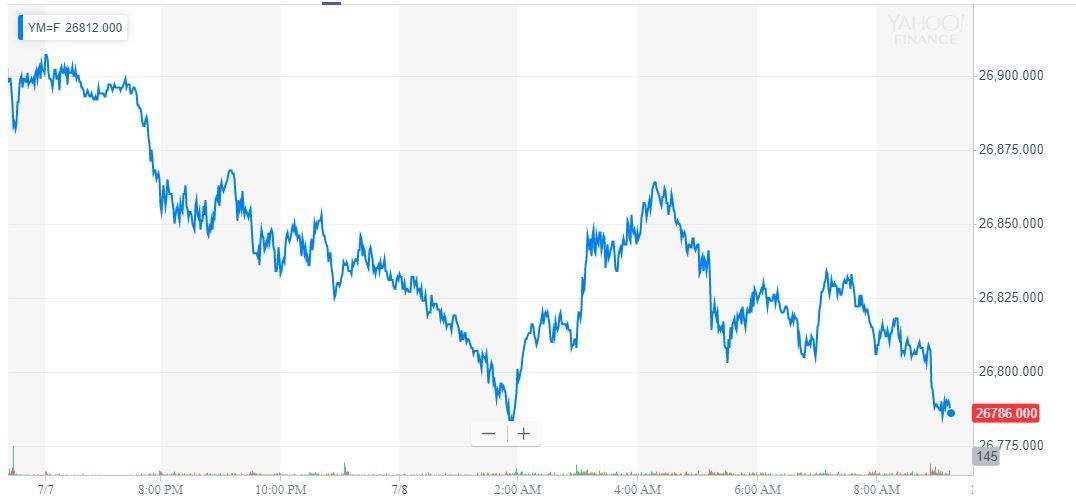

All of Wall Street’s major indices endured hefty losses at the opening bell. As of 9:31 am ET, the Dow Jones Industrial Average had plunged 130.92 points or 0.49%; the DJIA last traded at 26,791.2.

The S&P 500 slid 13.27 points or 0.44% to 2,977.14

The Nasdaq fell 55.56 points or 0.68% to 8,107.97 amid a tech stock bloodbath.

Rosenblatt Forecasts 25% Apple Stock Plunge

Stocks extended their previous-week declines after strong jobs data made traders fearful that they had been too eager to price in multiple Federal Reserve interest rate cuts by the end of the year.

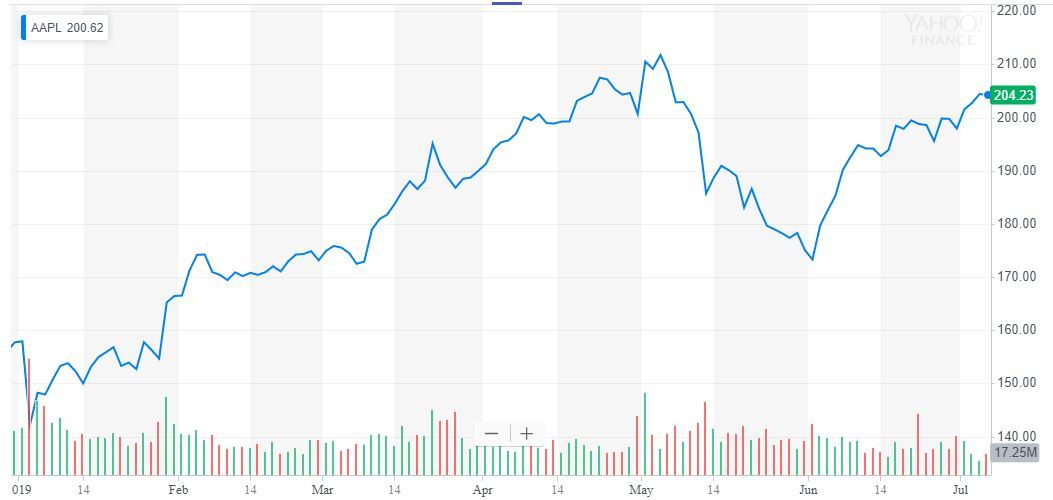

However, one stock in particular – Apple – suffered after Wall Street research firm Rosenblatt slapped a “sell” rating on the Tim Cook-led tech giant, a downgrade from its previous “neutral” rating.

Rosenblatt forecast that Apple stock would face “fundamental deterioration ” over the next year, marked by “disappointing” iPhone sales.

“Adding to our ‘sell’ thesis, we believe new iPhone sales will be disappointing, iPad sales growth will slow in the second half of 2019, other product sales growth, such as the HomePod, AirPod, and iWatch, may not be meaningful to support total revenue growth,” said Rosenblatt’s Jun Zhang.

The analyst maintains a $150 share price target on Apple stock, which anticipates a plunge of more than $50 or 25% from Friday’s close at just over $204.

Apple is the Dow’s sixth most heavily weighted component, accounting for 5.14% of the index.

Trapped in Trump’s Trade War

The firm is one of several Dow Jones leviathans trapped in the center of the US-China trade war, and President Trump has shown little sympathy for companies that are affected by his administration’s tariffs because they outsource manufacturing to China.

“Apple makes their product in China. I told Tim Cook, who’s a friend of mine … ‘Make your products in the United States,'” Trump said in January . “China is the biggest beneficiary of Apple — not us.”

Apple has explored moving as much as 30% of its hardware production out of China due to fears of a prolonged trade war. However, it has also reportedly decided to transfer Mac Pro production to China from its Austin, Texas plant. According to the Wall Street Journal , the Mac Pro was the only major Apple device still assembled in the United States.

Nevertheless, Rosenblatt’s bearish forecast remains an anomaly – at least for now. TipRanks data indicates that most Wall Street analysts still label Apple stock a “buy.” The consensus analyst price target is $213.45, representing 4.5% upside from Friday’s close.

Click here for a real-time Dow Jones Industrial Average (DJIA) price chart.