Dow Risks Cataclysmic Collapse After Trump Blindsides Stock Market

Donald Trump sent the Dow into a tailspin on Thursday. | Source: Scott Olson / Getty Images / AFP

By CCN.com: The Dow resumed its excruciating downward spiral on Thursday after President Trump broke from White House talking points to ramp up the trade war rhetoric and further inflame US-China tensions ahead of high-stakes negotiations between the economic superpowers.

Trump Sends Dow into 400 Point Tailspin

The US stock market stumbled toward another putrid loss, with all three major indices suffering steep losses at the opening bell.

By 11:23 am ET, the Dow Jones Industrial Average had plunged 417 points or 1.61% to shove the DJIA down to 25,550.33. The S&P 500 slid 1.35% to 2,840.62, and the Nasdaq plummeted 1.5% to 7,824.12 as investors scrambled for the exits.

Twenty-eight of the Dow’s 30 components fell into decline, led by a 5.16% bloodbath for Intel. Key stocks Boeing, Caterpillar, and Apple all plunged more than 2.25%.

The trigger for that painful sell-off? More bombastic comments from Donald Trump.

Speaking at a rally on Wednesday evening, Trump told a crowd of his raucous supporters that Beijing “broke the deal” and will “be paying” when the US slaps enhanced tariffs on Chinese goods on Friday morning.

“By the way, you see the tariffs we’re doing? Because they broke the deal. They broke the deal,” Trump said. “So they’re flying in, the vice premier tomorrow is flying in — good man — but they broke the deal. They can’t do that, so they’ll be paying.”

Trump’s aggressive tone seemed to contradict his earlier claim that China intended to “make a deal” when a delegation led by Vice Premier Liu He arrived in Washington on Thursday.

CCN.com reported at the time that those comments were a gamble meant to stem the Dow’s bleeding, and it appears Trump’s chickens are quickly coming home to roost.

‘Zero’ Chance US & China Strike Trade Deal on Thursday

Hu Xijin, editor-in-chief of the Global Times, cited a source close to the Chinese negotiators who said there was now “zero” chance that Washington and Beijing arrive at a deal before those tariffs kick in at 12:01 am ET on Friday.

China’s government already vowed to retaliate against any tariff increase, seemingly setting the stage for a rapidly-escalating trade war that could set back negotiations even further as Washington and Beijing play a game of economic chicken.

Dow Would Plummet 15% if Trade Talks Break Down

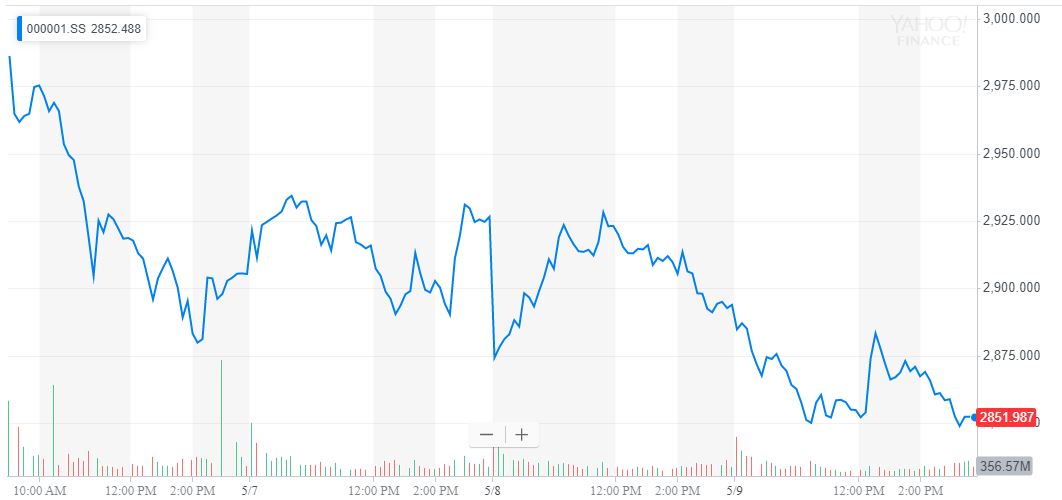

Trump’s inflammatory trade war commentary has already pummeled China’s stock market – the SSE Composite slid 1.48% on Thursday – but Wall Street analysts warn that cooling negotiations could hamstring US stocks as well.

According to UBS, the Dow risks a 15% percent correction if trade talks break down.

Goldman Sachs predicted that nine of the DJIA’s 30 members would suffer disproportionate losses, including Coca-Cola, Exxon Mobil, Intel, Boeing, Chevron, and Pfizer.

Conversely, Apple, Visa, and Walt Disney should weather a trade war without much difficulty.

Click here for a real-time Dow Jones Industrial Average (INDEXDJX: .DJI) price chart.