Dow Rises as Trump & Kudlow Tease Ambitious Trade War Timeline

The Dow Jones avoided crashing with Boeing stock on Monday as Donald Trump and Larry Kudlow dropped hints about an impending trade deal. | Source: AP Photo / Pablo Martinez

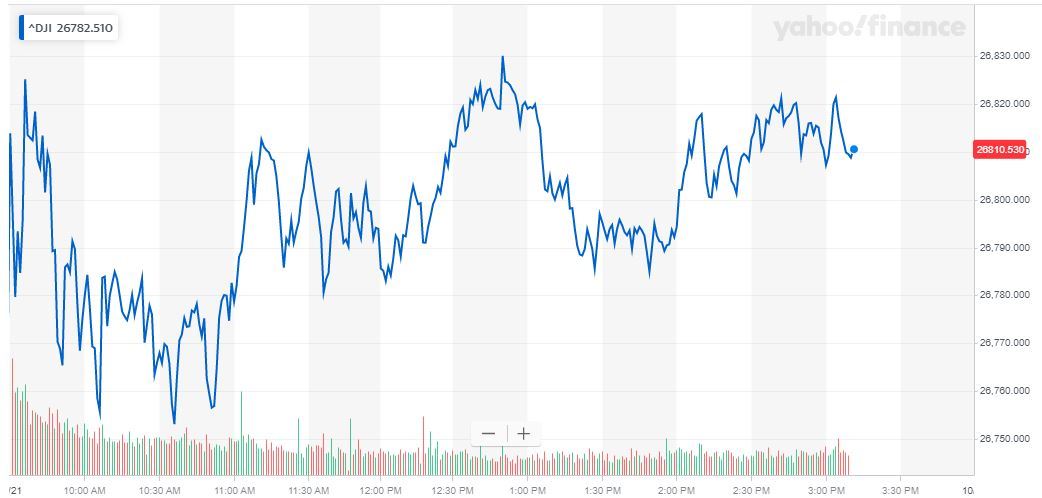

The Dow Jones managed to barely capitalize on an extremely positive mood in financial markets on Monday.

Boeing stock continues to suffer after Friday’s safety system bombshell, battering an index that might otherwise have surged in response to ambitious trade war proclamations from President Donald Trump and Larry Kudlow.

Dow Jones Battered by Boeing Despite Trade War & Brexit Progress

Heading toward the closing bell, the Dow Jones Industrial Average had gained 49.27 points or 0.18% to trade at 26,819.47.

The Nasdaq (+0.87%) was once again the top-performing major US stock index, while the S&P 500 rallied 0.65% as the Dow Jones lagged far behind with its paltry 0.18% move.

The gold price dropped 0.5% to $1,486, as havens sold off amid the rally in stocks.

Brexit progress is a positive for global stocks, as the risks of a damaging no-deal Brexit have plummeted , while a rallying British pound and euro have helped suppress a strong US dollar . Boris Johnson still faces plenty of hurdles in securing an agreement with the EU because the UK Parliament has rejected his deal. Adding to the PM’s troubles, Speaker Bercow denied a second debate on the topic on Monday .

Trump and Kudlow Lay Deal Breadcrumbs (Again) for Dow Bulls

The positive boost to stock markets in the US from trade war developments was noticeable at the open of trade. Trump saying that he hoped to sign a trade deal at the APEC summit in Chile mixed with Larry Kudlow’s hints that the tariffs planned for December could also be removed to create an optimistic cocktail for investors.

Dow bulls will take Kudlow’s comments particularly seriously, given that the last time he teased progress, it came to fruition. Before these developments, Chinese Vice Premier Liu He, who is in charge of Beijing’s trade team, suggested that substantial progress had been made, setting the foundation for the White House’s positivity.

Nevertheless, escalating tensions in Hong Kong remain an ongoing threat to the trade deal, as well as the Dow Jones.

Adding to background risks for markets, the ceasefire in Northern Syria looks to have been a failure after Trump capitulated on the issue amid bipartisan backlash . The need to appease Republicans has been all too apparent as the impeachment process rumbles on, and another concession by the president not to hold a G7 summit at his hotel in Doral was made after angering lawmakers on both sides of the aisle .

Global Growth Concerns Remain Primary Risk Factor for Stocks

Focusing more on the current economic health of the United States, recent data releases have been alarming in the manufacturing and industrial sectors. While the stock market has been mainly resilient thanks to a sturdy US consumer, risks are rising.

Nordea economists Martin Enlund, Joachim Bernhardsen, and Andreas Steno Larsen believe that growth will continue to dip heading into next year , as Trump’s trade war continues to damage the global risk environment.

They write:

“While some economists have highlighted the GM strike as possible driver of the divergence between regional surveys and the important ISM manufacturing gauge, we think the China/US conflict is much more important. The divergence unfolded as the ISM exports orders component crashed fairly soon after the breakdown in China/US talks this spring (this makes sense because of less sensitivity to China in the the regions covered by the Philly & NY Fed surveys). In short, we expect economic uncertainty to remain high, especially as US and global growth will likely slow further going into next year.”

Dow Stocks: Boeing Tanks, Apple Zooms to Record High

Boeing stock had another miserable day on Monday, piling a 4.1% pullback on Friday’s sell-off. The damage to the Dow 30 continues to come from instant messages that appeared to show that Boeing misled the FAA on a safety issue with the infamous 737 MAX airplane, prompting an aggressive rebuke from activist Ralph Nader.

The bright mood in the broader stock market lifted Treasury yields , sending JPMorgan Chase to fresh record highs above $123, while Goldman Sachs rose 1.3% amid the squeeze out of bonds.

Apple stock continues to be buoyant, and shares are trading at fresh record highs above $240. Analysts can’t get enough of AAPL , and they continue to raise their forecasts relentlessly. In fundamental news, the iPhone XR is now being assembled in India for domestic sales , bolstering Apple’s efforts to avoid de-globalization risks and ensure access to one of the world’s most rapidly growing economies.

Oil companies Exxon Mobil and Chevron both rose around 1.5%, despite some continued weakness in the price of crude.