Stunning! Dow Recovers as US Economy Thrives, Adding 263k Jobs

| Source: https://www.ccn.com/dow-recovers-us-economy-thrives

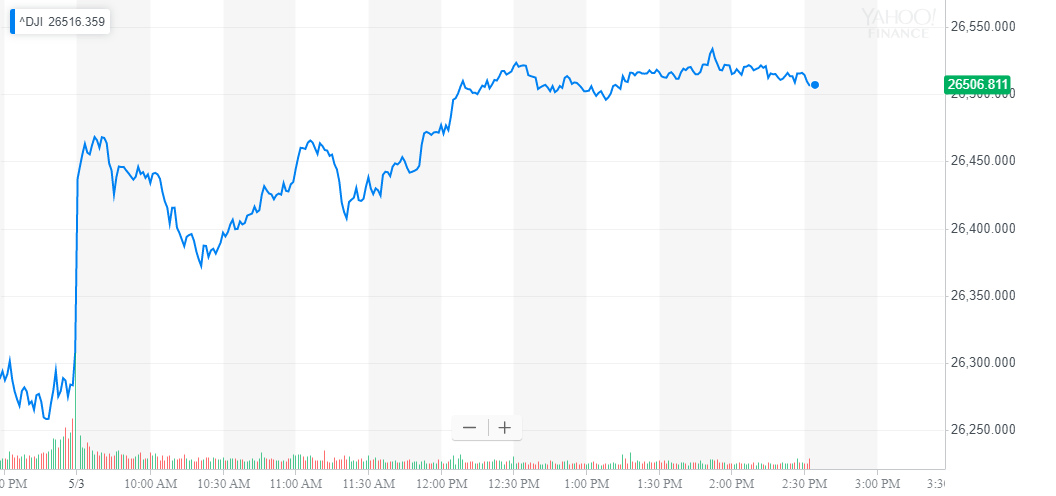

By CCN.com: The Dow Jones has surged by 0.8% on the day to 26,517 points after a dip on May 2, which saw the Dow fall to as low as 26,213 points.

The unexpected 1.6% decline in the Dow earlier this week is said to have been primarily triggered by the withdrawal of Stephen Moore from the consideration of being placed on the Federal Reserve Board of Governors.

U.S. President Donald Trump said :

“Steve Moore, a great pro-growth economist and a truly fine person, has decided to withdraw from the Fed process. Steve won the battle of ideas including Tax Cuts and deregulation which have produced non-inflationary prosperity for all Americans. I’ve asked Steve to work with me toward future economic growth in our Country.”

In less than 48 hours since the withdrawal of Moore rattled the U.S. equities market, strong jobs growth in April and the continuous drop in the unemployment of the U.S., which is already at a record low, has seemingly fueled the confidence of investors in the market.

U.S. Economy in a Strong Position to Stimulate Dow Rally

This week, the unemployment rate of the U.S. officially dropped to a 50-year-low, reaching the lowest level since December 1969 according to the Labor Department.

Lynn Reaser, the chief economist at Point Loma Nazarene University, said in an interview with WSJ that the newly released jobs report for April indicates the U.S. economy is strong.

She said :

“The jobs report shows that the U.S. economy remains strong. The unemployment rate falling from a year ago is notable, but labor-force participation not moving at all in that time is disappointing.”

An independent survey of 142,000 employers conducted by WSJ found evidence of strong hiring, suggesting that a rapidly growing number of U.S. citizens and residents are moving back into the workforce.

A crucial element to the jobs report which indicates the strength of the U.S. economy is the reluctance of the Federal Reserve to raise its benchmark interest rate in 2019.

Previously, strategists expressed concerns over the possibility of the Federal Reserve adjusting the benchmark interest rate if the central bank sees signs of growth of the U.S. economy.

https://www.youtube.com/watch?v=tCMNCdAtVb4

On May 1, the Federal Reserve voted to maintain the interest rate at the current rate and reports suggest that the April jobs report will further solidify the cautious stance of the Fed in both raising and dropping its rate.

“Overall the economy continues on a healthy path, and the committee believes that the current stance of policy is appropriate. We don’t see a strong case for moving [rates] in either direction,” Fed Chairman Jerome Powell said at the time.

With the Federal Reserve vowing to maintain the interest rate steady throughout 2019 and various fundamental factors such as jobs growth, productivity growth, and the progress in the U.S.-China trade talks weighing in favor of the U.S. economy, the Dow and the rest of the equities market are expected to sustain their momentum.

No Rate Cuts Though

Speaking to CNBC, Federal Reserve Bank of St. Louis President James Bullard emphasized that it is not the time to adjust interest rates to the downside, noting that the Fed is considering the rate of growth of the U.S. economy over the next two years.

“There’s been a sea change in U.S. monetary policy. That sea change has altered the structure of interest rates, and you can really see in the 10-year Treasury note. I would attribute the lion’s share of that to changed Fed policy,” he said.