Dow’s Absurd Rally Intensifies as Markets Flip Script on Toxic Data

The Dow's absurd rally grew even more intense on Friday after the stock market managed to flip the script on toxic jobs report data. | Source: AP Photo/Richard Drew

By CCN.com: The Dow and broader U.S. stock market extended their relief rally to a fourth day on Thursday after dismal jobs data bolstered expectations that the Federal Reserve will slash interest rates this summer.

Dow Extends Rally; S&P 500, Nasdaq Follow

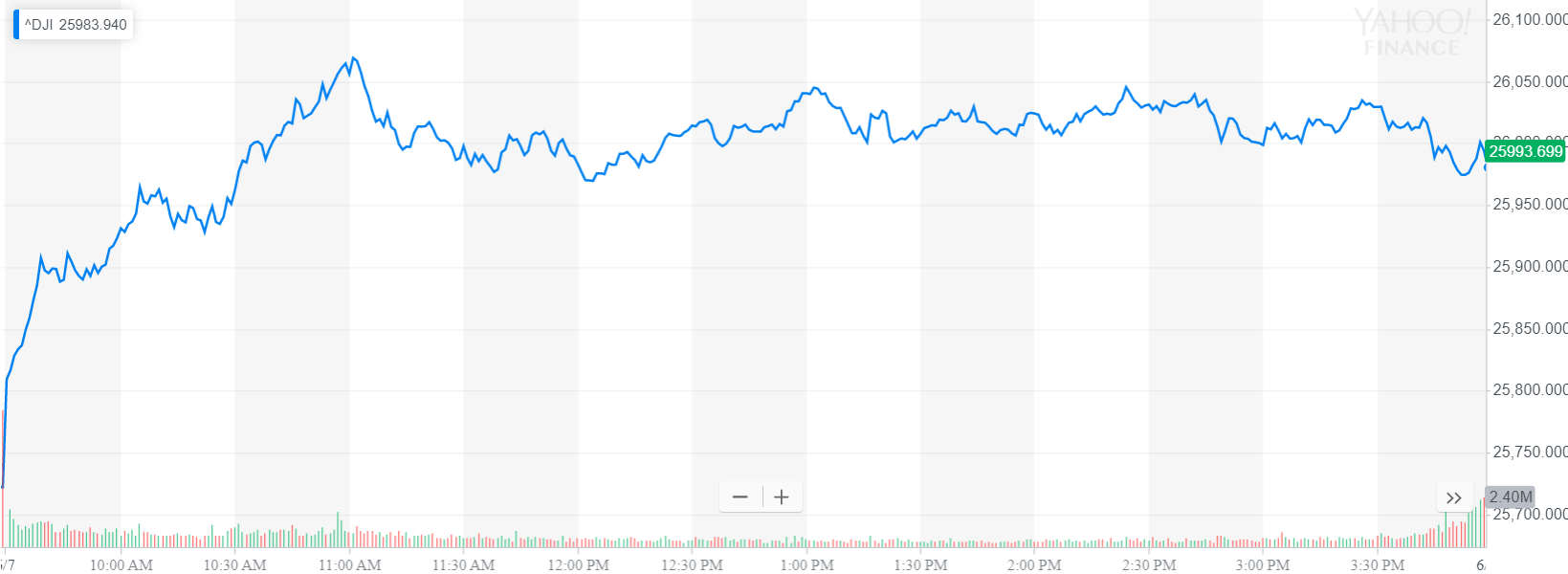

All of Wall Street’s major indexes continued higher on Friday, mirroring a strong pre-market for Dow futures. By the close, the Dow Jones Industrial Average had surged 263.28 points, or 1%, to 25,983.94. The blue-chip index has recovered more than 1,000 points this week.

The broad S&P 500 Index of large-cap stocks rallied 1.1% to 2,873.34, with nine of 11 primary sectors reporting gains.

Surging technology shares fueled a large rally for the Nasdaq Composite Index. The tech-driven benchmark rallied 1.7% to 7,742.10.

Investors Eat Up Dismal Economic Data

The U.S. labor market cooled much faster than expected in May, a sign that companies are treading carefully at a time of heightened trade tensions.

Employers added just 75,000 workers to payrolls in May, about 110,000 shy of expectations and one of the weakest monthly gains since the financial crisis, the Department of Labor reported Friday. The unemployment rate held steady at 3.6% as workforce participation remained unchanged. Only 62.8% of America’s working-age population is part of the workforce; the remainder have dropped out of the labor market entirely.

Traders took the dismal jobs report in stride because it suggests the Federal Reserve will cut interest rates imminently. Central bankers have all but capitulated on monetary policy, with Chairman Jerome Powell conceding that rates could be lowered at some point in the future. He didn’t provide a timeline, but said the Fed was closely monitoring trade negotiations with China to determine its next course of action.

The Fed isn’t expected to cut interest rates at its forthcoming meeting on June 18-19, but could pull the trigger next month, according to CME Group’s Fed Fund futures prices. At last check, Fed Fund futures prices implied a more than 80% chance of a reduction in July.

Click here for a real-time Dow Jones Industrial Average price chart.