Dow Rally Fizzles as Bulls Ignore Volcker Do-Over

The Dow's bullish rally fizzled on Tuesday as the Fed's resident hawk distracted Wall Street from the Volcker Rule do-over. | Source: AP Photo / Richard Drew

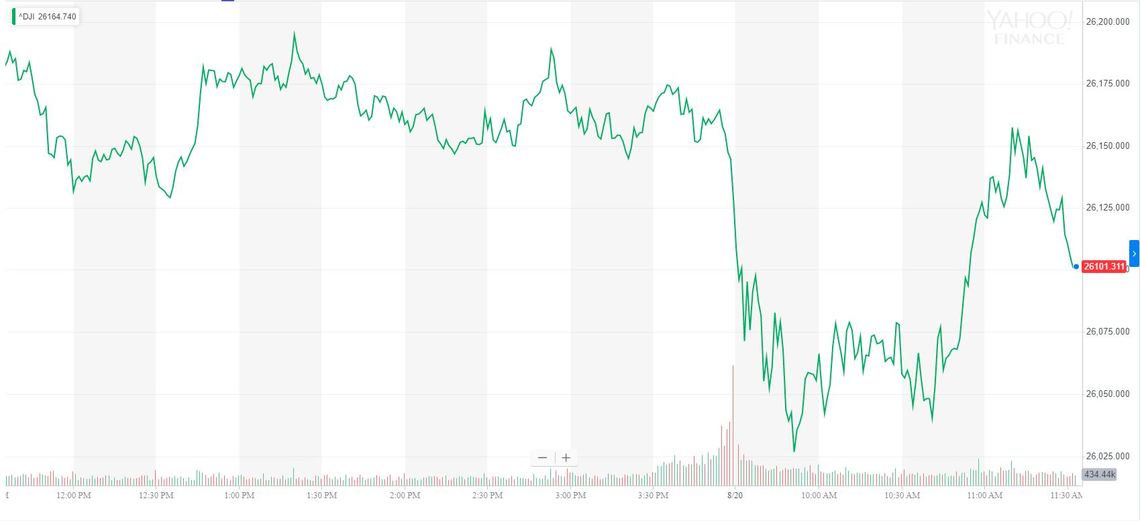

By CCN.com: The Dow Jones tracked sideways on Tuesday as the US stock market teetered toward its worst session in nearly a week.

Beijing pushing back against Trump on Hong Kong definitely worsened sentiment, but it was the Fed that injected renewed fear into the markets.

Dow Jones Trades Sideways as Rally Fizzles

As of 12:35 pm ET, the Dow Jones Industrial Average had lost 42.21 points or 0.16% to settle at 26,093.58. The DJIA spent the morning session see-sawing between positive and negative territory.

There was plenty of good news that should have helped lift the Dow Jones on Tuesday.

First, there was the news that the FDIC was prepared to revise the Volcker rule , a likely deregulatory move that would typically be cheered by Wall Street speculators.

There were also some extremely bullish stock market forecasts, with Kyle Bass telling CNBC that “all the money” is going to flow into the United States as most of the world languishes in negative-yielding debt.

Fed, Not Trump Now Driving Macro Outlook

The FOMC’s resident hawk, Boston Fed President Eric Rosengren spoke late on Monday , appearing to have been handpicked to prep markets for a resolute Jerome Powell in Jackson Hole.

The uncertainty on Wall Steet may stem from a significant development that went mostly unnoticed by traders on Monday. Writing in their “Market Watch ” note, analysts at AFEX said that investors now pay more attention to FOMC voters than President Trump.

“FOMC member Rosengren pushed back against further US rate cuts arguing that the economy remains in good shape, and he does not expect a significant slowdown. Rosengren voted against the first-rate cut last month and said he wants to see more evidence that rate cuts are warranted. The comments supported the dollar across the board and came a few hours after President Trump tweeted that the Fed should cut rates by 1% and restart QE. This shows the market is paying more attention to the Fed than Trump.”

Naturally, this raises the stakes even more aggressively for Chairman Powell’s statements in Jackson Hole for the Dow Jones and other major US indices.

It is probably no coincidence that the more hawkish Rosengren was selected to open the week’s discourse on interest rates. FOMC minutes tomorrow are also now more important for stock markets.

Dow Stocks: Home Depot Carries Index

It was a mostly mixed day for Dow stocks , but there was one shining star. Home Depot was up more than 4% after posting better than expected sales . The bounce was even more impressive considering that the company cut its growth forecasts on trade war concerns.

Apple extended its gains, rising 1.2% on the day.

Dow Inc. was undoing most of Home Depot’s good work with a 4.5% loss, while JP Morgan and Goldman Sachs were slightly in the red as yields were weak again and both failed to respond meaningfully to the Volcker rule news.

Click here for a real-time Dow Jones Industrial Average chart.