Dow Rally Is a Head Fake Ahead of 50% Stock Market Crash

Despite Tuesday's gains, critical support has been breached in the stock market that could send the major indices to steep declines of 50 percent. | Source: Shutterstock

By CCN.com: Despite today’s 2% rally in the stock market, critical support levels have been breached that may signal the beginning of a 50% market decline.

The Stock Market Is Falling Apart

With the stock market trading at its third most expensive level in history, led by outrageously overvalued FANG and growth stocks, it’s only a matter of time before it regresses to its mean valuation.

That time appears to be shaping up as now.

The three major indices in the stock market – the Dow Industrials, NASDAQ, and S&P 500 – have all fallen below their long-term daily, weekly, and monthly moving averages.

When prices dip under these averages, the stock market tends to fall until they hit some other level where buying support is likely to be found.

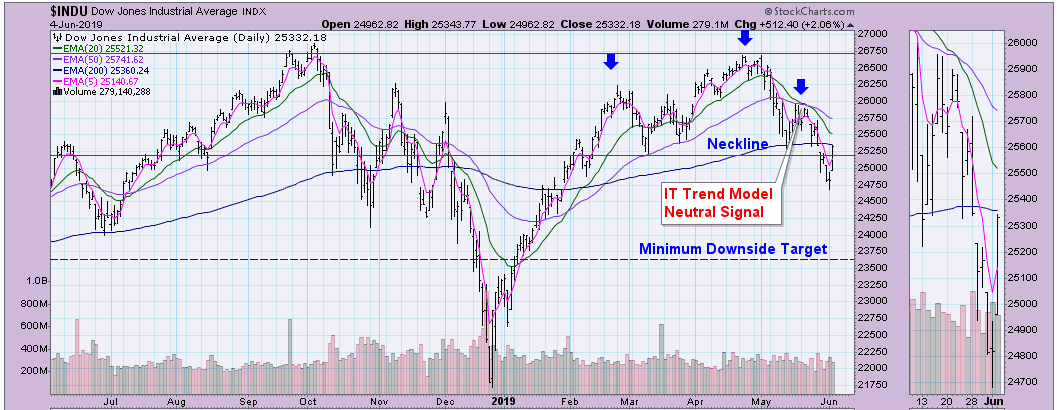

The Dow Industrials Are Cracking

This daily chart of the Dow Industrial shows a “head-and-shoulders” formation for which the minimum downside target is 23,600, or about 7%.

That would take the Dow Industrials to a 15% correction.

If that level is breached, the next stop would be a decline to December lows, another 8%.

What’s critical then is whether or not support holds there.

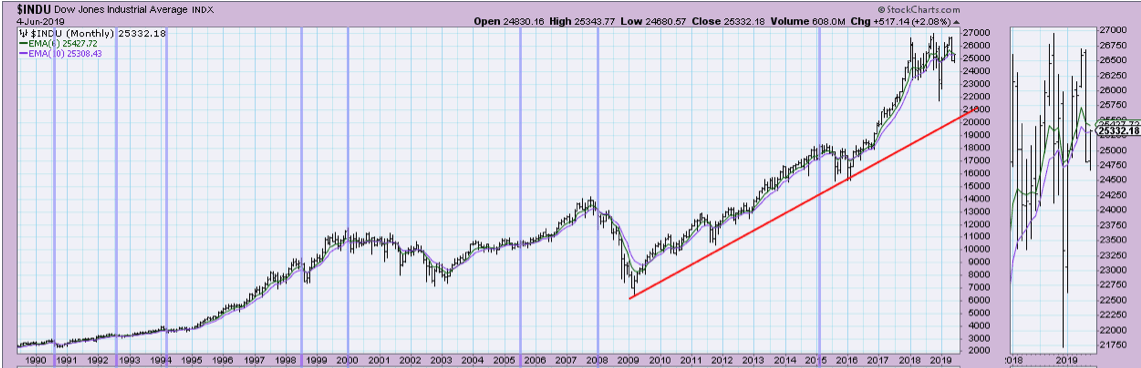

If not, the next stop is on the rising trend line of the monthly chart at 20,400.

If the stock market reaches that point, the total market crash will have hit 25%.

The next leg down brings the stock market to 14,000 – a nearly 50% market crash.

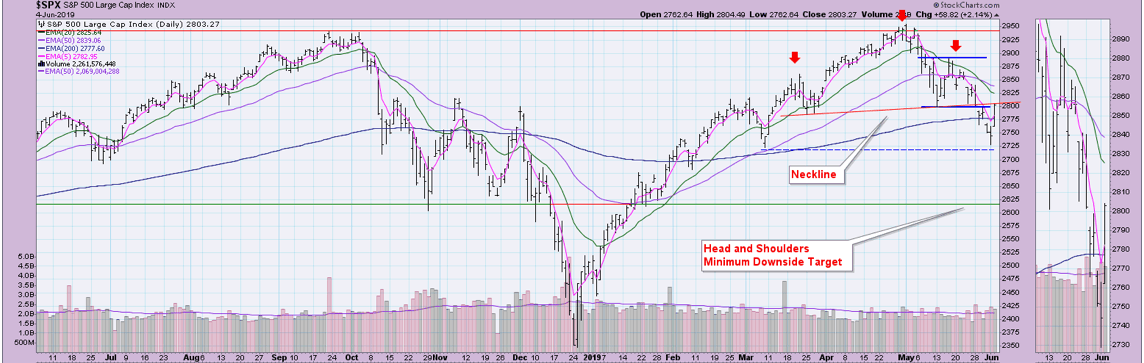

The S&P 500 Is Stumbling

Over at the S&P 500, which many investors use as a proxy for the stock market, the same head-and-shoulders pattern has appeared. The minimum downside target is 2,720, or 7%.

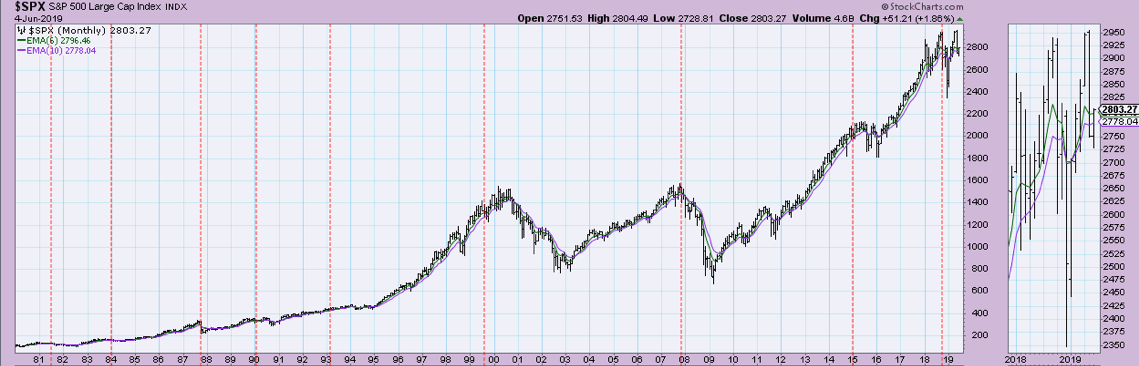

The remaining levels of support all mirror the Dow Industrials. The monthly chart shows a double top which would serve as support but again would mean a 50% market crash from the top.

FANG Stocks Are Cratering

You can see on the NASDAQ chart – the index that houses the FANG stocks – that prices bounced off horizontal support but only rose back to the 200-day moving average.

The December lows are the next stop, which would bring the NASDAQ to a 25% decline. After that, say hello to 4,000, a nearly 50% market crash.

This news is not good because underlying these breakdowns are what we call “market internals.” A smaller number of companies are pulling the market higher, which means more and more are pulling it lower.

What Should a Stock Market Investor Do?

What do you, as an investor, do in these situations?

You must have a market crash protocol in place that aligns with your specific investing goals. If you are a long-term diversified investor with substantial positions in alternative investments with at least a 10-year time horizon, stay the course.

If your time frame is shorter than that, now is the time to put your hedges in place.