Dow Rally Skirts Attack as Sector Rotation Spooks Investors

The Dow Jones Industrial Average reverses gains in the final hour of trading Tuesday. | Source: REUTERS / Brendan McDermid

The Dow and broader U.S. stock market tumbled on Tuesday, but quickly regained their footing in the final moments of trade amid fears that an impending sector rotation will batter the high-flying technology industry.

Dow Closes Higher; S&P 500, Nasdaq Flat-Line

All of Wall Street’s major indexes were on track for losses in the final hour of trading, mirroring a tepid pre-market for Dow futures. Markets quickly recovered in the final moments, with the Dow Jones Industrial Average closing up 79.92 points, or 0.3%, at 26,909.43.

Dow industrials are up 3% over the past five sessions and have returned 15.4% year-to-date.

Tumbling technology and consumer shares weighed on the S&P 500 Index, which narrowly escaped losses Tuesday afternoon. The index settled at 2,979.39, inching up 0.03%.

The Nasdaq Composite Index, which is largely driven by technology, edged down 0.04% to 8,084.16.

Underlying volatility rose on Tuesday for a second consecutive day. The CBOE VIX, commonly known as the fear index, rose as much as 8.2% to 16.52.

Sector Rotation Spooks Wall Street

The U.S. stock market is undergoing a major rotation into so-called cyclical industries, a move that will likely invoke plenty of volatility in the very near future.

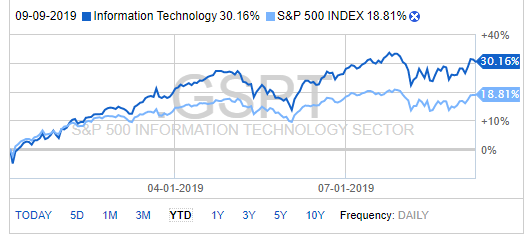

As analysts have noted, a potential change in leadership from technology and defensive stocks to commodity-sensitive industries may have begun last week. In this environment, investors can expect capital outflows from information technology, utilities and consumer stocks in favor of energy, materials and industrial names.

Such moves are considered healthy for stocks, which have salvaged their bull market despite a brutal correction at the end of 2018. While technology stocks have outperformed the S&P 500 this year, defensive players have the upper hand on a 12-month basis.

That said, information technology is an $8 trillion market, and outflows from this sector likely won’t bode well for the major indexes.

Click here for a live Dow Jones Industrial Average chart.