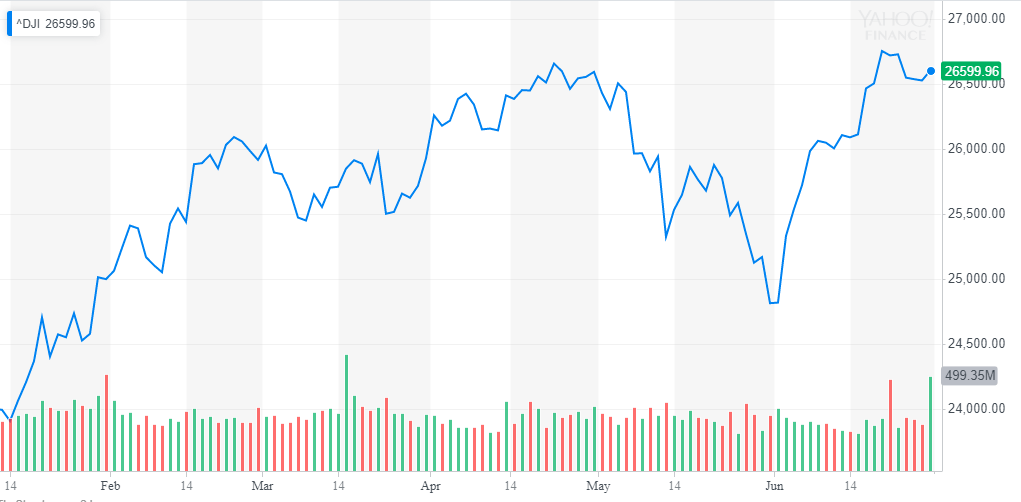

Dow Rallies 7.2% in June: Trade Talks Resume, Market Sentiment Surging

As the U.S. and China resume trade talks, the Dow Jones and the rest of the U.S. equities market have shown strong recovery. | Source: REUTERS/Lucas Jackson

As the U.S. and China resume trade talks following the highly anticipated G20 summit, the Dow Jones and the rest of the U.S. equities market have shown strong recovery.

In the past 30 days, the Dow Jones has rebounded from 24,819 points to 26,599 points, recording its best June in 81 years.

The U.S. has paused the imposition of additional sanctions on Chinese goods and China is set to begin purchasing American farm products in the upcoming days, opening the conversation for a potential comprehensive trade deal.

Full trade accord unlikely but improving sentiment likely to fuel Dow Jones

Due to intensifying geopolitical risks, major economies in the likes of Australia and the eurozone have either already cut their benchmark interest rates or are planning to do so shall the slowdown of global economic growth continue.

On June 9, Reuters reported that European Central Bank (ECB) policymakers are open to dropping its policy rate if the eurozone struggles to revitalize as a result of the trade war.

“If inflation and growth slow, then a rate cut is warranted,” one source told Reuters.

With major economies gearing toward a rate cut in the near term, strategists including Evenflow Macro’s Marc Sumerlin said that the Fed is too tight and that a rate cut is expected to occur in July.

The expectations of a rate cut in the upcoming weeks and improving sentiment around the trade talks between the U.S. and China could act as catalysts for the ongoing rally of the Dow Jones and U.S. stocks in general.

Stephen Guilfoyle, President at Sarge986 LLC, said in an interview with Fox Business:

“Drivers [of the rally] would be a change in the perceived trajectory for monetary policy, coupled with a bit of optimism in renewed negotiations with China.”

However, there is opposition in resuming trade talks from both Democratic and Republican representatives due to the involvement of Huawei as a part of the deal.

A WSJ report said that U.S. President Donald Trump will allow U.S. companies to sell high-tech equipment to Huawei once again, which would effectively allow the firm to utilize various hardware and software that are crucial in building its smartphones and other popular appliances.

The ban imposed on U.S. companies from working with Huawei does not affect Huawei’s 5G technology, but it creates a difficult environment for the Chinese conglomerate to sustain the sales of its flagship devices that have started to obtain a large market share on the global stage.

“If President Trump has, in fact, bargained away the recent restrictions on #Huawei, then we will have to get those restrictions put back in place through legislation. And it will pass with a large veto-proof majority,” Senator Marco Rubio said .

Fears about U.S. stocks

The major concern of strategists in recent weeks amidst one of the strongest monthly rallies for the Dow Jones is that the upside movement may not be sustainable throughout the near to medium term.

Some worry that the trade talks are priced into the market. And with investors expecting the discussions to potentially last a long time, only a comprehensive trade deal would significantly improve the sentiment around the Dow.

Still, the momentum demonstrated by U.S. stocks in June has been strong in comparison to the latter half of 2018. And with President Trump continuing to place pressure on the Fed, there are hopes that a rate cut, even a minor change in policy, would improve the state of the market.