Dow Rallies 110 Points as Low Earnings Expectations Prove Easy to Beat

More than 75% of the S&P companies that have reported surpassed earnings estimates. | Source: Shutterstock

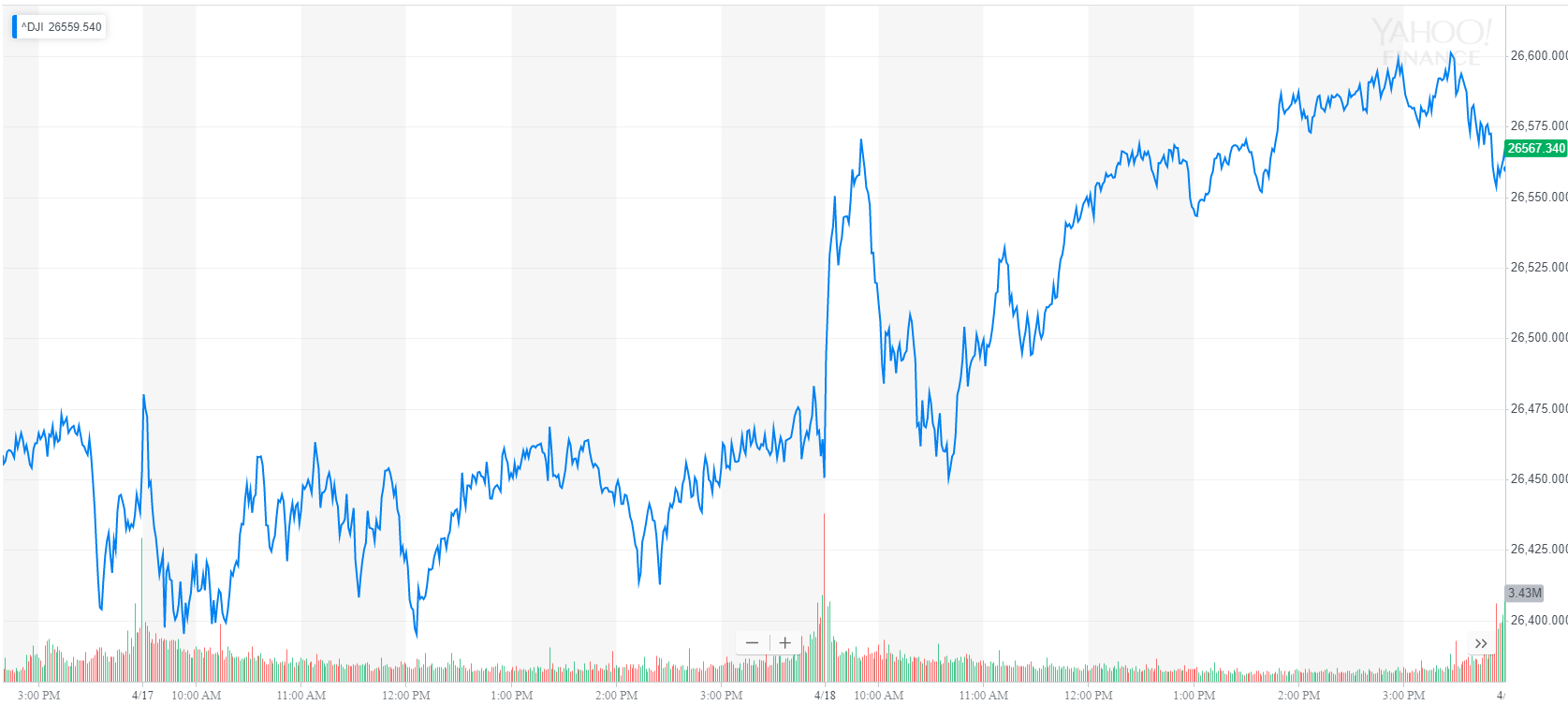

By CCN.com: The Dow jumped triple digits on Thursday, outpacing the broader U.S. stock market as corporate earnings season continued to surprise to the upside.

Dow Charges toward Record Highs

The Dow Jones Industrial Average rallied by as much as 141 points, reflecting a positive pre-market session for U.S. stock futures. The blue-chip index closed up 110.00 points, or 0.4%, at 26,559.54, where it was within 300 points of a record high.

The broad S&P 500 Index of large-cap stocks climbed 0.2% to settle at 2,905.03. Gains were primarily concentrated in industrials and the much smaller real estate sector. On the opposite side of the ledger, energy shares mostly lagged the broader market.

Meanwhile, the technology-focused Nasdaq Composite Index flat-lined at 7,998.06.

Stocks are rallying on news of better than expected financial results from Wall Street’s biggest companies. According to FactSet, more than three-quarters of the S&P 500 companies that have reported have exceeded analysts’ expectations.

U.S. Economy Back on Track

U.S. consumer spending gathered pace at the end of the first quarter, alleviating concerns of a more protracted cool down in the economy. Retail sales, a proxy for consumer spending, surged 1.6% in March, the Commerce Department reported Thursday. That was much highest pace of expansion since September 2017. It was also far higher than the median forecast calling for 0.9% growth.

Consumer spending accounts for roughly two-thirds of U.S. gross domestic product (GDP), which makes retail sales data especially pertinent for investors monitoring the health of the domestic economy. Before March, retail sales had failed to grow in three of the past four months.

In a separate report, the Department of Labor said initial jobless claims fell last week to a fresh 49-year low, offering definitive proof that the jobs market was still on solid footing. The number of Americans filing for first-time unemployment benefits declined by 5,000 to a seasonally adjusted 192,000, the lowest since September 1969. Markets were bracing for an increase to 205,000.