Dow Faces Serious Pressure as US-China Trade Spat Mesmerizes Stock Market

The U.S.-China trade war continues to have the stock market on edge. | Source: Shutterstock

The Dow and wider U.S. stock market declined on Thursday, as the United States and China embarked on their final round of trade negotiations before a self-imposed deadline. By the looks of it, the negotiating window will have to be extended far beyond the March 1 deadline for both sides to get a new deal in place.

Dow Under Pressure from Trump & Xi

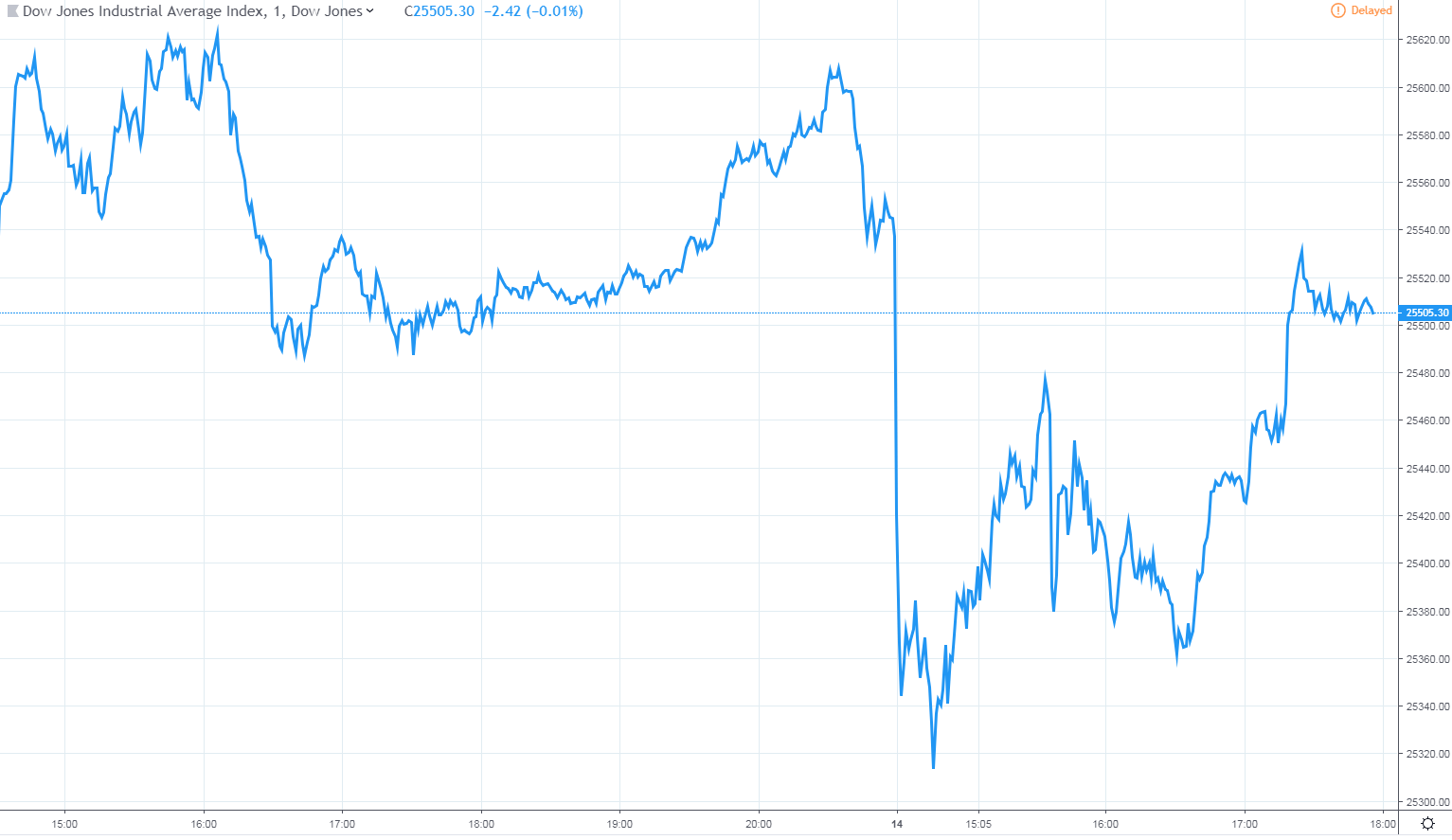

Wall Street’s major benchmarks were off their session lows by midday. The Dow Jones Industrial Average fell by as much as 235 points but later pared losses. It was last down 38 points, or 0.2%, to 25,505.30. The performance diverged from a strong pre-market session for Dow futures, which implied further gains for stocks on Thursday. The U.S. stock market closed at more than two-month highs Wednesday.

The broad S&P 500 Index pared losses to trade flat at 2,751.87. Shares of consumer staples and financials declined sharply, offsetting gains in communication services and energy.

The technology-focused Nasdaq Composite Index climbed 0.3% to 7,442.34, reversing an earlier loss.

A measure of 30-day volatility known as the CBOE VIX headed higher on Thursday. The so-called “fear index” touched a session high of 17.27. It would later consolidate just below 16.00.

No U.S.-China Trade Deal to Save Stock Market

U.S. and Chinese negotiators began a fresh round of trade talks on Thursday following three days of mostly high-level chatter. The negotiations are set to take place over two days, offering little time for breakthrough ahead of a looming trade-deal deadline.

Although President Trump has expressed willingness to hold off on reinstating tariffs, the U.S. and China remain far apart on several key issues. Chief among them are China’s technology ambitions, which are at the center of a criminal investigation by the Department of Justice (DOJ). Last month, the DOJ filed a bevy of criminal charges against Huawei, a Chinese telecommunications giant, over intellectual property theft and violating U.S. sanctions.

The prospect of a trade deal being reached this week is minuscule, but that won’t stop Beijing from trying to pursue American officials to hold off on tariffs for as long as possible. Essentially, they will seek an extension of the 90-day tariff truce agreed to by Presidents Trump and Xi Jinping in early December.

Uncertainty over trade and tariffs have weakened China’s economy and placed downward pressure on international markets. The International Monetary Fund (IMF) last month called for weaker global growth over the next two years, citing tariffs as a primary concern.

On the data front, China’s exports rebounded in January, providing cautious optimism that Beijing was making up for lost U.S. business elsewhere. Customs data released Thursday showed exports rose 9.1% annually in January. Exports to the United States fell by 2.4%.

From optimism to frustration, U.S.-China trade negotiations are set to continue for the foreseeable future. Take a look at what China has offered in exchange for tariff-free access to U.S. markets.

Featured image courtesy of Shutterstock. Chart via TradingView.