Dow Plunges After China Lashes Out at ‘Bully’ Trump

The Dow plunged after President Trump exposed his bombshell plans to impose retaliatory tariffs on Mexico, leaving the markets shellshocked. | Source: Brendan Smialowski / AFP

By CCN.com: The US stock market succumbed to a grisly bout of volatility on Friday, triggered by yet another escalation to the US-China trade war.

Dow Volatile After Beijing Unloads on Trump Administration

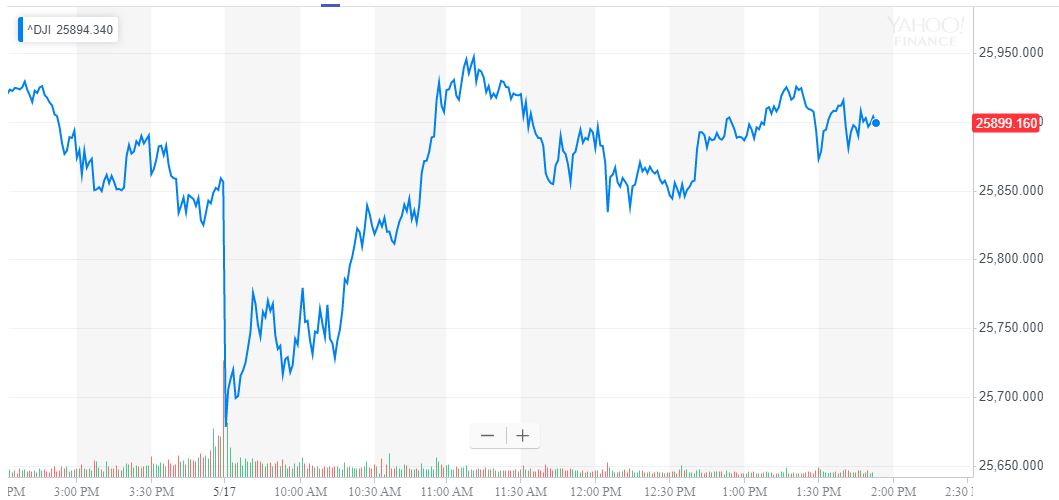

The Dow Jones Industrial Average began the day with a 200 point plunge, only to rally back into positive territory by midday. However, the index turned sour as the afternoon session matured, and by the closing bell, the Dow had lost 98.68 points or 0.38% to settle at 25,764.

The S&P 500 lost 0.58% to close at 2,859.53, and the Nasdaq plunged 1.04% to 7,816.29 to round out a frantic day on Wall Street.

All of Wall Street’s major indices recovered after the University of Michigan Consumer Sentiment Index climbed to a 15-year high of 104.2 for the month of May. Stocks also bounced on a report that the US would lift steel and aluminum tariffs on fellow NAFTA countries Canada and Mexico.

Earlier, a fearful stock market shivered after China’s government bared its teeth in the rapidly-escalating trade war.

Citing comments in state-run Chinese news agency Xinhua, CNBC reports that a spokesperson for the Chinese Ministry of Commerce blamed the United States for derailing the trade negotiations.

“The two sides had open and constructive communication during the 11th round of the China-U.S. high-level economic and trade consultations,” spokesperson Gao Feng said. “However, it is regrettable that the US side unilaterally escalated trade disputes, which resulted in severe negotiating setbacks.”

The spokesperson further attacked President Trump and his administration for exhibiting “bullying behavior” in their handling of the negotiations, adding that Beijing had no choice but to retaliate.

In addition to raising tariffs on hundreds of billions of dollars of Chinese goods, the Trump administration launched a targeted assault on Huawei that effectively blackballs the Chinese telecom giant from operating in the US.

Trade War Escalation Pressures Major Stocks & Reverses Recovery

The actions against Huawei aren’t expected to benefit US companies in the near-term. Beijing’s response could place severe pressure on major firms such as Apple, which already faces headwinds from the Trump’s tariff hikes.

Nomura Instinet slashed its Apple stock price target to $175 this morning, implying an 8% decline from AAPL’s previous-day close at $190.

“Apple could eat the tariffs (we estimate 15-20% EPS impact on its own), pass to US consumers (~4% impact), and squeeze suppliers (less room here than before). Trade tension hurt China iPhone demand this winter; we would assume the same would apply again,” Nomura analyst Jeffrey Kvaal wrote.

Friday’s stock market downturn reversed a fairly remarkable intraweek recovery.

On Thursday, the Dow soared 214.66 points or 0.84% to 25,862.68, completing the long march back from the more than 617 point plunge it endured on Monday. The S&P 500 jumped 25.36 points or 0.89% to 2,876.32, and the Nasdaq added 75.9 points or 0.97% to close at 7,898.05.

Click here for a real-time Dow Jones Industrial Average price chart.