Dow Plunges 150 Points as Trump Adviser Questions Trade Deal Progress

The Dow's meager recovery collapsed into a third straight loss after a shocking UBS downgrade ravaged a key DJIA stock on Thursday. | Source: Drew Angerer / Getty Images / AFP

The Dow and U.S. stock market traded sharply lower on Wednesday amid reports that Washington’s top trade adviser was in an “uncomfortable bind” over President Trump’s apparent softening on China.

Dow Slips – S&P 500 and Nasdaq Follow

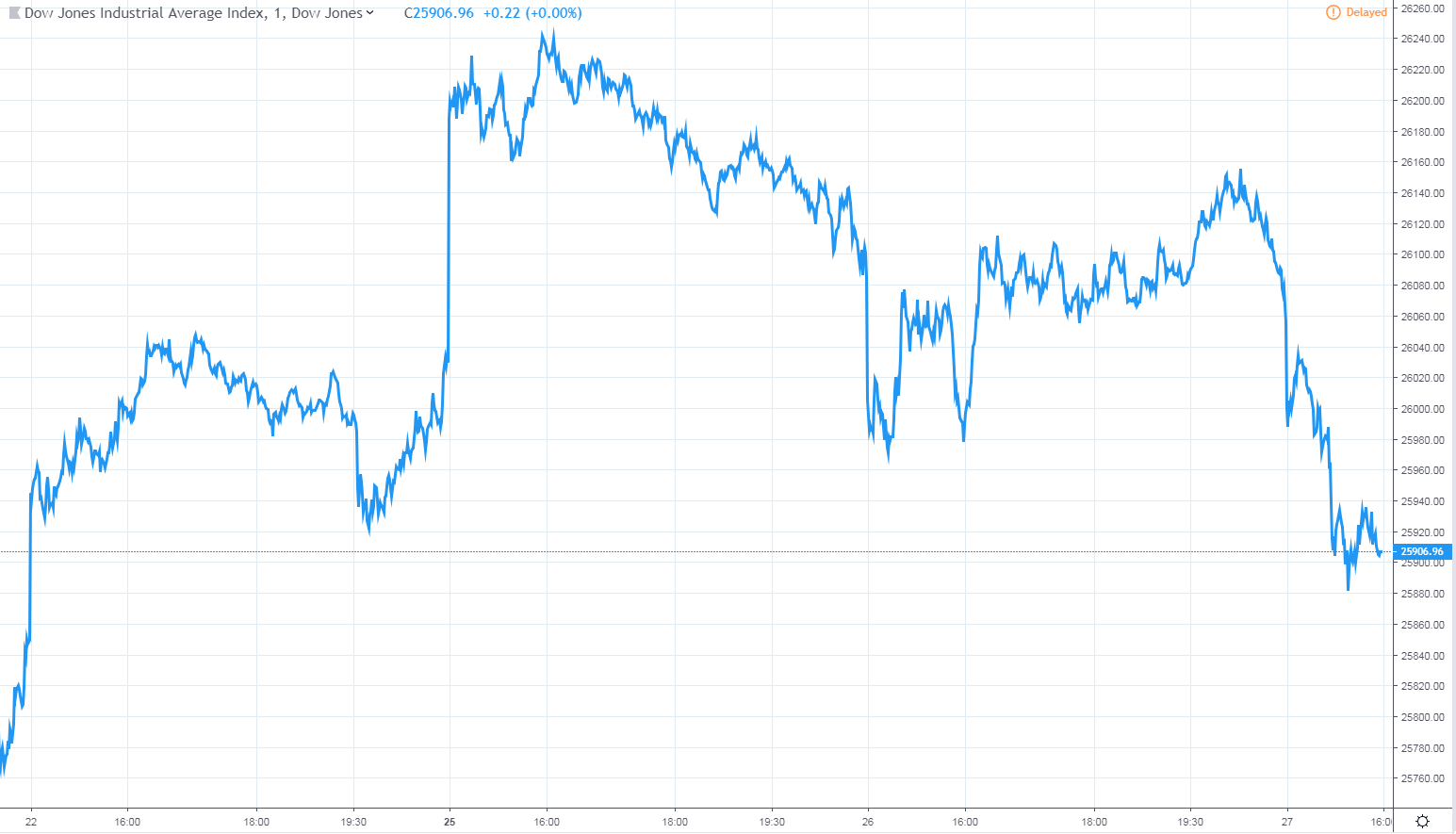

All of Wall Street’s major indexes headed for steep losses in morning trade, reflecting a rocky pre-market for Dow futures. The Dow Jones Industrial Average fell 151 points, or 0.6%, to 25,906.74. The blue-chip index fell by as much as 180 points earlier in the session.

Most of the Dow industrials reported losses, with UnitedHealth Group Inc. (UNH) leading the declines. The health care facilities provider dropped 2.9%. Shares of Home Depot Inc. (HD) declined 1.7% following a disappointing earnings report earlier in the week.

The broad S&P 500 Index fell 0.4% to 2,782.57. Eight of 11 primary sectors traded lower, with information technology and communications services each falling 0.9%. Energy was the most notable gainer, climbing 0.9% after the U.S. Energy Information Administration (EIA) reported a sharp drop in commercial crude stockpiles.

The technology-focused Nasdaq Composite Index declined 0.5% to 7,511.50.

A measure of implied volatility known as the CBOE VIX traded sharply higher on Wednesday. VIX, which tracks the market’s expected volatility over the next 30 days, rose 4.8% to 15.89 where it was on track to settle at two-week highs.

White House Can’t Keep China Stance Straight

The United States and China have made notable progress in their ongoing trade talks, but not everyone in the Trump administration is pleased with the negotiations.

As Fortune and The New York Times both reported, Trump and top trade adviser Robert Lighthizer recently engaged in a spat over the term “memoranda of understanding” (MOU). Lighthizer, a trained lawyer, said MOUs are standard protocol in trade deals. Trump opined that they are meaningless. The exchange took place in the Oval Office where Chinese trade negotiators were present.

The U.S. and China wrapped up another round of trade talks last week in Washington. While both sides remain far apart on a new deal, President Trump has already expanded the negotiating window and said he looks forward to inviting China’s Xi Jinping to a “signing summit” in the near future.

“I am pleased to report that the U.S. has made substantial progress in our trade talks with China on important structural issues including intellectual property protection, technology transfer, agriculture, services, currency, and many other issues,” Trump tweeted on Monday. “I will be delaying the U.S. increase in tariffs now scheduled for March 1. Assuming both sides make additional progress, we will be planning a Summit for President Xi and myself, at Mar-a-Lago, to conclude an agreement. A very good weekend for U.S. & China!”

Lighthizer: ‘Much Still Needs to be Done’ on Trade Deal

Lighthizer testified before House lawmakers Wednesday, where he threw shade on reports that the U.S. and China have made significant progress toward a new trade deal.

“If we can complete this effort — and again, I say’ if’ — and can reach a satisfactory solution to the all-important and outstanding issue of enforceability, as well as some other concerns, we might be able to have agreement that does turn the corner in our economic relationship.”

He added that “much still needs to be done” before an agreement is reached.

“Let me be clear…much still needs to be done both before an agreement is reached and, more importantly, after it is reached, if one is reached.”

That’s not what Wall Street wanted to hear.

With additional reporting by Josiah Wilmoth

Featured image courtesy of Drew Angerer / Getty Images / AFP. Chart via TradingView.