Dow Plummets as Oil Price Decline Spills Into Stock Market

A single trader caused this stock to crash 38% in minutes - wiping nearly $415 million off its market cap - due to an embarrassing blunder. | Source: AP Photo / Richard Drew

By CCN.com: The Dow and broader U.S. stock market extended their slide on Thursday, as plunging oil prices and a defiant Federal Reserve weighed on the major indexes.

Dow Falls Triple Digits; S&P 500 Slides Further from Record Highs

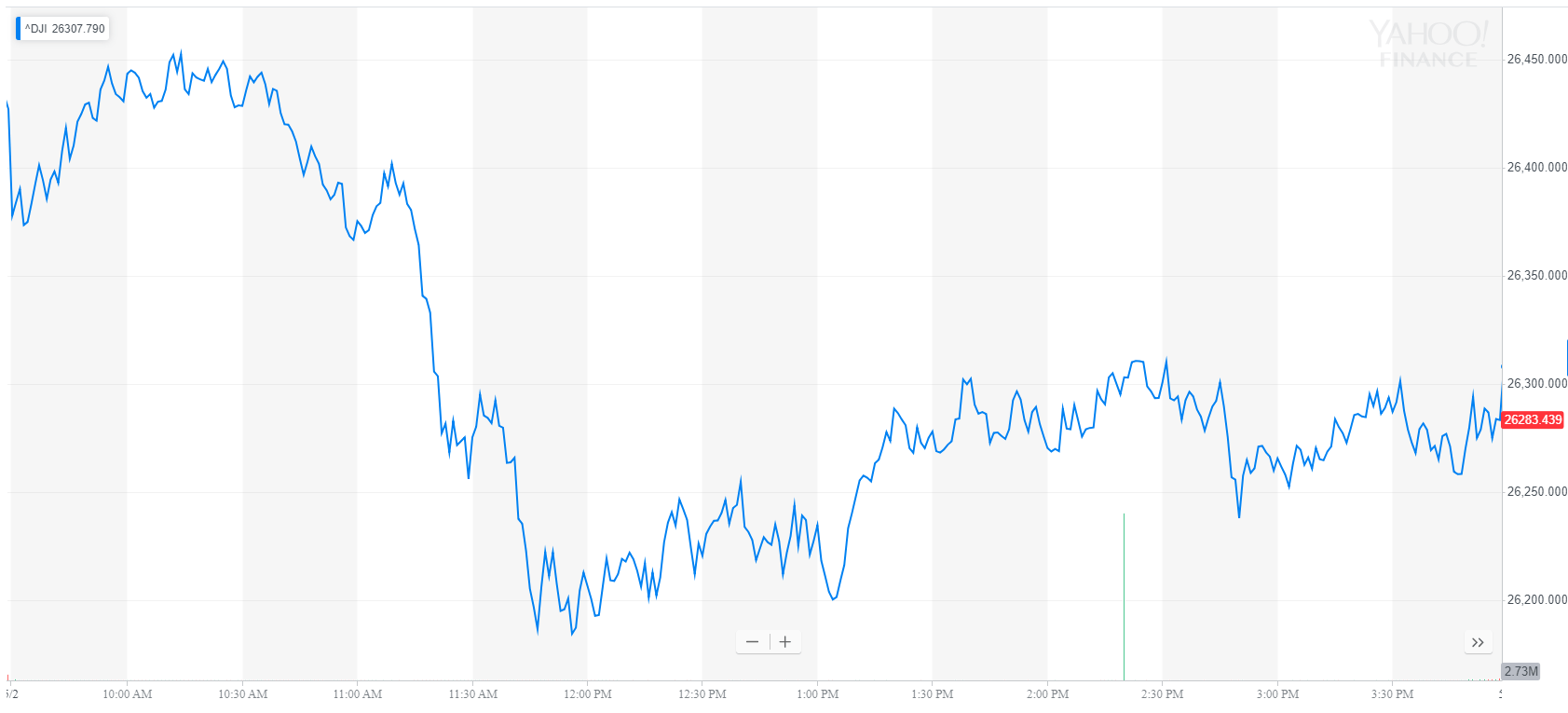

All of Wall Street’s major benchmarks traded lower, reflecting a tepid pre-market for Dow futures. The Dow Jones Industrial Average fell by as much as 250 points before paring losses later in the session. It closed down 122.35 points, or 0.5%, at 26,307.79.

The broad S&P 500 Index of large-cap stocks declined 0.2% to 2,917.52. Eight of 11 primary sectors fell, with energy shouldering the heaviest losses.

Meanwhile, the technology-focused Nasdaq Composite Index fell 0.2% to 8,036.77.

A measure of implied volatility known as the CBOE VIX declined slightly on Thursday but continued to hold near five-week highs. The so-called “fear index” edged down 1.7% to 14.55 after climbing nearly 13% on Wednesday.

Equity markets began their slide late Wednesday after the Federal Reserve brushed aside the possibility of an interest rate cut. Following the decision to leave interest rates unchanged, Fed Chair Jerome Powell told reporters that there was no compelling reason for rates to change anytime soon.

Oil Prices Plummet, Adding Further Pressure to Stock Market

Crude oil’s decline accelerated on Thursday, which spilled over into the stock market. The West Texas Intermediate (WTI) benchmark for U.S. crude futures fell $2.06, or 3.2%, to 61.54 a barrel on the New York Mercantile Exchange. Brent crude, the international benchmark, declined $1.82 or 2.5%, to $70.36 a barrel.

Oil is down in five of the past seven sessions after President Donald Trump called on OPEC to stop artificially inflating prices. The selloff hastened on Wednesday after U.S. government data showed a sharp rise in commercial crude inventories. Commercial stockpiles surged by more than 9.93 million barrels in the week ended April 26, according to the Energy Information Administration (EIA).

Saudi Arabia has pledged to increase oil production after the Trump administration started banning all crude exports from Iran on Thursday. However, as The Wall Street Journal reports, the United States and its Saudi allies are potentially at odds over how many extra barrels will kingdom produce.

Click here for a real-time Dow Jones Industrial Average price chart.