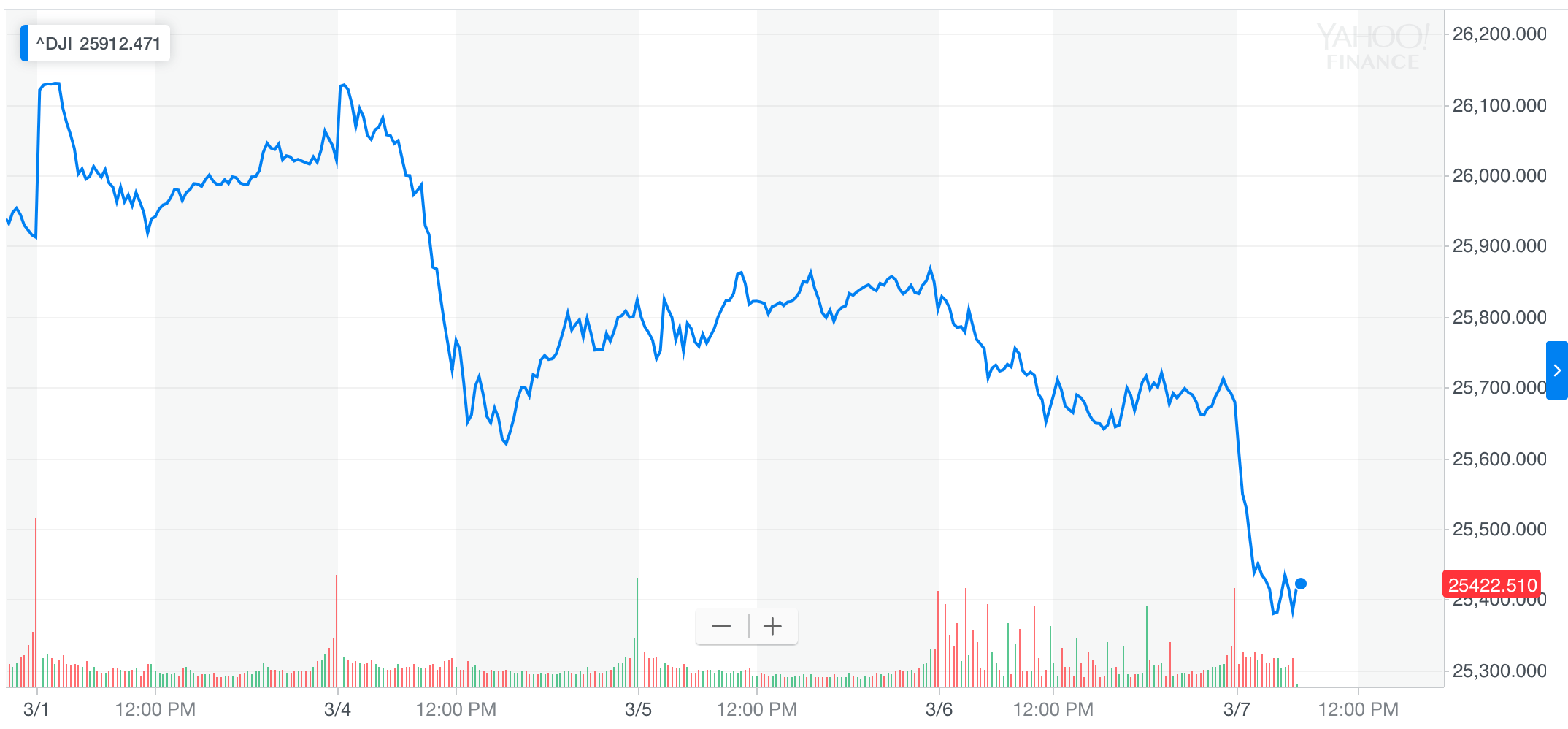

Dow Plummets 250 Points as Europe Floods Economy with Cheap Loans

Plunging consumer prices likely paves the way for new rounds of ECB stimulus. | Source: REUTERS / Vincent Kessler

The Dow Jones Industrial Average plummeted more than 250 points during the first half of Thursday’s trading session. It marks the fourth straight day of decline for US stocks.

With a barrage of poor economic data and lack of fresh details on the China trade deal, the Dow is crying out for a catalyst to pump higher.

Dow Careens into the Red

Things went from bad to worse as the European Central Bank (ECB) committed to pumping more cheap money into the European markets. In an announcement early on Thursday , the ECB pushed back its plans for an interest rate hike. More controversially, it rolled out a new stimulus package that offers cheap loans to banks.

ECB president Mario Draghi’s gloomy economic forecasts have had a domino effect on the US markets. The Dow is now running on empty until a fresh boost of good news can reverse its direction.

The Nail in the Dow’s Coffin

The nail in the Dow’s coffin this week was the European Central Bank announcement on Thursday. ECB president Mario Draghi doubled down on his economic doomsday mantra, slashing growth forecasts from 1.7 percent to 1.1 percent in 2019.

Draghi blamed Trump’s protectionist policies on the slowdown of growth:

“The persistence of uncertainties related to geopolitical factors, the threat of protectionism and vulnerabilities in emerging markets appears to be leaving marks on economic sentiment.”

ECB: Addicted to Printing Money

More concerning is the Draghi’s commitment to flooding the European economy with cheap money. Since the eurozone debt crisis in 2011, the ECB has unveiled a constant stream of stimulus packages – from quantitative easing to bond purchases to low interest rates.

All of this has the effect of flooding the economy with money and lowering the purchasing power of the euro. On Thursday, Draghi pushed back its interest rate program, effectively keeping ultra-low interest rates until the of end the year.

The ECB also unveiled a new stimulus package which will give cheap loans to European banks. The banks can then lend the money to customers at low rates.

The Dow Needs a Catalyst to Reverse Its Losing Streak

US stocks have boasted a record start to the year, posting almost 20 percent gains since January. But the last four days have been crushing for traders.

Leading the negative sentiment was the brutal OECD downgrade on global growth on Wednesday. The think tank revised global economic forecasts down to 3.3 percent in 2019 and predicted further slowdowns in 2020.

Wall Street’s earnings season has also finished with limp results. The number of S&P 500 companies beating expectations was below the long-term average. Worse, a large number of companies lowered their guidance for the coming year.

Traders are looking for good reasons to buy, but none are coming.

Traders Waiting For News on China Trade Deal

So far this year, the Dow has pumped higher on any positive news from Donald Trump’s trade negotiations with China.

In this last week, however, talks have gone quiet. Some analysts now believe the forthcoming trade deal is already priced into the markets. If that’s true, the deal would have to beat all expectation for the Dow to push higher. As Peter Boockvar, chief investment officer at Bleakley Advisory Group told CNBC :

“We’re finally here. It’s like we’re at the finish line [on a trade deal]. The stock market has to reconcile with the bond market how the downward trend is going to reverse on a trade deal.”

Traders are starting to worry the deal may not live up to expectations. It begs the question, what is the next big market trigger for investors?