Dow on Steroids: Amped U.S. Stocks Open Sharply as Fed Prepares Rate Cut

The Dow is nearing its all-time highs. | Source: Shutterstock

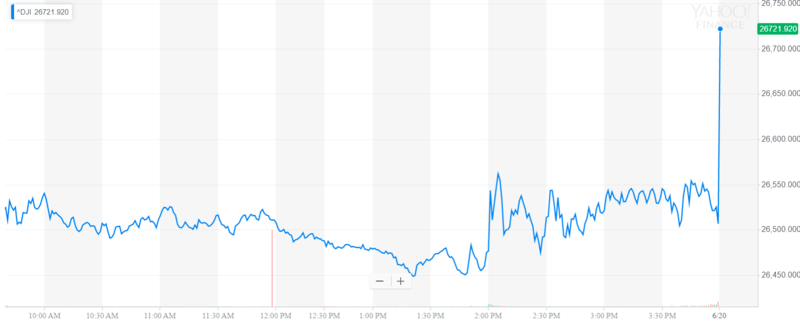

By CCN.com: The Dow and broader U.S. stock market surged on Thursday, as traders doubled down on their bets that the Federal Reserve will lower interest rates following next month’s policy meeting.

Dow Extends Rally; S&P 500, Nasdaq Follow

All of Wall Street’s major indexes opened sharply higher on Thursday, mirroring a strong pre-market for Dow futures. The Dow Jones Industrial Average spiked 215.31 points, or 0.8%, to 25,719.31.

The broad S&P 500 Index of large-cap stocks climbed 1% to 2,954.81, with seven of 11 primary sectors reporting gains. Health care stocks were the biggest gainers, climbing 1% as a collective. Utilities also rose sharply.

The technology-focused Nasdaq Composite Index jumped 1.2% to 8,083.84.

A measure of implied volatility known as the CBOE VIX continued to decline on Thursday, reaching its lowest level since the beginning of May. The so-called “investor fear index” fell 2.1% to 14.03 on a scale of 1-100 where 20-25 represents the historic average.

Fed Rate-Cut Chances Hit 100%

Futures traders are unanimous in their view that the Federal Reserve will lower interest rates next month for the first time in over a decade, according to CME Group’s FedWatch Tool . In other words, traders believe there’s a 100% chance the Fed cuts rates following the July 30-31 Federal Open Market Committee (FOMC) meeting. The Dow will be watching.

Market participants are betting on a rate cut with renewed conviction after the Federal Reserve signaled on Wednesday that a shift in monetary policy could be warranted if the economic outlook weakens.

“The case for somewhat more accommodative policy has strengthened,” Fed Chairman Jerome Powell said in a news conference Wednesday following the two-day policy meeting in Washington.

Nine of ten Fed officials voted to keep interest rates steady on Wednesday. St. Louis Fed President James Bullard was the lone dissenter, voting to lower interest rates by 25 basis points.

The Fed’s message sent the 10-year U.S. Treasury yield plunging below 2% on Wednesday for the first time since November 2016. The yield touched a low of 1.97% on Thursday, according to CNBC. Interesting times ahead for the Dow.