Dow Nears Epic May Collapse to Snap 4-Month Winning Streak

The Dow sunk 120 points as U.S. manufacturing data approached crisis levels and triggered recession alarms. | Source: Shnutterstock

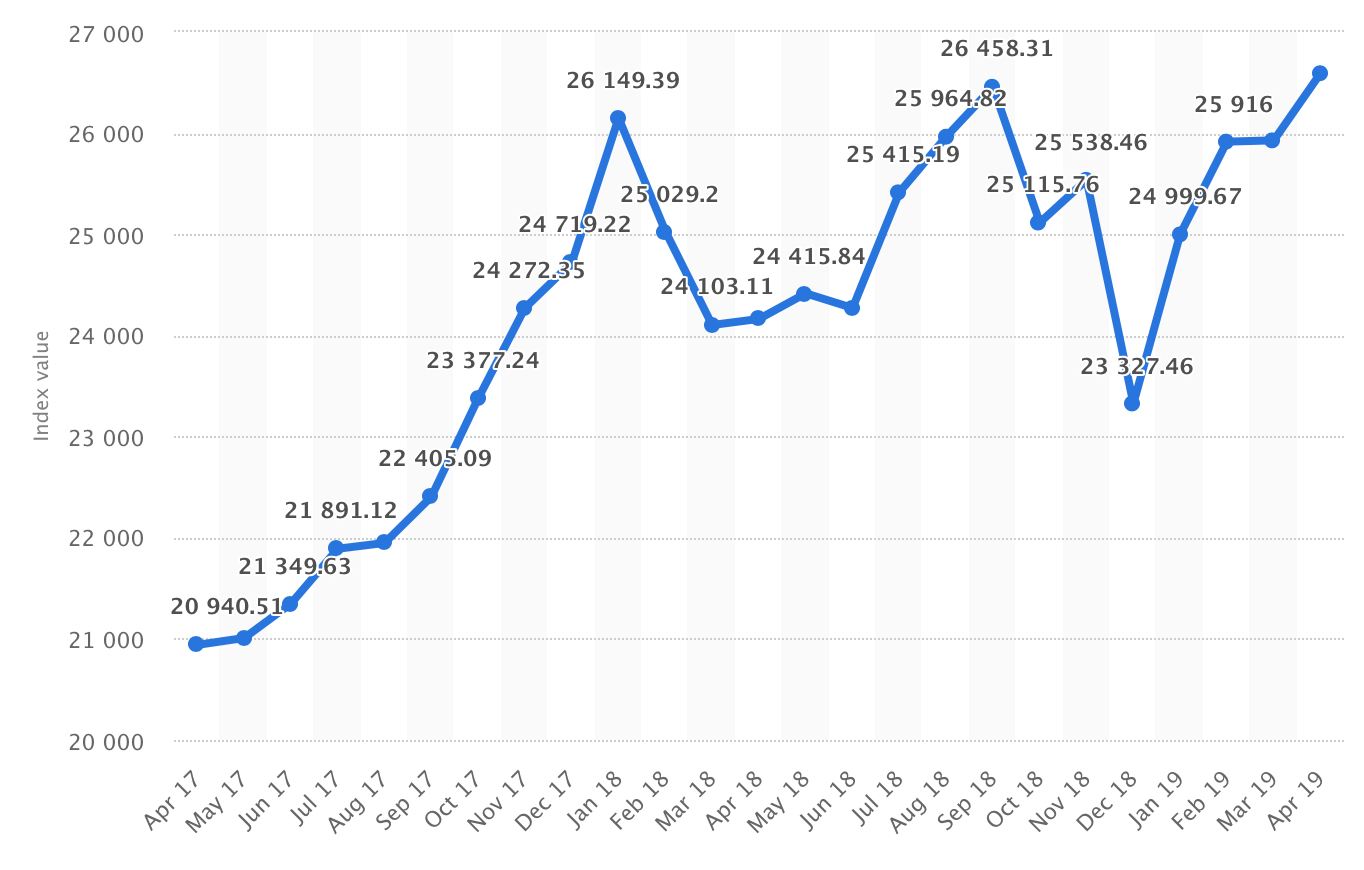

By CCN.com: The Dow Jones Industrial Average (DJIA) is on track to post its first monthly loss of the year in May. The flagship US stock market index raged into 2019 but growth stumbled this month as Trump’s trade negotiations with China collapsed.

As of Tuesday May 28th, the Dow is down 3.6 percent in May. Unless traders can break out in the last week of trading, the DJIA will snap a four-month winning streak. As they say on Wall Street, sell in May and go away.

Dow Jones: Sell in May and go away

Thus far in 2019, the Dow has chalked up an impressive winning streak, with gains in every month since January.

- January: 7.1% gain

- February: 3.6% gain

- March: 0.04% gain

- April: 2.6% gain

- May: -3.6% loss

Even March’s meagre 0.04 percent gain was enough to keep the momentum going. This month’s slump, however, is the first major pullback of the year.

Trump – China trade war collapses in flames

The catalyst for May’s selloff was a thump back down to reality in the Sino-American trade war.

President Trump kicked off the month with a confrontational tweet aimed at China. He raised existing tariffs on $200 billion worth of Chinese goods from 10 percent to 25 percent, sparking retaliatory tariffs from Xi Jinping.

Negotiations promptly broke down. Trump blamed China for backing out of the deal and a Chinese delegation went home from Washington empty-handed.

Dow Jones crushed by “arrogant” Trump demands?

In an editorial published by Chinese state media Xinhau this weekend, China slammed Trump’s arrogant negotiating stance. The reports hints that China will never accept structural changes to its economy.

“At the negotiating table, the U.S. government has made many arrogant requests, including restricting the development of state-owned enterprises” – translated by CNBC .

It echoes another recent report out of China, which predicted a terrifying 15 year trade war deadlock.

Tariffs are hurting the US economy, not helping it

Dow traders are beginning to price in the negative impact of an all-out trade war. Lewis Alexander, chief US economist at Japanese firm Nomura, said Trump’s tariffs are hitting US companies hard .

“Frankly, on net, it’s likely to be a drag on U.S. growth rather than neutral.”

He said Trump’s claim the US government banks billions of dollar in tariff payments is false. Instead, the costs are absorbed by US companies and passed on to consumers.

Dow Jones recovery in June?

The pullback in May is arguably a healthy retracement. Investors have come back down to Earth as the reality of the US-China trade battle hits home.

In June, the focus may shift back to company earnings and fundamentals. In late June and early July Wall Street will focus on the quarterly earnings season and we’ll get an insight into the health of the biggest Dow stocks.

Meanwhile, Trump struck a positive tone on trade talks with Japan. And the Fed maintains a healthy “wait-and-see” approach to raising interest rates.