Dow Plows Higher Despite Mueller Dump – Don’t Fear a ‘Trump Reckoning’

The Dow plowed higher on Thursday, even as Wall Street braced for the release of the Mueller report and a possible reckoning for Donald Trump. | Source: AP Photo / Richard Drew

By CCN.com: The Dow plowed higher on Thursday, even as Wall Street breathlessly waited for US Attorney General William Barr to release a redacted version of special counsel Robert Mueller’s report into the 2016 Trump campaign. But though touted by liberals as a reckoning for Donald Trump, the Mueller report is really just a smokescreen, at least so far as the stock market is concerned.

Dow Climbs as DOJ Dumps Mueller Report

Responding to strong retail sales data, the Dow Jones Industrial Average popped at the opening bell, rising more than 100 points before paring those gains. As of 11:13 am ET, the DJIA had jumped 79.13 points or 0.3 percent to 26,528.67. The S&P 500 gained just 0.01 percent to hold at 2,900, and the Nasdaq lost 0.19 percent to fall to 7,980.92.

On Wednesday, the stock market seesawed into decline following a positive pre-bell session. The Dow ultimately closed at 26,449.54 for a loss of 3.12 points or 0.01 percent. The Nasdaq posted a similar decline, dipping 4.14 points or 0.05 percent to 7,996.08. Weighed down by the health-care sector, the S&P 500 dropped 6.61 points or 0.23 percent to 2,900.45.

Trump’s ‘Judgment Day’ Shouldn’t Impact Stock Market

This morning, all eyes were on Attorney General William Barr as he answered questions about the Mueller report and then released a redacted version to the general public.

Trump critics have long fantasized that Robert Mueller would swoop in and provide Democrats with the ammunition they need to successfully impeach the president they view as illegitimate. But while the nearly 400-page document will likely paint a more complex picture of the 2016 Trump campaign than Trump’s “No Collusion – No Obstruction !” mantra alleges, few analysts expect it to have any long-term bearing on the 2020 presidential election.

Analysts maintain that, despite Trump’s divisiveness, the election will be a referendum on the economy – not his personal peccadilloes or the culture wars.

“A lot of this is priced in already, and the market is saying that Trump is going to be the candidate,” Daniel Clifton, head of policy research at Strategas, told CNBC . “The risks of impeachment are very low even if there’s something in that report. I think the consensus view holds, and does it make it easier to get a China deal through? The answer is yes.”

Greg Valliere, the chief US policy strategist at AGF Investments, offered similar commentary in a note to clients.

“The markets have learned to live with the Washington dysfunction, and there’s no reason to believe the Mueller report will have any real impact on investors,” he said, predicting that even the document’s most unsavory details could be met with a “yawn.”

Still, Trump’s Twitter timeline seemed to betray a bit of unease:

Dow’s Parabolic Recovery Features Worrisome Trading Volumes

Regardless, here’s what investors should actually be worried about: the Dow’s parabolic recovery has been accompanied by shockingly low trading volumes.

As first noted by MarketWatch , composite stock market trading volume is on track for its worst April since 2013. On April 15, the New York Stock Exchange and Nasdaq recorded 5.7 billion shares worth of turnover, the lowest full-session total since September 10. Even Christmas Eve, when the markets closed three hours early, saw more volume.

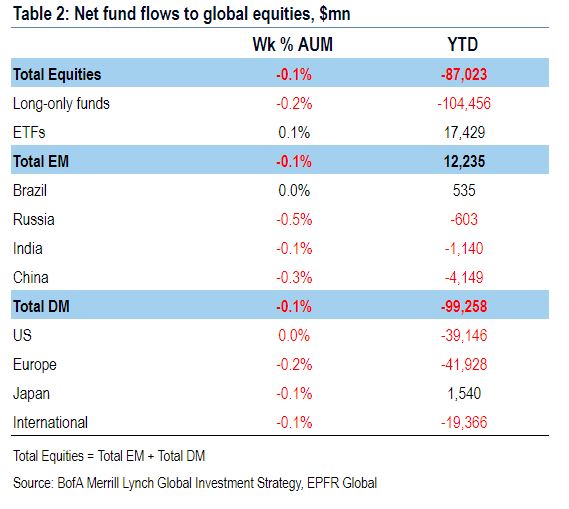

Most analysts attribute the lack of volume to investor skepticism about the sustainability of the recovery. During the first quarter, mutual funds and ETFs experienced sizable net outflows, even as the stock market posted its best quarterly performance in around a decade.

“For the New York Stock Exchange, there has been a bit of hesitation to have full participation in the rally…with a decent amount of people on the sidelines,” State Street’s Bartolini said. Investors who “missed the bounce back [since the December low] are waiting to see what happens on earnings season.”

Larry Fink, who as CEO of BlackRock lead’s the world’s largest asset manager with roughly $6 trillion under management, made similar comments earlier this week. He warned that once sidelined investors begin to pile back into the stock market, equities could succumb to a “melt-up.”

In the short-term, that melt-up would cause the Dow and its peers to rocket to new all-time highs, but it would also amp up the risk of a sharp correction. And without reliable trading volumes, analysts might not be able to see that drop coming.

Quincy Krosby, the chief market strategist at Prudential Financial, explained in an interview with MarketWatch that volume metrics help analysts confirm market movements.

“Volume [measures] do help you to confirm the move in the market, particularly when we are looking for signs, in terms of the tug of war taking place [between bulls and bears], and helping investors gauge which side of the tug of war is winning,” she said.

Absent reliable volumes, investors could be flying blind.