Dow Jumps 240 Points – This Chart Warns the Party Won’t Last

The Dow surged on Wednesday, but a sharp decline in corporate stock buybacks threatens to force the market into a corner. | Source: AP Photo / Richard Drew

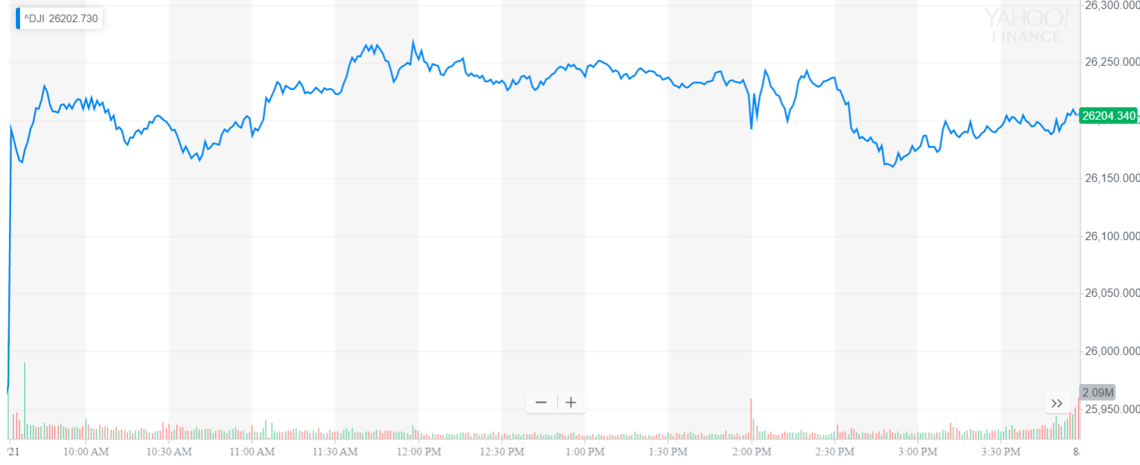

By CCN.com: The Dow and broader U.S. stock market rallied sharply on Wednesday, as investors reacted to the increasingly-likely prospect of another Federal Reserve interest rate cut this year.

Despite the rally, a sharp drop in share repurchases suggests that the bull market may not have much room to grow. Investors may be surprised just how much stock buybacks have contributed to Wall Street’s gains in the last five years.

Dow Spikes; S&P 500, Nasdaq Follow

All of Wall Street’s major indexes reported firm gains Wednesday, mirroring a strong pre-market for Dow futures. The Dow Jones Industrial Average gained 240.29 points, or 0.9%, to close at 26,202.73.

The broad S&P 500 Index of large-cap stocks advanced 0.8% to 2,924.43. All 11 primary sectors contributed to the rally.

Surging technology shares propelled the Nasdaq Composite Index sharply higher. The tech-laden benchmark rose 0.9% to 8,020.21.

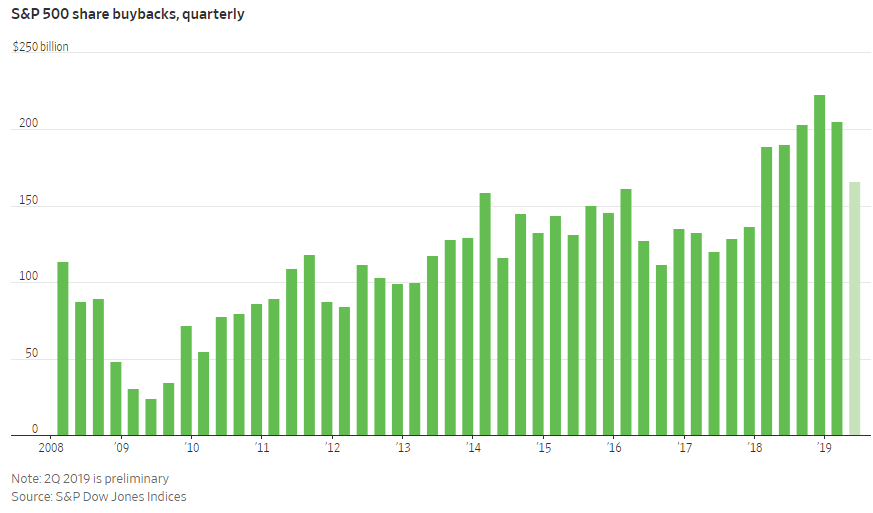

Share Repurchases Hit 18-Month Low

Companies in the S&P 500 are buying back their shares at the slowest rate in one-and-a-half years, raising fresh alarm over the future of the bull market.

The Wall Street Journal reported Wednesday that buybacks totaled $166 billion in the second quarter, down from $205.8 billion in the first quarter and $190.6 billion a year ago. Repurchases peaked in the fourth quarter of 2018 when they reached $223 billion.

Spending on repurchases has declined due to trade uncertainty, weaker corporate profits, and slowing global growth.

Investors often cheer repurchases because they boost share prices.

As Hacked.com reported earlier this year, the S&P 500 Index would have been 19% lower in the first quarter had it not been for massive buybacks.

Click here for a real-time Dow Jones Industrial Average chart.