Dow Futures Eye Feeble Open, But is Bitcoin on the Verge of a Historic Recovery?

The bitcoin price made a major push toward $4,000, but the US stock market sputtered heading into Tuesday's trading session. | Source: Shutterstock

The US stock market appears doomed to make a weak entry into the week’s first trading session following Monday’s Presidents’ Day holiday, as the Dow and its sister indices are all forecasting opening bell declines. The bitcoin price, on the other hand, burst out of a prolonged period of stagnancy and has many investors questioning whether the cryptocurrency is on the front end of a new bull market.

Dow Futures Point South

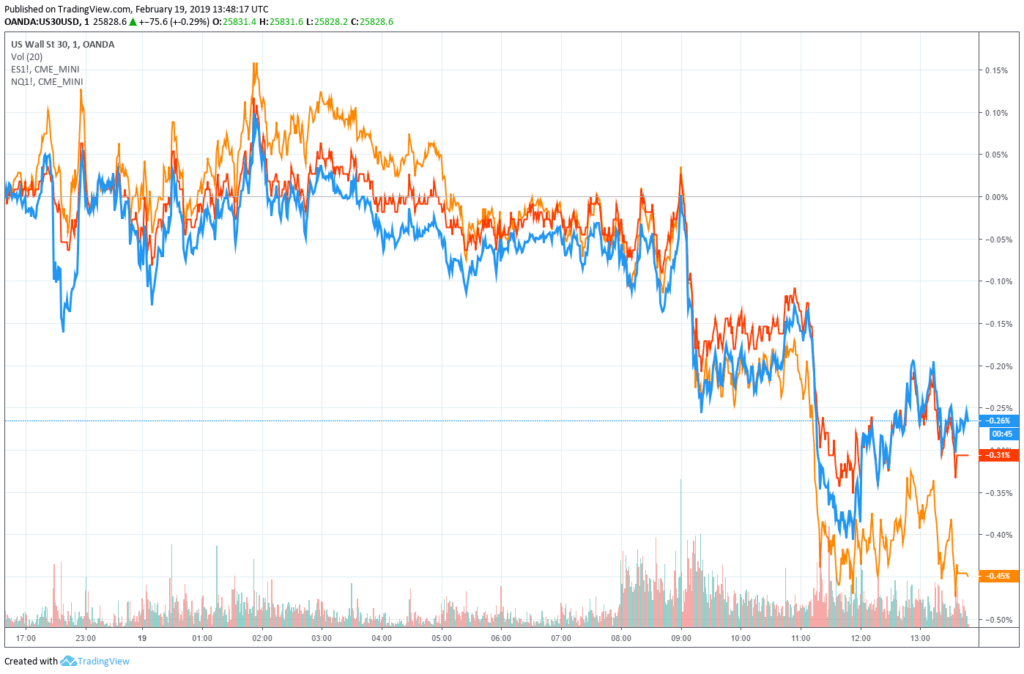

As of 8:55 am ET, Dow Jones Industrial Average futures had lost 58 points or 0.22 percent, implying a loss of 46.25 points at the open. S&P 500 futures dropped 0.32 percent, and Nasdaq futures fell 0.29 percent to round out the US stock market’s weak pre-bell session.

One exception to the stock market’s sluggish pre-market session was Walmart, which smashed analyst estimates on the back of 43 percent growth in e-commerce sales. Walmart shares climbed 3.45 percent before Tuesday’s bell.

Analyst Adam Kobeissi Predicts Stock Market Recovery Will Hit a Wall

On Friday, the Dow raced to a 443.86 point gain, climbing 1.74 percent to close the week at 25,883.25. The S&P 500 and Nasdaq also ended the day in the green, rising 1.09 percent to 2,775.6 and 0.61 percent to 7,472.41.

The Dow has now risen for eight consecutive weeks , even as stock market bears continue to pound the table on the recovery’s imminent demise. Here’s one example, courtesy of Kobeissi Letter editor-in-chief Adam Kobeissi. Pointing to the S&P 500’s inability to break through resistance at 2,800 – even after crossing its 200-day moving average – he predicted that the broad consumer index could drop more than 225 points over the next few weeks as the stock market enters a cooling off period.

“Looking forward, we believe that upside is limited and buying equities now presents a highly unfavorable risk-to-reward ratio as expected return has dwindled with recent bullishness,” he said. “We maintain our target at 2,550 on the S&P 500 and believe that short positions in equities are set for a great few weeks.”

US-China Trade Talks Move to Washington

On Tuesday, though, Wall Street is watching warily as US and Chinese negotiators begin a new round of trade talks in Washington, just days after US Trade Representative Robert Lighthizer and Treasury Secretary Steven Mnuchin returned from Beijing without striking a deal to end the trade war.

Few analysts expected those talks to culminate in a formal agreement, but the stock market is nevertheless growing antsy as US President Donald Trump’s self-imposed March 1 trade deal deadline rapidly approaches. If that deadline passes, and Trump fails to announce an extension, the US would hike tariffs on $200 billion worth of Chinese goods. That move would not only intensify the ongoing US-China trade war but would also threaten to further strain relations between the world’s two largest economies.

Bitcoin Price Tests $4,000; is the Bear Market Over?

The cryptocurrency market, on the other hand, already made a massive push to the upside before Wall Street had woken up from its long weekend.

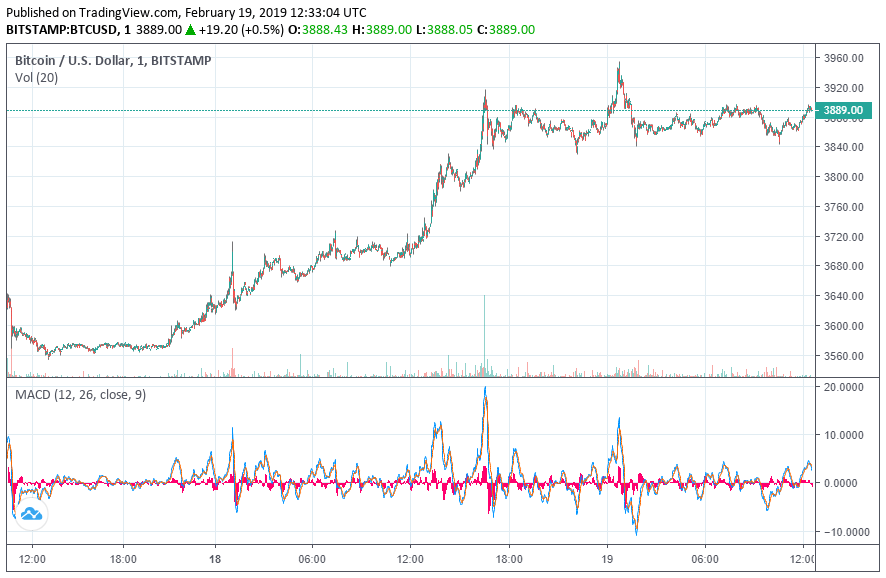

On Bitstamp, the bitcoin price rose as high as $3,955, though it failed to crack the $4,000 level before retreating to a present value of $3,889. Even so, the flagship cryptocurrency retains a tidy 24-hour gain of 4.29 percent.

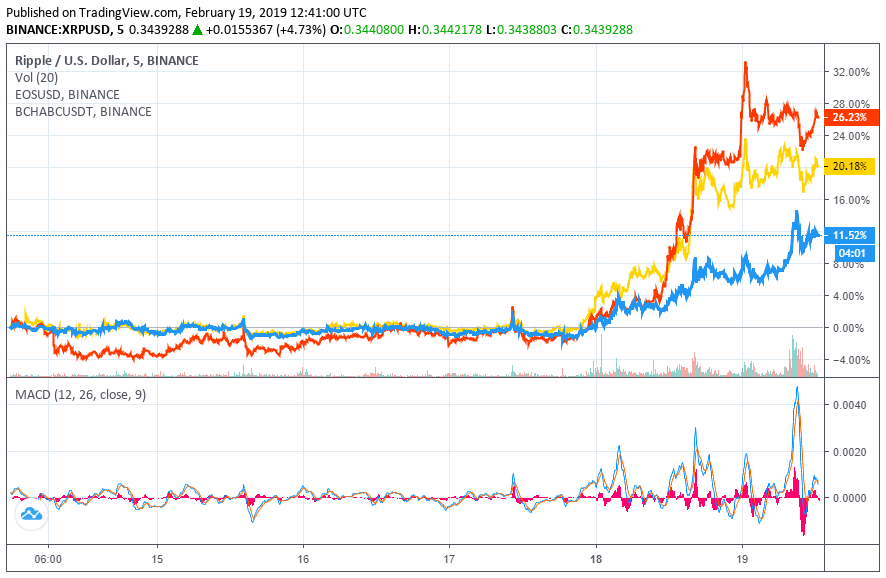

Still, the most significant action came in the altcoin markets. The ripple price (XRP) rose 7.9 percent, while bitcoin cash leaped 12.18 percent to $146. The large-cap index’s top performer was EOS, which surged by 17.23 percent over the past 24 hours and now trades at $3.66.

Today’s remarkable rally has understandably excited longsuffering cryptocurrency investors who may now be tempted to question whether bitcoin has begun to make the long grind back toward its all-time high around $20,000 – or perhaps even higher.

However, eToro Senior Market Analyst Mati Greenspan says that investors need to temper their euphoria, at least until bitcoin makes a more definitive push past technical and psychological resistance at $5,000. Only then, he says, should bulls feel confident that the cryptocurrency had closed the chapter on its longest-ever bear market.

“These gains are clearly creating a wave of optimistic sentiment throughout the crypto community, with market volume up by $8 billion in the last 24 hours. Market volume is now above $36 billion and we haven’t seen these levels since April 2018. But, until Bitcoin breaks above the much-needed psychological level of $5,000, the bear market is still very much in play.”

In the meantime, crypto broker BitOoda – which remains bearish on bitcoin’s short-term prospects – is closely observing shifts in Bitcoin Dominance, which measures the flagship cryptocurrency’s share of the overall crypto market cap. The firm expects altcoins to chip away at bitcoin’s market share throughout the remainder of the bear market. This morning, Bitcoin Dominance stands at 51.5 percent, down from a year-to-date high of about 54 percent.

Featured Image from Shutterstock. Price Charts from TradingView .