Dow Claws Higher, But Will These Trump Tweets Threaten Trade Deal?

The Dow clawed higher on Monday, even as Donald Trump and China traded new jabs ahead of resuming already-fraught trade war negotiations. | Source: REUTERS / Jonathan Ernst (i), REUTERS / Florence Lo (ii). Image Edited by CCN.com.

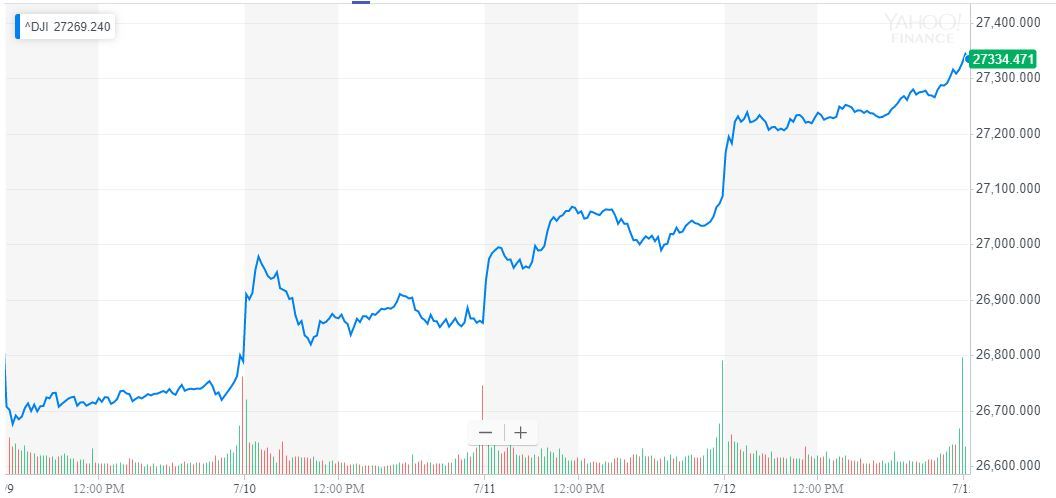

The Dow attempted to claw to a new record high on Monday as a resilient US stock market brushed off two potential escalations to lingering risks from the US-China trade war.

Dow Eyes 5-Day Winning Streak

All of Wall Street’s major indices traded slightly higher during the morning session. Shortly after the opening bell, the Dow Jones Industrial Average had fought its way to an admittedly-paltry 1.46 point or 0.01% gain, which nevertheless raised it to a fresh all-time high at 27,333.49.

The S&P 500 added 0.43 points or 0.01% to trade at 3,014.54.

The Nasdaq outperformed with a 12.5 point or 0.15% increase to 8,256.64.

China Threatens Sanctions on US Defense Industry

Stocks continued to rise on expectations of a Federal Reserve rate cut, but new developments in President Trump’s trade dispute with China risk clouding the market’s rosy forecast.

The South China Morning Post reports that China’s foreign ministry threatened to slap new sanctions on US companies that engage in arms trading with Taiwan.

“The arms sale to Taiwan has violated the basic norms of international law, international relations, and the one-China principle and the three Sino-US joint communiqués [which helped establish diplomatic relations between Beijing and Washington],” said Geng Shuang, a foreign ministry spokesman, in remarks translated by SCMP.

A People’s Daily article revealed that specific targets could include Honeywell International – which manufactures engines for Abrams tanks – and Gulfstream Aerospace, whose parent company – General Dynamics – is the fifth-largest private defense contractor in the US.

Trump Takes Victory Lap as Chinese GDP Plunges to Record Low

Meanwhile, President Trump took to Twitter to credit himself with grinding Chinese economic growth to its slowest pace on record.

According to Bloomberg , China’s gross domestic product expanded by 6.2% in the second quarter, its worst mark since quarterly data first became available 27 years ago in 1992.

While some analysts might take that slowdown as evidence of the global economy teetering toward recession, Trump touted it as evidence that tariffs on Chinese imports are crippling China’s economy and causing “thousands of companies” to leave.

News of the slowdown initially triggered a decline in Chinese stocks, but the SSE Composite recovered following the publication of data indicating that factory output and retail sales growth had beat analyst estimates despite the GDP slowdown.

JPMorgan Hikes Stock Market Forecast on Trade Deal Optimism

The US and China are currently preparing to resume trade talks following a two-month standoff that followed an unexpected breakdown in negotiations. Each side blamed the other for the sudden escalation, which caught investors off guard just as negotiations appeared to be nearing the finish line.

Anticipating a US-China trade deal, JPMorgan recently hiked its S&P 500 target to 3,200 from 3,000.

Writing in a note to clients, JPMorgan chief equity strategist Dubravko Lakos-Bujas said that the firm is “raising our S&P 500 12-month price target to 3,200 as our upside case for equities is increasingly in play with Fed and Trump easing on policy while investor positioning/sentiment remains low,” according to CNBC.

However, skeptical analysts warn that there is no evidence that either the US or China is prepared to compromise on tricky subjects like forced technology transfer and enforcement mechanisms.

Click here for a real-time Dow Jones Industrial Average (DJIA) price chart.