Dow Quakes While Trump Savagely Mocks ‘Crazy Bernie Sanders’

The Dow reversed early gains to drop on Wednesday after President Trump unleashed a savage Twitter assault on Joe Biden and Bernie Sanders. | Source: AP Photo / Andrew Harnik

By CCN.com: The Dow dipped into the red during the week’s penultimate session, as the US stock market continued to digest an earnings season that has been anything but predictable. Meanwhile, Donald Trump has begun to narrow his Twitter fire on the two politicians he believes will most likely emerge victorious from the bloody Democratic primary: Joe Biden and Bernie Sanders.

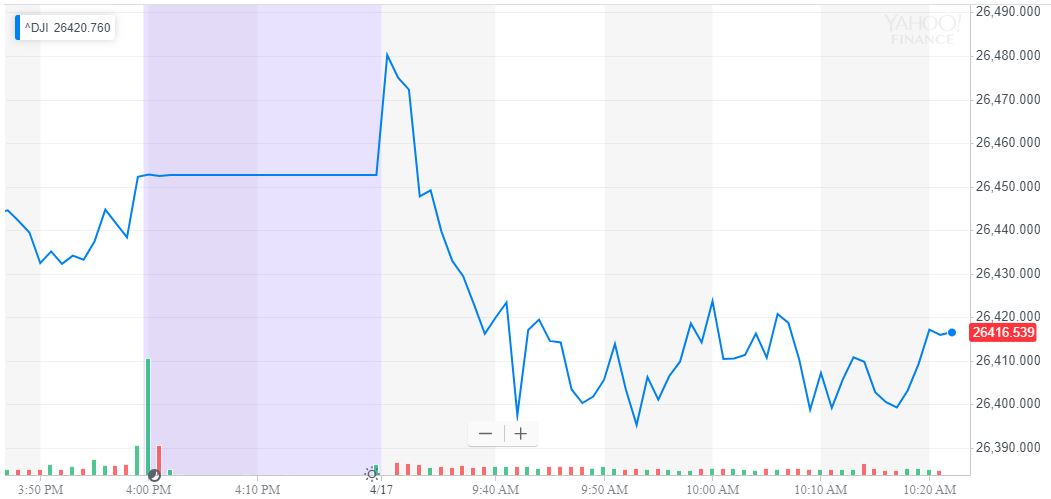

Dow Careens South after Solid Open

The Dow Jones Industrial Average had opened to modest gains, but the index quickly dropped into negative territory. By 10:24 am ET, the DJIA had lost 31.26 points or 0.12 percent to trade at 26,421.4. The S&P 500 fell 0.08 percent to 2,905.15, while the Nasdaq clung to a 0.07 percent gain.

Strong performances from Intel (+3.77 percent), Goldman Sachs (+2.25 percent), JPMorgan Chase (+1.4 percent), Apple (+1.1 percent), and Walt Disney (+1 percent) bolstered the Dow.

However, declines from key healthcare stocks rocked the index. Merck lost 2.35 percent, and Pfizer followed close behind with a 2.2 percent drop. UnitedHealth Group extended its April bloodbath, dropping 2.7 percent the day after warning that “Medicare for All” would absolutely destabilize the US economy.

The Dow’s second-largest component after Boeing, UnitedHealth Group has plunged more than 13 percent since ending March at $247.26 and now trades at just $215.06.

Donald Trump Ridicules ‘Sleepy Joe’ & ‘Crazy Bernie Sanders’

Today, voters – and Wall Street – got another taste of Donald Trump’s 2020 reelection strategy as the president mocked his top challengers with new nicknames: “Crazy Bernie Sanders” and “Sleepy Joe Biden.”

“I believe it will be Crazy Bernie Sanders vs. Sleepy Joe Biden as the two finalists to run against maybe the best Economy in the history of our Country (and MANY other great things)!,” Trump gloated on Twitter. “I look forward to facing whoever it may be. May God Rest Their Soul!”

Trump’s boast came at the tail-end of a multi-hour tweetstorm in which he pilloried Bernie Sanders – and seethed at Fox News – following the Democratic frontrunner’s town hall on the conservative cable news network.

In addition to peddling the conspiracy that Fox News had purposely stuffed the studio with Bernie Bros, Trump accused Sanders of hypocrisy for his opposition to the administration’s tax cuts.

“He is always complaining about these big TAX CUTS, except when it benefits him. They made a fortune off of Trump,” the president said.

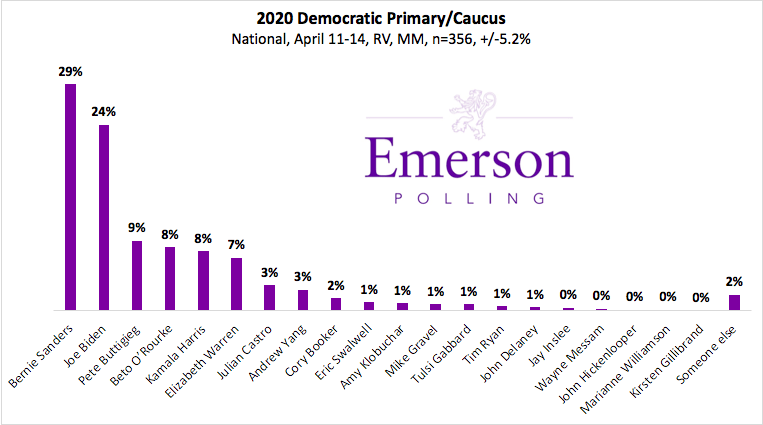

Earlier this week, Emerson Polling revealed that Bernie Sanders had raced to a comfortable lead in the Democratic primary contest. The democrat-socialist from Vermont polled at 29 percent among Democratic primary voters, with Joe Biden – who has yet to formally announce his candidacy – trailing slightly behind at 24 percent.

No other candidate polls at greater than 9 percent, suggesting that the Democrats are well on their way to nominating their own old white man to challenge the one that currently occupies the White House.

Betting Markets Are Less Bullish on Bernie

But while Bernie Sanders has jumped to a clear polling advantage, betting market data paints a somewhat murkier picture about his presidential odds.

In the Democratic primary market, he retains a small lead over Joe Biden, but that lead has narrowed now that it appears the former vice president will survive his #MeToo moment. The two septuagenarians also face a surprising challenge from South Bend Mayor Pete Buttigieg, whose nomination odds have more than tripled in the past month.

Moreover, Bernie Sanders has actually dropped to third in the “Who will win the 2020 US presidential election? ” market, sliding just behind Biden. Trump continues to dominate this market, though traders heavily favor the generic Democrat candidate over the generic Republican.

Robert Shiller: Trump Win Would Boost Dow

Notably, despite Trump’s alleged anti-establishment stance, entrenched financiers seem to favor the president, or at least view his reelection as an inevitability.

An RBC Capital Markets survey recently found that a staggering 70 percent of Wall Street insiders believe Trump will become the fourth straight president to win reelection, and Goldman Sachs published analysis indicating that Trump will likely score a “narrow” victory in a deeply-divisive contest.

Even Nobel-winning economist Robert Shiller broke from his oft-bearish market forecast to predict that a Trump victory in 2020 would invigorate equity prices, allowing the Dow to pound toward new highs.

Trump, unsurprisingly, agrees:

Click here for a real-time Dow Jones Industrial Average price chart.