Dow Spikes After Trump Axes Bolton & Clears Path for Iran Talks

The Dow Jones spiked to session highs after Trump shocked the markets by firing National Security Advisor and Iran hawk John Bolton. | Source: AP Photo / Pablo Martinez Monsivais

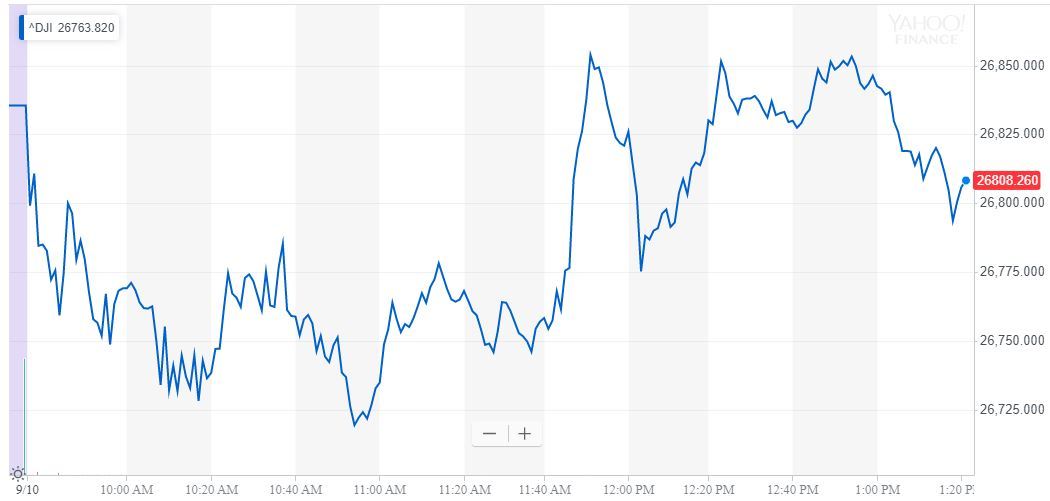

In a move that shocked markets on Tuesday, Donald Trump tweeted that he had removed John Bolton from the position of National Security Advisor. Oil tanked sharply, while the Dow Jones Industrial Average spiked to daily highs on the outlook for lower energy prices and brighter risk sentiment.

Dow Jones Rallies, Oil Slides as Trump Ousts Bolton

For the stock market, the removal of an aggressive hardliner in the Trump administration looks to be good news. Heading into the mid-afternoon, the Dow had recovered from a triple-digit loss to post a decline of 6.77 points or 0.03%. The DJIA was last seen at 26,828.74.

The Nasdaq and S&P 500 also recovered from session lows in the aftermath of the news, while gold plunged 0.72%.

As a notable foreign policy hawk, John Bolton long advocated for a robust approach to dealing with Iran. Bolton even went so far as to advocate for military intervention in Iran, so his removal could be interpreted as a generous concession by Trump ahead of a possible meetin g with the Rouhani regime.

The oil price slid considerably following Bolton’s ouster. WTI crude last traded at $57.74 for a decline of 0.19%. Drops like this are typically affiliated with an easing of tensions, as there are currently strict restrictions on the flow of Iranian oil.

It had been a bad few days for Bolton, after Trump suffered an embarrassing cancellation of a widely criticized meeting with leaders of the Taliban. Adding to the chaos, Bolton tweeted that he had offered to resign, but the president had delayed the conversation.

DJIA Stocks: Chevron & Exxon Shrug Off Oil Dip

Despite the rapid sell-off in crude oil, the Dow 30’s two largest oil companies were both able to hold onto their gains on the day. Chevron posted an impressive 2.31% gain, while Exxon Mobil, was up 0.78%.

The Dow has (generally) been enjoying a risk-on rally over the last week, with positive developments in Brexit and the US-China trade war.

If the president wants to add Iran to this list, it would aid his desire for a lower oil price and provide additional stimulus for the economy, which could be very positive for the Dow Jones.

Click here for a live Dow Jones Industrial Average chart.