Dow Suffers Brutal 475 Point Reversal, Trump Blames Fed

The Dow suffered another brutal plunge on Wednesday, and President Trump says it's all the Federal Reserve's fault. | Source: AP Photo / Richard Drew

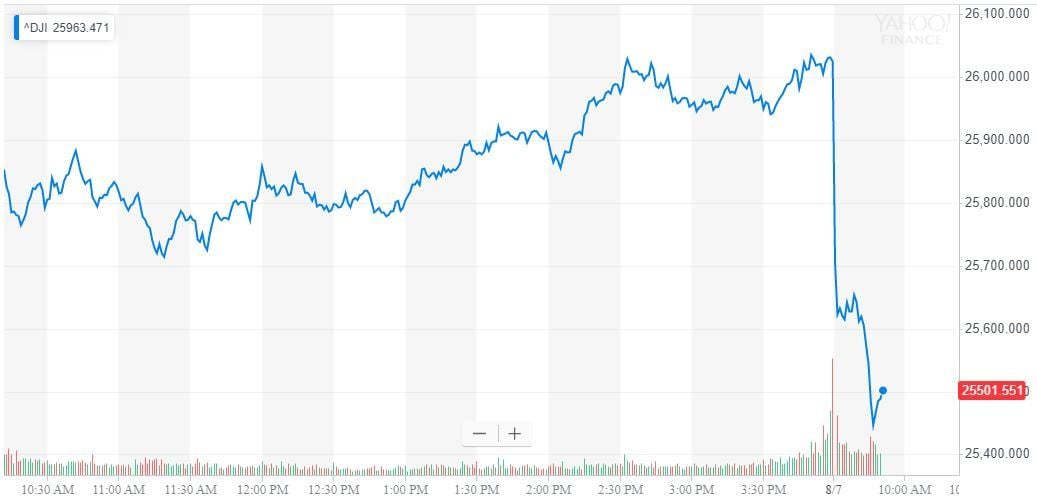

The Dow Jones snapped back into its brutal reversal on Wednesday, as recession alarms thundered throughout the global economy and China continued to confound analysts with its handling of the yuan.

But to hear President Trump tell it, the stock market’s dismal downturn has a singular cause: the US Federal Reserve.

Dow Craters, Slides Toward 25,500

All of Wall Street’s major indices fell on Wednesday, whipsawing into decline despite a futures session that signaled gains for most of the morning. The Dow Jones Industrial Average plunged as much as 550 points, but by 9:56 am ET it had settled down to 25,553.06 for a loss of 476.46 points or 1.83%.

DJIA futures had pointed to gains of more than 100 points prior to the bell.

The S&P 500 slid 41.02 points or 1.42% to 2,840.75.

The Nasdaq lost 95.89 points or 1.22%, forcing the tech-heavy index down to 7,737.37

Stocks Fall as Bond Yields Broach Record Lows

Stocks plunged as bond yields fell around the globe, reigniting lingering fears about a potential recession.

The 30-year Treasury yield flirted with a new all-time low, while 10-year UK yields dove to unprecedented depths.

Confirming the bearish outlook, central banks in India, New Zealand, and Thailand all surprised analysts by cutting interest rates by wider-than-expected margins.

China Tinkers With the Yuan – Again

Meanwhile, the People’s Bank of China (PBoC) again tinkered with the yuan, fixing it at a weaker-than-expected 6.9996 against the US dollar.

Even so, it’s slightly above the psychologically significant 7-per-dollar ratio, which the CNY dipped below earlier this week. The breach prompted President Trump and the Treasury Department to accuse China of manipulating its currency.

“The timing of the move beyond 7.00 is clearly not a coincidence and may have a political dimension,” S&P Global Ratings said in a report published Wednesday, according to CNBC. “While the timing may raise concerns that big currency policy changes are afoot, so far, we have not seen any evidence that the overall policy framework has changed.”

Analysts have speculated that the PBoC’s decision to let the yuan slide below 7 was meant to send a message to the Trump administration, which plans to slap new tariffs on Chinese imports in September. By weakening the yuan, the PBoC can mitigate the damage from those tariffs – and future ones that follow.

Trump Bashes Fed as Dow Plunges

However, President Trump alleged that China had nothing today with today’s stock market sell-off.

Writing on Twitter, Trump blamed the US Federal Reserve for failing to cut interest rates more aggressively. Despite executing a 25-basis point cut in July for the first time in more than a decade, Trump believes the Fed should have slashed rates deeper – and earlier.

“Our problem is a Federal Reserve that is too proud to admit their mistake of acting too fast and tightening too much,” he said. “They must Cut Rates bigger and faster, and stop their ridiculous quantitative tightening NOW.”

“Incompetence is a terrible thing to watch,” Trump added.

Several Federal Reserve officials will speak this week, beginning with Chicago Fed President Charles Evans. Wall Street will closely monitor their comments to discern whether the latest economic and trade war developments will increase the likelihood of aggressive easing during the remaining months of 2019.

Dow Extends Weeklong Tailspin

Wednesday’s pullback threatened to erase the previous day’s moderate recovery, which saw the Dow recoup more than 311 points following its worst loss of the year.

The DJIA has now crashed more than 1,650 points – or 6% – since closing at 27,221.35 on July 29.

Click here for a real-time Dow Jones Industrial Average chart.