Dow Recoups 275 Points as China Manipulates the Market – Again

The Dow's recovery sped toward 300 points after China manipulated its currency market - this time in the direction stock traders want. | Source: NICOLAS ASFOURI / POOL / AFP

The Dow and broader U.S. stock market began their long road to recovery on Tuesday after the People’s Bank of China (PBoC) announced it would take decisive measures to stabilize the yuan.

In other words, PBoC is manipulating the currency market in the direction that appeases stock traders.

Dow Rallies; S&P 500, Nasdaq Follow

Wall Street’s major indexes were in recovery on Tuesday after posting their worst trading session of 2019. The Dow Jones Industrial Average rallied 271.36points, or 1.06%, to 25,989.1.

The broad S&P 500 Index of large-cap stocks rallied 1.19% to 2,878.55. Nine of 11 sectors contributed to the rally, with information technology leading the pack.

A strong rebound in tech shares propelled the Nasdaq Composite Index higher. The index was up 1.37% at 7,831.52 as of 3:22 pm ET.

Chinese Central Bank to Stabilize Yuan

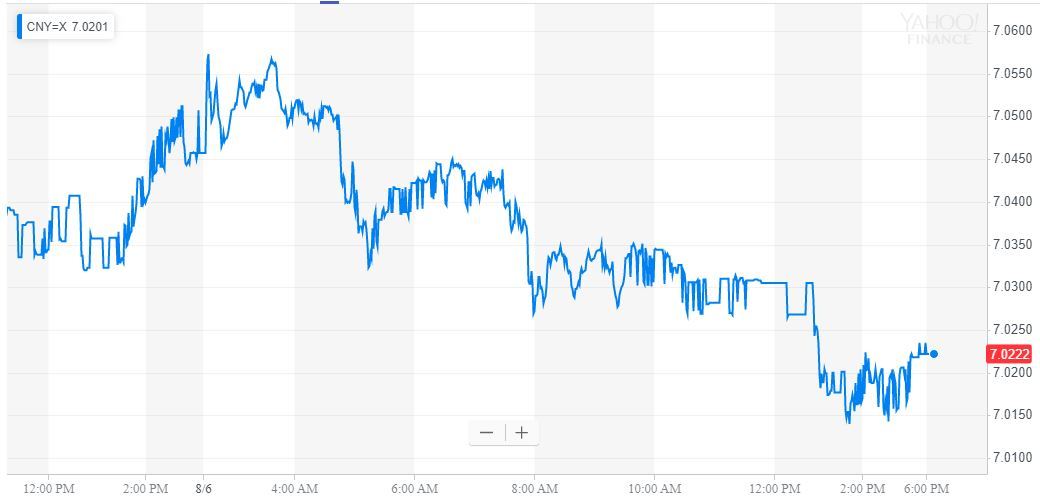

The People’s Bank of China announced Tuesday that it would provide some stability to the yuan after officials let their midpoint rate slide above 7 per U.S. dollar for the first time in over a decade. By orchestrating a fall in the yuan, China was able to convey to the world that it has plenty of ammunition to combat the U.S.-led trade war.

As Bloomberg reported , PBoC officials set the daily currency peg on the CNY stronger than analysts had expected and announced plans to sell yuan-denominated bonds in the coming weeks. Beginning August 14, the central bank will hold a sale of 30 billion yuan in Hong Kong in a move designed to lower offshore liquidity.

For investors, PBoC’s actions suggest it is trying to prevent further yuan depreciation while still maintaining flexibility. It also sends a positive signal that the Chinese government is open to resuming trade negotiations.

Bilateral talks between the U.S. and China resumed last week in Shanghai. Although President Trump described the meeting as “constructive,” he criticized China for abandoning an agreement in May and said it hadn’t lived up to its promise to purchase more U.S. agricultural goods. On Thursday, Trump announced 10% duties on all remaining Chinese imports valued at $300 billion.

Click here for a real-time Dow Jones Industrial Average chart.