Dow Spins Tires as Timid Investors Plow Back Into Stocks

The Dow spun its tires even as investors raced back into equities - just one week after the largest stock exodus in 5 years. | Source: Spencer Platt / Getty Images / AFP

The Dow struggled to assemble a fifth consecutive gain on Tuesday, even as timid investors raced back into equities just one week after triggering the largest domestic stock fund exodus in half a decade.

Dow, S&P 500, and Nasdaq All Struggle

Wall Street’s major indices were little changed during the morning session, placing the stock market’s winning streak at risk. The Dow Jones Industrial Average shed opening bell gains to remain virtually unchanged at 27,358.04.

The S&P 500 and Nasdaq also lacked conviction, declining 0.03% and 0.04%. Gains in industrials and materials were offset by hefty losses in the energy and utilities sectors.

Investors Pile Into S&P 500 Funds Just One Week After Equities Exodus

The stock market continues to trade near-record highs after investors rushed back into equities amid the broad expectation that the Federal Reserve will cut interest rates this month.

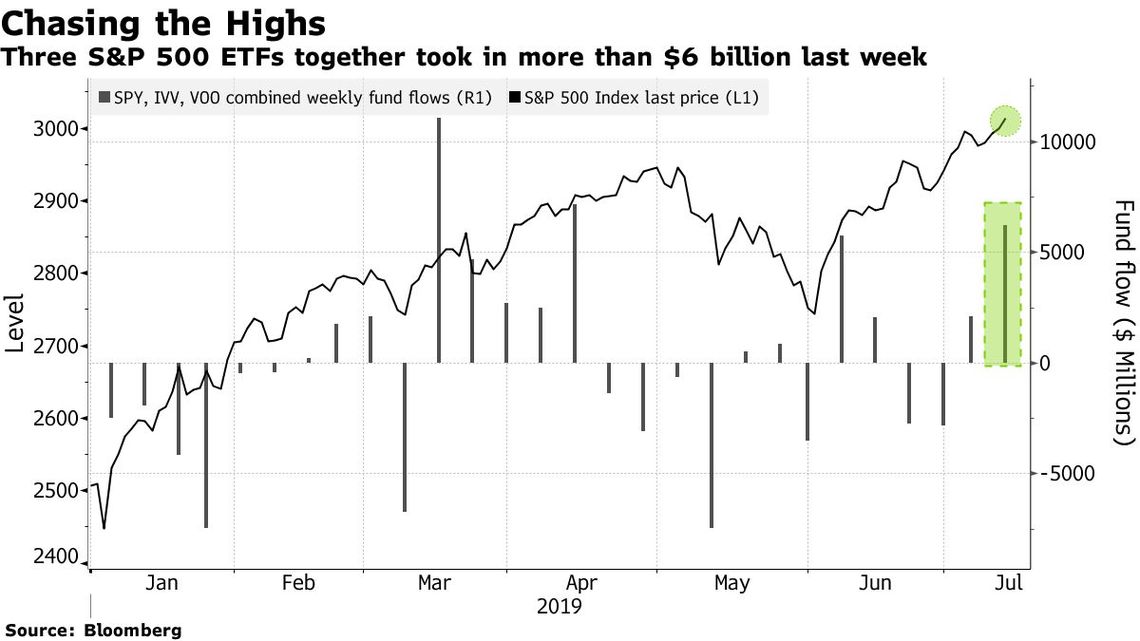

According to Bloomberg data , the three largest S&P 500 exchange-traded funds (ETFs) – SPDR’s SPY, iShares’ IVV, and Vanguard’s VOO – collectively took in $6.2 billion last week as the S&P 500 and other indices like the Dow crossed historic milestones.

That could indicate that investors believe the stock market’s mammoth ascent has more room to run in 2019, even after rising more than 20% in the first seven months of the year.

However, other data complicates that picture and gives the impression that investors still don’t have a firm conviction that the most recent leg of the rally is more than a flash in the pan.

Last week, the Investment Company Institute (ICI) reported that US mutual funds and ETFs had experienced their largest net outflow since February 2014 for the week ended July 2. Altogether, investors yanked $25.2 billion out of the US stock market, and they also pulled $3.6 billion out of world funds as they plunked $10.4 billion into bonds.

Analysts say that much of this year’s stock market rally is the result of corporate buybacks, through which companies purchase their own shares on the public market. Thus the Dow and its peers continue to grind higher, despite analysts estimating that stock funds will experience net outflows from investors for the year.

That could bode well for the market, given that stock buyback plans aren’t nearly as fickle as investors who might pile into an S&P 500 ETF one week, only to retreat to cash or bonds the next.

Click here for a real-time Dow Jones Industrial Average (DJIA) price chart.