Dow Pounces Higher But UBS Warns of Brutal Stock Market Reckoning

The Dow crashed on Monday after China retaliated against Trump's tariff threats by "weaponizing" the yuan and "abandoning" the trade deal. | Source: Drew Angerer / Getty Images / AFP

The Dow and overall US stock market bounced back on Monday, as investors diverted their attention from risks associated with both the US-China trade war and what many fear could develop into an actual war between the US and Iran.

Meanwhile, a UBS analyst warns that the global economy is “one step away” from a brutal recession that could ignite a stock market crash.

Dow Creeps Toward 27,000

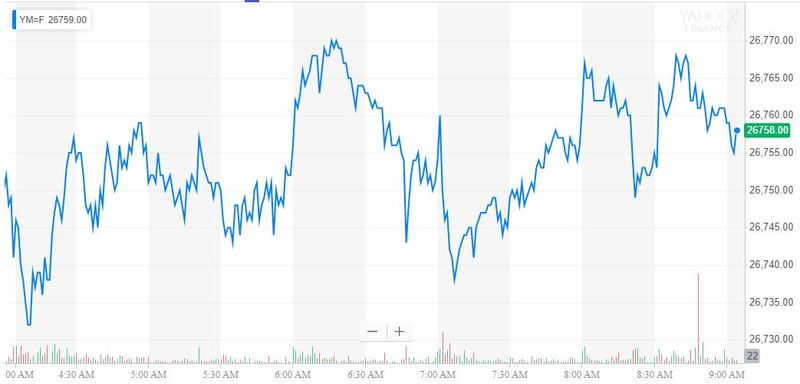

All of Wall Street’s major indices inched toward moderate gains during the morning session. Shortly after the opening bell, the Dow Jones Industrial Average had gained 56.81 points or 0.21%; the DJIA last traded at 26,775.94.

The S&P 500 climbed 3.77 points or 0.13% to 2,953.65. Nine of 11 primary sectors reported gains, with Financials and Health slipping into the red.

The Nasdaq rose 15.16 points or 0.19% to 8,046.87.

Trump Threatens More Sanctions, Iran Calls His Bluff

Stocks traded higher even as the Trump administration prepared to levy new sanctions on Iran, in lieu of launching planned air strikes against the Islamic Republic for shooting down a US Navy drone last week.

“We’ve done very massive sanctions. We’re increasing the sanctions now,” Trump told NBC over the weekend.

An emboldened Iran dismissed Trump’s sanction threats as “propaganda,” and it seems like Wall Street also intends to ignore the simmering conflict’s market fallout.

That may be because the Iranian economy contains precious little remaining for the White House to target with those sanctions. Indeed, US Secretary of State Mike Pompeo estimates that the Trump administration has already sanctioned four-fifths of the Iranian economy.

“The Trump administration has already hit most of Iran’s cash-earning exports and pushed the country into a deep recession this year,” Peter Harrell, a fellow at the Washington-based Center for New American Security, told Bloomberg . “A lot of exports to Iran have dried up because of risk aversion and all the banking sanctions.”

With any new sanctions unlikely to impose a crippling effect on the Iranian economy, the Trump administration appears to be running out of non-military responses to Iran’s continuing provocations if it intends to maintain “maximum pressure” on the rogue regime.

Wall Street on Pins & Needles Ahead of Trump-Xi Meeting

Meanwhile, investors will closely watch President Trump’s upcoming meeting with Chinese President Xi Jinping. The two men plan to meet during the G-20 summit in Osaka, Japan on June 28 and 29.

While few expect Trump and Xi to bridge the growing divide between the two economic superpowers, Wall Street hopes their meeting will thaw the frigid tensions between the countries.

However, some analysts, including Nordea , warn that the Trump-Xi parley could add fuel to the trade war fire. If that happens, the stock market could suffer a reckoning.

UBS: Trump-Xi Failure Could Ignite Stock Market Meltdown

According to UBS, any escalation to the trade war during the G-20 meeting could plunge the global economy into a brutal recession.

UBS global head of economic research Arend Kapteyn warned clients that the economy is already just “one step away” from a recession, and a failed trade war meeting would be sufficient to trigger a market meltdown.

Under that scenario, “we estimate global growth would be 75bp lower over the subsequent six quarters and that the contours would resemble a mild ‘global recession’ —similar in magnitude to the Eurozone crisis, the oil collapse in the mid-1980s and the ‘Tequila’ crisis of the 1990s,” Kapteyn wrote, per CNBC .

So what does this mean for the Dow, S&P 500, and other major indices? A vicious bear market.

Kapetyn predicts that a trade-induced recession would wipe 20% off global stocks, with emerging markets and the Materials sector suffering the largest blows.

For now, though, the Dow continues to trend higher, putting the DJIA in position to close its best June in more than 80 years.

Click here for a real-time Dow Jones Industrial Average (DJIA) price chart.