Dow Erases 600-Point Plunge But Macro Risks Threaten US Economy

The Dow Jones roared back to erase a vicious 600-point plunge, but macro risks continue to threaten the US economy. | Source: REUTERS / Brendan McDermid

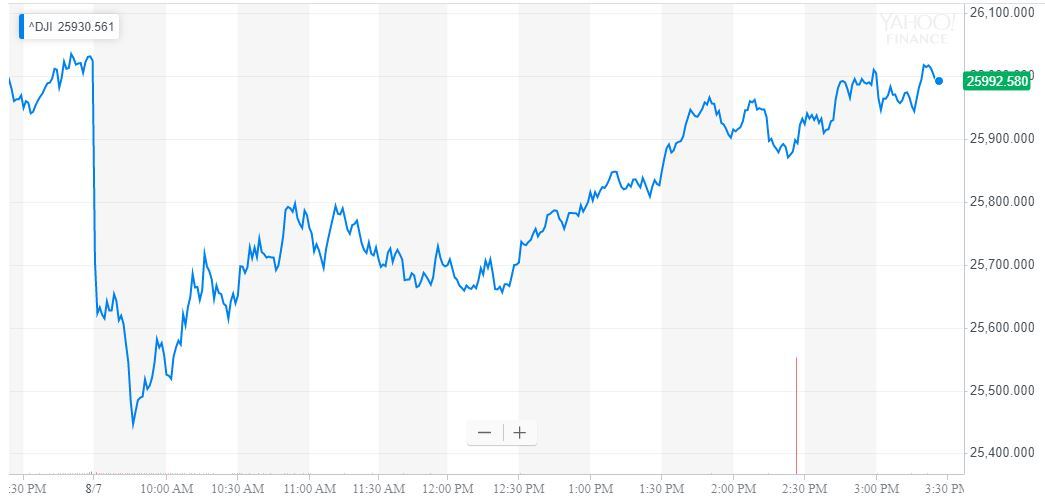

The Dow and broader U.S. stock market executed a mammoth afternoon recovery on Wednesday to erase steep morning losses, even as global bond yields continued to unravel.

Dow Pares Losses; S&P 500, Nasdaq Flip Green

After plunging nearly 600 points, the Dow Jones Industrial Average had pared almost all of its losses by late afternoon. The blue-chip index was last down 21.37 points, or 0.08%, at 26,008.15.

The broad S&P 500 Index of large-cap stocks completely reversed its intraday slump and was last seen trading up 0.1% at 2,883.29. Consumer staples jumped 1%, and materials added 0.8% as a sector. Gains in these categories offset sharp declines in financials and energy companies.

The Nasdaq Composite Index advanced 0.37% to 7,861.92.

U.S. Economy to Weaken Further in Q3

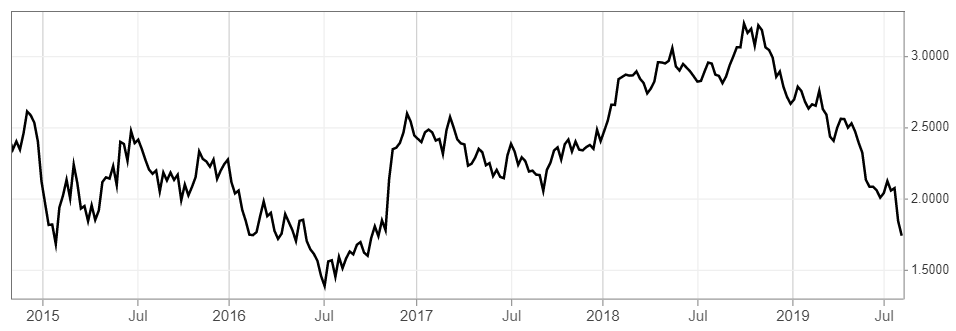

The U.S. economy has avoided recession under President Trump, but the bond markets suggest that a major economic downturn may be inevitable.

As it now stands, hopes of an amicable resolution to the U.S.-China trade war have all but evaporated following the latest tit-for-tat between Washington and Beijing. In the context of a weakening global economy, the trade hostilities have pushed bond yields to unprecedented lows.

On Wednesday, the yield on the 10-year U.S. Treasury fell 7 basis points to 1.668%, the lowest in almost three years. Yields fall as bond prices rise.

Now, the Atlanta Federal Reserve is warning that the nation’s economic expansion will weaken further in the third quarter. According to the latest GDP tracker, the U.S. economy is on pace to grow just 1.9% annually between July and September, down from 2.1% in the second quarter. The pace of the expansion avoids recession for now, but it leaves the United States vulnerable to significant macro risks.

Nowhere is this more apparent than in manufacturing – a sector that narrowly avoided contracting in July. The IHS Markit manufacturing purchasing managers’ index (PMI) came in at 50.0 last month, but its sub-index of factory output plunged to 48.9, a 119-month low.

Click here for a real-time Dow Jones Industrial Average chart.