Dow Jones Primed for a 100-Point Boost on US-China Trade Optimism

US President Donald Trump is expected to meet Chinese Vice Premier Liu He, President Xi's special envoy and top trade negotiator to foster a preliminary deal ahead of the March 1 deadline for an agreement between the two superpowers. | Source: AP Photo/Manuel Balce Ceneta)

US President Donald Trump is scheduled to meet China’s President Xi’s special trade talk envoy Liu He today. The meeting could mean progress in US-China trade talks and set the Dow Jones and US Stock Markets on track for an end of week boost.

Donald Trump to Meet China’s Vice Premier Liu He

Liu He is the designated top negotiator for China. With the March 2 trade resolution deadline looming time is running out for the US and China to make a deal. After March 1 tariffs on Chinese imports could double without a firm resolution on the table.

The meeting between the two leaders, scheduled for 2.30pm at the Whitehouse today, is a sign that trade talks are progressing, fuelling market optimism. According to Bloomberg reporting Liu may have greater authority to make a deal with US President Trump. Memorandums of Understanding (MoU’s) that could relate to issues like agriculture, technology, and intellectual property rights are in preparation by negotiators, according to sources.

China Proposes a Further $30 Billion US Agricultural Spend

Further sources have revealed China is offering to up its agricultural spending on US exports of crops like corn and soybeans by $30 billion. Incentivizing the US into viewing China with more favor during the talks. The proposal is just a part of the MoU’s negotiators are working on. The additional spend, included in confidential plans, is on top of China’s US agricultural spend levels before the trade-war began.

During the past year, China’s spend on agricultural imports from the US has fallen by almost $10 billion. US Agriculture Secretary Sonny Perdue refused to commit to revealing figures recently but told reporters at a recent conference:

If we reach an agreement on structural reforms we can recover markets very, very quickly.

The news sent corn-based futures upwards by 1.3% on February 21.

Arlan Suderman, chief commodities economist for INTL FC Stone was skeptical about eventual volumes but added:

It would not require very large purchase of corn, ethanol and DDGS to significantly improve the corn balance sheet.

US Stock Markets and Global Indices Demonstrate Positivity

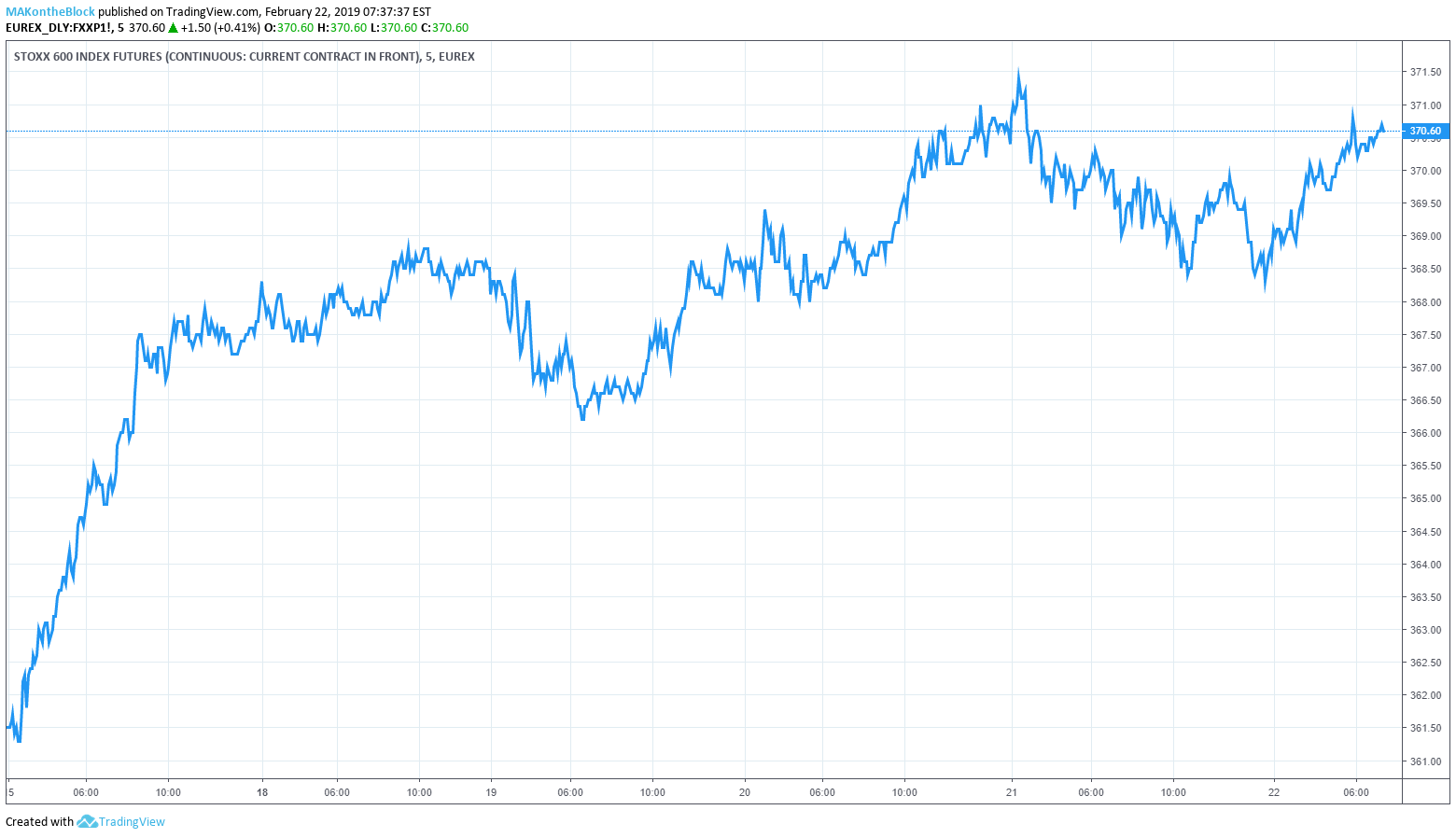

Global stock markets showed gains on opening today with many set to close the week up off the back of US-China trade talk optimism. The Stoxx Europe 600 headed 0.1% higher in its opening minutes today and just after lunchtime in Europe is holding at 0.41% higher.

Asia’s Hang Seng and the Nikkei have also risen by over 3% and over 2% respectively since Monday.

Tim Edwards, managing director of index investment strategy for S&P Dow Jones Indices says:

Trade negotiations are front and center and they are absolutely a global story.

Dow Jones Industrial Average Could Rise 110 Points on Opening Today

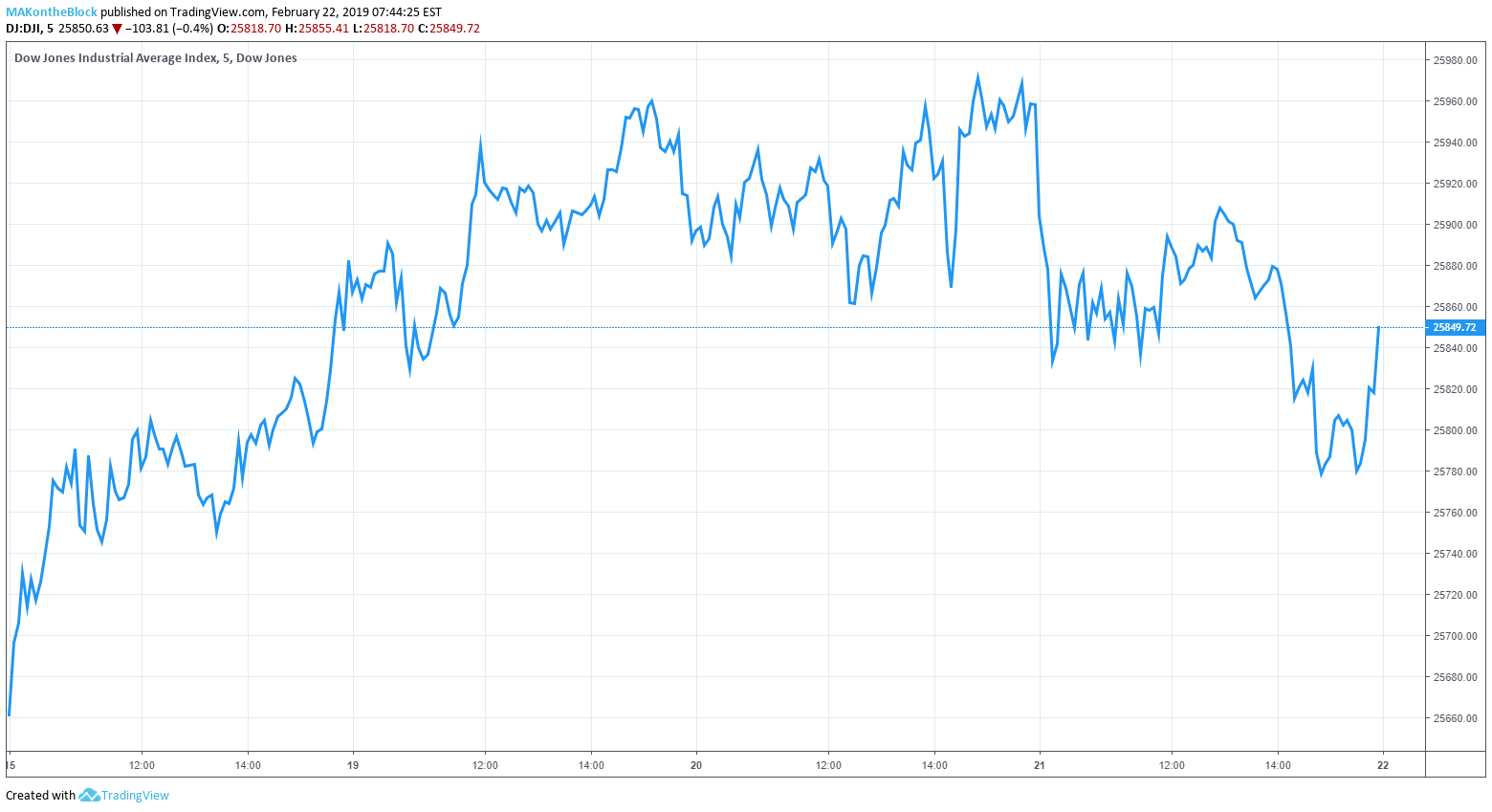

Premarket futures trading points to an implied opening for the Dow Jones Industrial Average today of over 110 points. Gains could also be expected for the S&P 500 and the Nasdaq.

Yesterday, the Dow Jones Index dropped by 103 points in afternoon lows before paring much of the loss but closing down alongside the S&P 500 and Nasdaq. Analyst views shift between the impact of the trade war and negotiations priced in. And, predictions that a huge rally could follow positive trade talk resolutions.