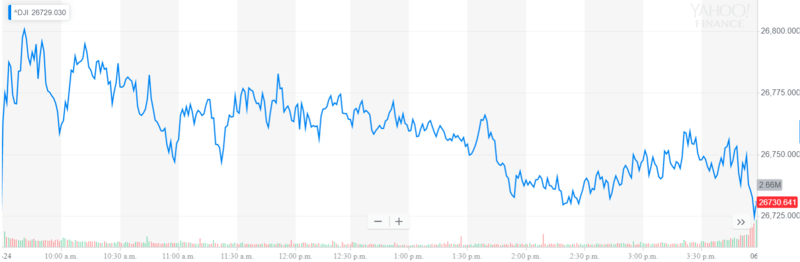

Dow Swirls in Holding Pattern Ahead of OPEC, G20, & June Data Dump

The Dow swirled in a stifling holding pattern on Monday, weighed down by an OPEC summit, a G20 meeting, and a critical June data dump. | Source: AP Photo / Richard Drew

The Dow and broader U.S. stock market traded in a narrow range on Monday, as investors remained on the sidelines in anticipation of a slew of high-profile events later in the week.

Dow Ekes Out Modest Gains; S&P 500 Falls

Wall Street’s major indexes hovered right around break-even on Monday, which reflected a tepid pre-market for Dow futures. The Dow Jones Industrial Average edged up 8.41 points, or 0.03%, to 26,727.54. The blue-chip index was up by as much as 87 points.

The broad S&P 500 Index of large-cap stocks slipped 0.1% to 2,94536. Losses were mainly concentrated in energy, health care, and consumer discretionary stocks.

The broad S&P 500 Index of large-cap stocks slipped 0.1% to 2,94536. Losses were mainly concentrated in energy, health care, and consumer discretionary stocks.

The technology-focused Nasdaq Composite Index fell 0.3% to 8,005.70.

OPEC, G20, Economic Data

The global financial markets are bracing for a highly active week filled with international summits, central-bank speeches, and critical economic data releases.

President Donald Trump and China’s Xi Jinping will hold face-to-face meetings at this week’s G20 summit in Osaka, Japan, where trade will be front and center. Negotiations between the two superpowers reached a stalemate last month after China reportedly reneged on a trade deal.

Wang Shouwen, China’s vice-minister of commerce, said both countries need to make concessions to end the trade dispute.

“We should meet each other halfway, which means that both sides will need to compromise and make concessions, and not just one side,” Wang said on Monday, according to the South China Morning Post .

The Organization of Petroleum Exporting Countries (OPEC) is also scheduled to meet with non-OPEC members beginning on Tuesday to reach a consensus about extending production cuts. The Saudi-led cartel will officially hold its biannual meeting in Vienna, Austria July 1-2, according to Reuters .

In terms of monetary policy, Federal Reserve Chairman Jerome Powell is expected to deliver a speech on Tuesday, roughly one week after delivering a dovish statement on monetary policy that flung the door wide open to a rate cut.

On the data wire, the U.S. government will report on international trade and durable goods orders on Wednesday. Orders for manufactured goods meant to last three years or more are forecast to rise by 0.2% in May after falling 2.1% in April. On Thursday, the Commerce Department will issue its third and final estimate of first-quarter GDP. The report is expected to confirm an annual GDP growth of 3.1% in the January-March period.

Click here for a real-time Dow Jones Industrial Average (DJIA) price chart.