Dow’s Feverish Rally Hits 400 Points, But Expert Warns of New ‘Cold War’

The Dow's feverish rally continued on Friday, but historian Niall Ferguson warned that the US an China are already locked in an unstoppable "Cold War." | Source: Drew Angerer / Getty Images / AFP

The stock market’s temperature cooled a few degrees on Friday, but that didn’t prevent the Dow from adding to its feverish September rally to close out its second straight weekly gain.

However, as Wall Street feasts on rampant trade war optimism, one economic historian warns that disagreements over tariffs are just a surface-level symptom of a far more destructive crisis.

The 21st century’s Cold War has begun.

Dow Jones Winning Streak Reaches Day 3

Two of Wall Street’s three primary indices survived dismal jobs data, along with wishy-washy remarks from Federal Reserve Chair Jerome Powell, to close the week on a high note.

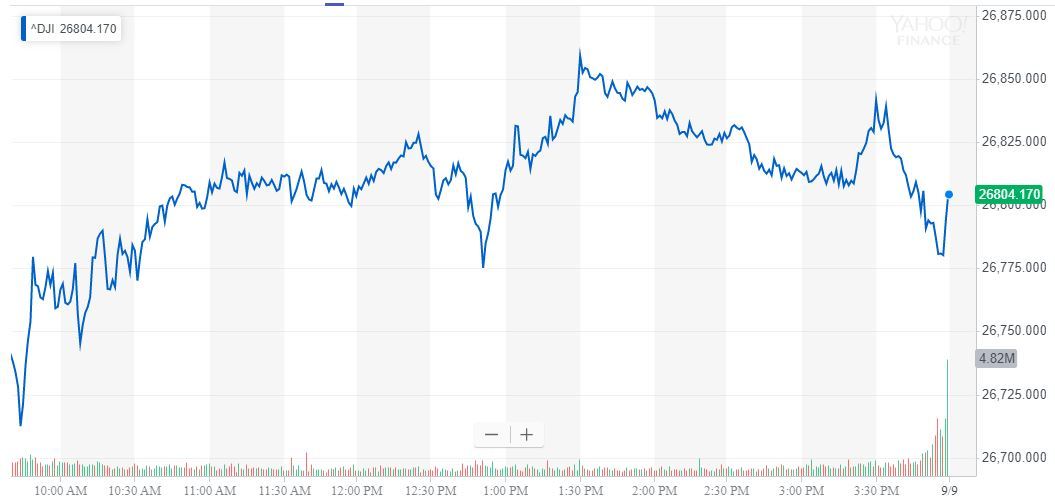

The Dow Jones Industrial Average recovered from early declines to gain 69.31 points. The 0.26% increase raised the DJIA to 26,797.46.

The Dow gained nearly 400 points during the holiday-shortened trading week, despite recording a 285 point loss on Tuesday.

Intel and Home Depot headlined Friday’s rally, advancing 1.64% and 1.31%, respectively. Altogether, 12 of the Dow’s 30 members rose at least 0.50%. Ten Dow stocks recorded declines, led by Microsoft (-0.68%) and Walmart (-0.61%).

The S&P 500 edged 2.71 points or 0.09% higher to 2,978.71. Eight of 11 primary sectors advanced, led by energy.

The Nasdaq lagged its peers, sliding 13.75 points or 0.17%. Weighed down by Facebook stock (-1.8%), the tech-heavy index settled at 8,103.07.

The CBOE VIX, a measure of implied market volatility, plunged 7.81% to 15.00. That’s well below the historical average.

Historian: US & China Now Locked in New ‘Cold War’

The Dow Jones soared this week thanks to a healthy dose of positive news on the trade war front.

However, Scottish historian Niall Ferguson warns that the conflict between the US and China has already evolved into a new “Cold War.” And he says a trade deal isn’t going to change that.

“The good news is I don’t think they are destined for a hot war over the South China Sea or anywhere else, but I do think they are in a Cold War,” Ferguson told CNBC on Friday. “And I don’t think President Trump any longer has the power to turn it off by doing a trade deal — which I think he intends to do at some point between now and next year’s election.”

Ferguson, a senior fellow at the Hoover Institution at Stanford University, added that although President Trump might want to use the China conflict as a tool to bludgeon his political enemies, he can’t just snap his fingers and make it go away.

“The problem for Trump is that, having started this Cold War with a trade war, he’s no longer in a position to simply turn it off when it suits him because the thing has escalated into other domains,” Ferguson said.

The silver lining for markets is that the corrosive effects of the new Cold War could be far less immediate – and visible – than the tit-for-tat tariff fight that Washington and Beijing have waged since 2018.

But that doesn’t make them any less serious.

Click here for a real-time Dow Jones Industrial Average chart.