Dow Spins Tires While Nasdaq Booms on $25 Billion Stock Boost

The Dow spun its tires to conclude a lackluster week of trading, while the Nasdaq soared as tech stocks smashed earnings. | Source: AP Photo / Richard Drew

The Dow spun its tires on Friday, helplessly advancing a few paltry points even as the Nasdaq surged thanks to a $25 billion helping hand from Google-parent Alphabet.

Dow Stuck in Holding Pattern, Tech Stocks Soar

Wall Street’s three major indices each rose on Friday, but their rallies were far from lock-step. The Dow Jones Industrial Average sputtered to a 37.6 point or 0.14% gain, raising the DJIA to 27,178.58.

The S&P 500 climbed 14.41 points or 0.48% to 3,018.08. Just five of 11 primary sectors recorded gains, and communication services did most of the heaving lifting with a 2.8% bounce.

The Nasdaq, meanwhile, jumped a remarkable 75.38 points or 0.91% to 8,313.92.

$25 Billion Alphabet Stock Buyback Bolsters Nasdaq

With the Dow stuck in a holding pattern, the Nasdaq pressed toward new highs amid a banner quarter for tech stock earnings.

Leading the charge was Alphabet, which shattered earnings expectations by more than 25%, returning $14.21 per share, ex-items, vs. $11.30 per share expected.

Revenue also edged past expectations, despite the fact that Google managed to decrease its traffic acquisition costs. Advertising revenue – Google’s bread-and-butter – grew by nearly $4 billion year-over-year.

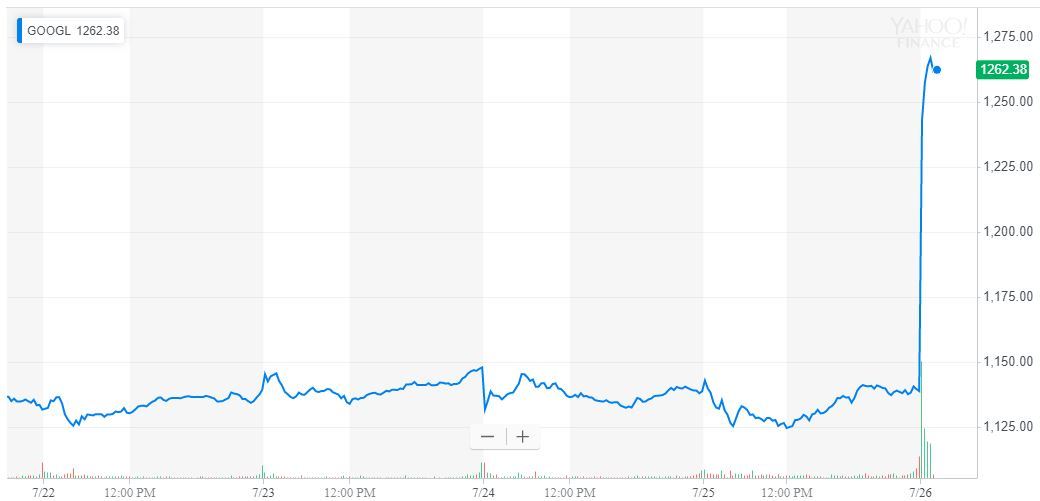

But the icing on the cake for investors was the firm’s announcement that it would initiate a massive $25 billion stock buyback program , providing Alphabet stock with sustained buy pressure.

GOOGL shares soared by 11.49% on Friday, reaching $1,266.89 as of the time of writing.

Stock Buybacks Continue to Send Market Higher

As CCN.com reported, stock buybacks have played an outsized role in the market’s rally this year, as cash-flush companies have sought to transfer capital to investors through these “tax-efficient dividends.”

However, share repurchase plans remain controversial on Capitol Hill where critics like Bernie Sanders allege that corporations use them to pad executive bonuses at the expense of workers.

Off Capitol Hill, some analysts are concerned that buybacks have made stocks too expensive for retail investors, who on net are pulling money out of the market, even as valuations shoot higher.

Click here for a real-time Dow Jones Industrial Average (DJIA) price chart.