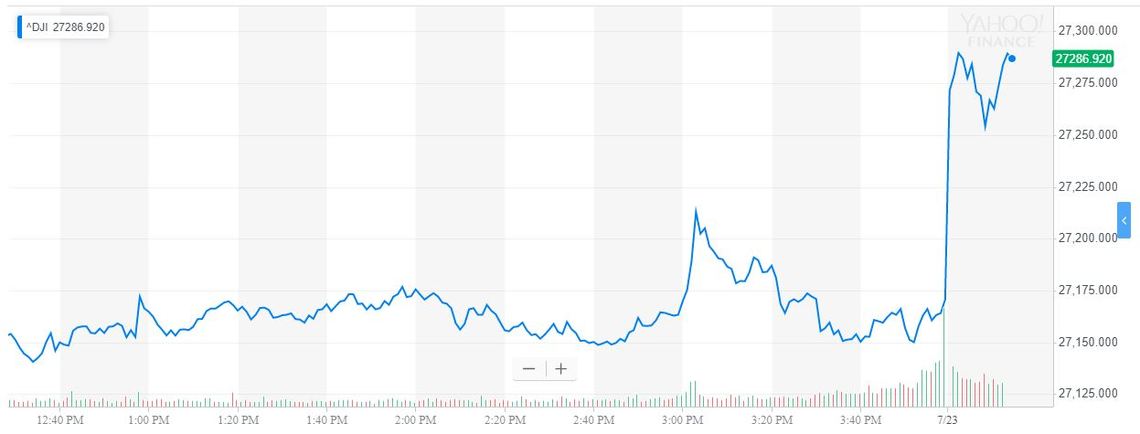

Dow Rallies 100 Points After Trump and Pelosi Avert Govt Shutdown

The Dow rallied after the Trump administration struck a deal with Nancy Pelosi to avert another economy-rattling government shutdown. | Source: Doug Mills / POOL / AFP

The Dow extended its recovery on Tuesday after the Trump administration struck a deal with House Speaker Nancy Pelosi to raise the debt ceiling and avert another market-crippling government shutdown.

Dow Mounts Triple-Digit Advance

All three primary stock market indices bounced during the morning session. The Dow Jones Industrial Average surged more than 100 points at the bell, and as of 9:47 am ET the DJIA had gained 95.4 points or 0.35% to trade at 27,267.3.

Gains in Coca-Cola Co (+4.76%) and Dow Inc (+1.73%) more than offset losses in fellow DJIA components Travelers Companies Inc (-1.6%) and UnitedHealth Group Inc (-1.03%).

The S&P 500 jumped 8.56 points or 0.29% to 2,993.59. The materials and consumer staples sectors powered the index higher, and only health and utilities recorded losses.

The Nasdaq rose 15.53 points or 0.19% to 8,219.67 to round out a positive day for US stocks.

No Government Shutdown Until 2021

Wall Street breathed a collective sigh of relief after Treasury Secretary Steven Mnuchin and other Trump administration negotiators brokered a bipartisan compromise with congressional Democrats that averts a government shutdown.

Assuming the agreement passes both houses of Congress, federal spending levels will increase by $50 billion in the next fiscal year. Altogether, the Wall Street Journal reports that the agreement includes $2.7 trillion in spending over two years – a full $320 billion above the sequester limits set in 2011.

The timing is important: The House of Representatives is just days away from closing up shop on Capitol Hill for its regular August recess. Considering that Mnuchin warned that the government would broach the upper bound of its credit line in September, there was a real chance that a stalemate – even a brief one – could cause a costly shutdown.

Everyone Wins – Except Fiscal Hawks

The agreement should have an easy path through Congress. Leaders on both sides of the aisle have praised the deal, and President Trump – perhaps remembering what a PR disaster the last government shutdown turned out to be – took a victory lap on Twitter.

Even more bullish for Trump, the agreement suspends the debt ceiling until July 2021, which by my math kicks fiscal crisis can down the road until well after the 2020 presidential election.

The real loser in the deal is fiscal hawks, who have watched idly by as annual federal deficits have ballooned past the $1 trillion mark. But nearly three years into the Trump era, few fiscal hawks remain to haunt the halls of Congress.

Earnings, Trade War Take Center Stage as Dow Targets New Highs

Regardless, the elimination of the threat of another government shutdown removes one risk factor from the stock market as the Dow, S&P 500, and Nasdaq strive to press toward even loftier heights.

Wall Street’s attention promises to remain firmly on earning season, especially as more FAANG stocks report their quarterly results. Netflix’s stock imploded following its earnings report, but analysts are more optimistic about the other tech giants.

Piper Jaffray, for instance, told CNBC that Amazon’s earnings could catapult the Jeff Bezos-led firm’s stock as much as 36% higher to $2,700, which would mark a new all-time high.

Meanwhile, Secretary Mnuchin will not get a chance to rest on his laurels following his successful negotiation of a spending agreement. He must also broker a trade deal with China, and reports indicate that he will likely travel to Beijing as soon as next week.

Click here for a real-time Dow Jones Industrial Average (DJIA) price chart.