Dow Storms Back as Trade War Tailspin Forces Fed’s Hand

The Dow Jones stormed into recovery mode as traders found a silver lining in the trade war - more Federal Reserve interest rate cuts. | Source: Drew Angerer / Getty Images / AFP

The Dow Jones stormed into recovery mode on Tuesday following its worst loss of the year as traders searched for – and found – a silver lining in the alarming escalation in the US-China trade war.

Dow Recovers from Grisly 2.9% Crash

All of Wall Street’s major indices took a bite out of their August 5 losses. The Dow Jones Industrial Average jumped 186.24 points or 0.72%, raising the DJIA to 25,903.98.

The S&P 500 added 25.62 points or 0.9% to recover to 2,870.36. Ten of 11 primary sectors recorded gains, led by technology (+1.6%) and industrials (+1.14%).

The Nasdaq surged 105.56 points or 1.37% to 7,831.6.

The CBOE VIX, which measures market volatility, fell 13.7% to 21.22, which is right around the historical average. The VIX had spiked as high as 36.2 during the Dow’s previous-session plunge; had it closed there, it would have been its highest close since the Eurozone debt crisis nearly eight years ago.

Beijing Stabilizes the Plunging Yuan

Though still deep in the red for the week, the stock market enjoyed a sizable recovery on Tuesday for two reasons.

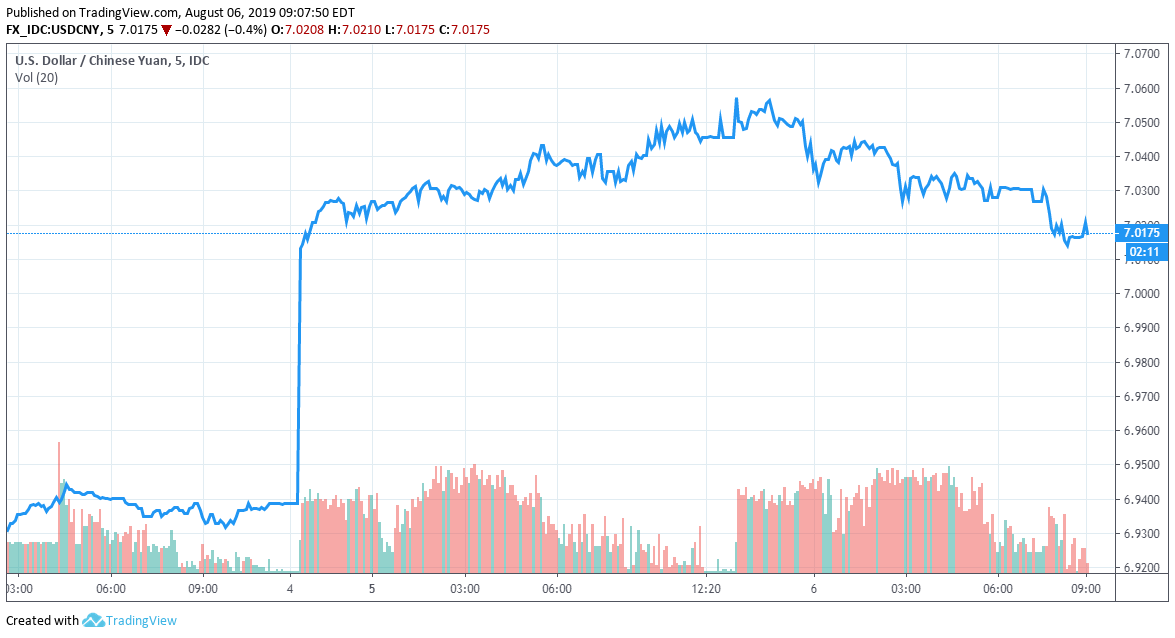

First, China took measures to stabilize the yuan, just one day after the country’s central bank allowed the currency to slide below the 7 per US dollar mark.

That action led the Trump Treasury Department to designate China a currency manipulator , and analysts warned that it was an indication that Beijing retained little hope for a US-China trade deal .

As Goldman Sachs analysts led by Chief Economist Jan Hatzius wrote in a research note:

“News since President Trump’s tariff announcement last Thursday indicates that U.S. and Chinese policymakers are taking a harder line, and we no longer expect a trade deal before the 2020 election.”

But while a weakening yuan would mitigate the damage from increasing US tariffs, it would also incite capital flight – something the People’s Bank of China (PBoC) does not want to incentivize.

Stock Market Bets on Aggressive Fed Easing

Second, Wall Street found a silver lining in the expectation that as the probability of a near-term US-China trade deal declined, the odds of aggressive Federal Reserve easing increased.

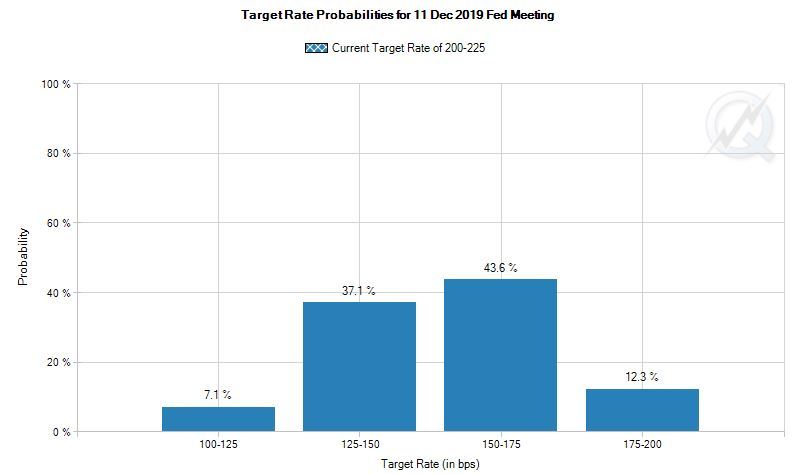

According to CME’s FedWatch Tool, the market has priced in a minimum of two more interest rate cuts in 2019, with a 44.2% probability that the Fed drops its target to 125-150 basis points – or lower – from its current level at 200-225. In fact, Fed Fund futures suggest there is a roughly 7% chance that interest rates sink as low as 100-125 basis points following the central bank’s December meeting.

All of those probabilities represent significant increases since the last FOMC meeting, when the Fed reduced its interest rate target for the first time since the financial crisis but also appeared to signal that it wasn’t yet ready to launch an aggressive easing regime.

However, if the Fed does pursue these steep interest rate cuts, it will have much less ammunition to combat the next recession when it sets in.

And at least one crucial recession indicator has already reached crisis levels.

Click here for a real-time Dow Jones Industrial Average chart.