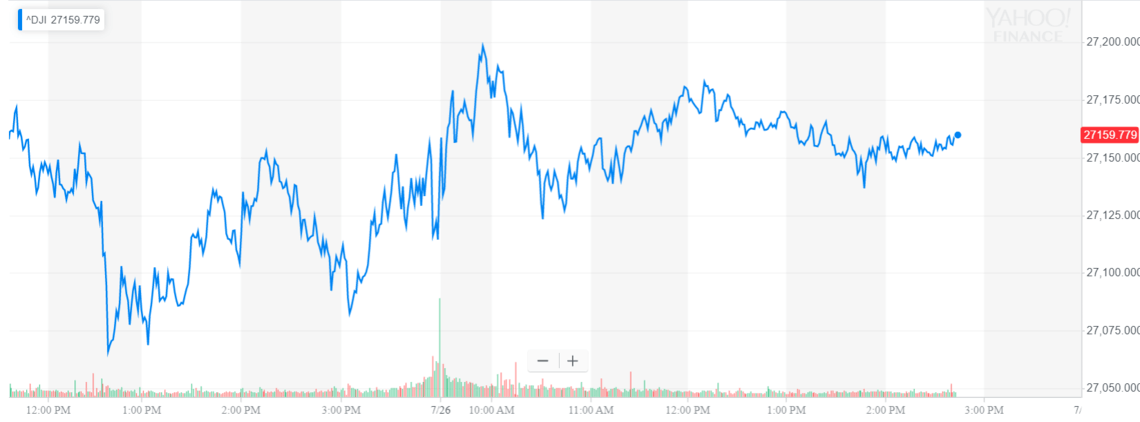

Dow Lags S&P 500, Nasdaq After GDP Dump Squashes Recession Talk

The Dow remained hopelessly trapped in a rut on Friday, even as the S&P 500 and Nasdaq shot higher following a GDP data dump. | Source: Spencer Platt / Getty Images / AFP

The Dow lagged the broader U.S. stock market on Friday after Dow Inc. (NYSE:DOW), one of its major components, reported declining second-quarter profits and lowered its guidance for capital expenditures.

Dow Lags S&P 500, Nasdaq

Unlike its peers, the Dow Jones Industrial Average struggled for direction on Friday after Dow Inc., the recently merged commodity chemical giant, reported disappointing second-quarter financial results. The stock fell more than 3% as a result.

As of 2:58 p.m. ET, the Dow was up 40.12 points, or 0.15%, to 27,181.1.

The broad S&P 500 Index of large-cap stocks rose 0.76% to 3,026.42, a new all-time high. Seven of 11 primary sectors reported gains, with communication services leading the pack by a wide margin.

Surging communication stocks propelled the Nasdaq Composite Index to new highs. The tech-laden index rose 1.15% to 8,333.32.

U.S. Economy Outperforms Expectations

After a strong start to the year, the U.S. economy decelerated in the second quarter as gross domestic product (GDP) expanded 2.1% annually, the Commerce Department reported Friday. The reading was well below the first-quarter growth rate of 3.1% but much higher than the Atlanta Fed’s latest estimate calling for 1.3%.

The second-quarter expansion was underpinned by an upsurge in consumer and government spending. Personal consumption expenditures increased 4.3%, the strongest performance since the fourth quarter of 2017, according to CNBC . Government expenditures and investment jumped 5%, the highest since 2009.

President Trump said the headline GDP number is “not bad considering we have the very heavy weight of the Federal Reserve wrapped around our neck.” That’s about to change as the Fed plans to lower interest rates next week for the first time since the financial crisis.

The GDP report offers reassurance that the U.S. economy wasn’t heading for recession despite a synchronized slowdown in global economic growth. It’s clear by the latest numbers that U.S. consumer spending is offsetting weakness in other segments of the economy, most notably manufacturing and housing.

Earlier this week, IHS Markit said U.S. manufacturing output plunged in July to the lowest level since 2009. The flash manufacturing purchasing managers’ index for July came in at 50.0, putting the sector on the brink of contraction.

Click here for a real-time Dow Jones Industrial Average (DJIA) price chart.